The Project Gutenberg EBook of Post Exchange Methods, by Paul D. Bunker

This eBook is for the use of anyone anywhere in the United States and most

other parts of the world at no cost and with almost no restrictions

whatsoever. You may copy it, give it away or re-use it under the terms of

the Project Gutenberg License included with this eBook or online at

www.gutenberg.org. If you are not located in the United States, you'll have

to check the laws of the country where you are located before using this ebook.

Title: Post Exchange Methods

A manual for Exchange Stewards, Exchange Officers, Members

of Exchange Councils Commanding Officers, being an

exposition of a simple and efficient system of accounting

which is applicable to large and to small Exchanges alike.

Author: Paul D. Bunker

Release Date: March 5, 2019 [EBook #59016]

Language: English

Character set encoding: UTF-8

*** START OF THIS PROJECT GUTENBERG EBOOK POST EXCHANGE METHODS ***

Produced by Donald Cummings, Adrian Mastronardi, The

Philatelic Digital Library Project at http://www.tpdlp.net

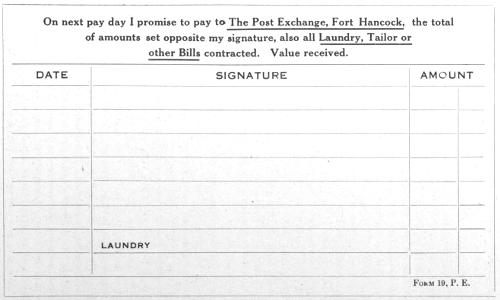

and the Online Distributed Proofreading Team at

http://www.pgdp.net (This file was produced from images

generously made available by The Internet Archive/American

Libraries.)

Transcriber’s Note: This book has two Figure 13s, but no Figure 29.

Illustrations described as “actual size” are unlikely to be actual

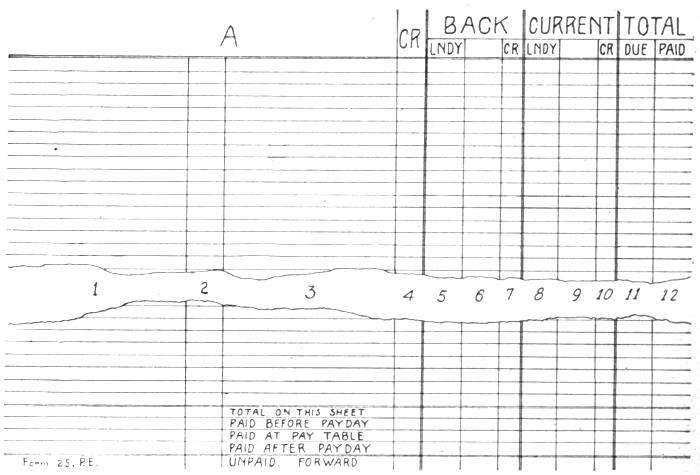

size, as the size is dependent on the device you’re reading this on.

Post Exchange Methods

by

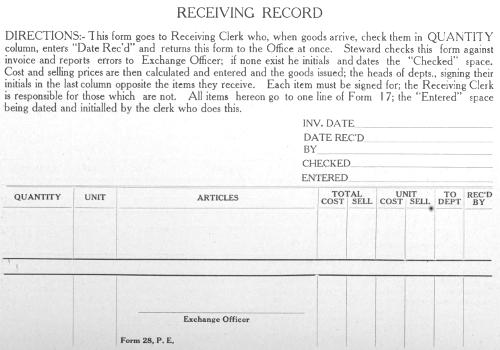

CAPTAIN PAUL D. BUNKER

UNITED STATES ARMY

A manual for Exchange Stewards, Exchange Officers,

Members of Exchange Councils Commanding

Officers, being an exposition of a simple

and efficient system of accounting which

is applicable to large and to small

Exchanges alike.

General Agents

The Eagle Press Service Printers

Portland, Me.

Copyright 1915

The Eagle Press—Portland, Me.

All rights Reserved

PREFACE.

Our Post Exchanges are usually in charge of officers with

little or no experience in book-keeping, their assistants are

usually enlisted men and not professional clerks and accountants,

and there is, at present, no codified or standard system

prescribed for handling this business. Some parts of the Post

Exchange Regulations have become antiquated through the

developments of modern business methods such as the

“Voucher Check System”.

In view of these facts it is felt that there is a real need of

this book, and it is hoped that the methods herein set forth

will prove to be a step toward a uniform system that will be

adopted in all Exchanges, one that will reduce overhead

charges, eliminate unnecessary labor and improve unsatisfactory

profits.

The writer intended discussing several other important

points, such as Journal Entries, Mail Order Business, Consignment,

Adding Machines, Loose-leaf and Card Index

Filing, etc., but circumstances over which he had no control

prevent, at present, any addition to these pages.

It is desired to give credit to Captain Henry M. Dichmann

24th Infantry, who by his work in connection with the

Post Exchange at Fort Slocum, N. Y., was the inspiration for

this work, and to Mr. James Parker, Cashier of the same Exchange,

for valuable assistance rendered.

PAUL D. BUNKER,

Captain, Coast Artillery Corps.

Fort Hancock, N. J.,

June 7, 1915.

“RANGER” BICYCLES

Follow the Flag.

Your choice of 94

Styles, Colors and

sizes.

More “RANGERS”

sold each year than

any other make.

TIRES, SUNDRIES AND REPAIR

PARTS For all makes of bicycles.

LARGEST STOCK IN THE WORLD

Catalogs and Special Prices For Post Exchanges

free for the asking.

MEAD CYCLE CO., CHICAGO, U.S.A.

Address Military Department

TAYLOR

ATHLETIC SUPPLIES

are correct in detail. They are way

ahead of the ordinary.

ATHLETIC OFFICERS

can rest assured of quality, prompt service

and unfailing personal consideration

from

Alex. Taylor

ALEX. TAYLOR & CO.

ATHLETIC OUTFITTERS

26 E. 42d. ST., NEW YORK

Send for Catalog and quotations

H. KOHNSTAMM & CO.

(Established 1851)

MFRS. AND DEALERS IN

STANDARD LAUNDERS’

MATERIALS

CHICAGO: 83-91 PARK PLACE

26-28 N. FRANKLIN ST. NEW YORK

Warehouse stocks for prompt

deliveries at 25 centrally

located cities.

Send for latest catalog.

FACTORIES: Brooklyn, N. Y. and

Camden, N. J.

PRINTING

EXCHANGE AND ORGANIZATION

SPECIALTIES

ANYTHING FROM A CARD TO A

BOOK.

THE EAGLE PRESS

PORTLAND, MAINE

E. W. Kilbourne, Proprietor

(Formerly Sergt. U. S. A.)

COUPON BOOKS

TO BE EFFECTIVE, MUST BE

Absolutely Accurate

The

SOUTHERN COUPON CO.

Are exclusive manufacturers of every kind of

COUPON BOOKS, and owing to their perfect

checking system, are in position to guarantee

absolute accuracy, perfect workmanship and

highest quality.

Each Coupon is Numbered

To correspond with number on cover, hence

even detached coupons can readily be identified

to their respective book—a great advantage.

WRITE TO-DAY FOR SAMPLES AND PRICES TO

THE SOUTHERN COUPON COMPANY

Box 346 BIRMINGHAM, ALA.

LOWEST POSSIBLE PRICES TO POST

EXCHANGES AND SHIP STORES

The Army and Navy Co-Operative Company is

splendidly equipped to serve Post Exchanges and Ship

stores WELL.

By WELL, we mean:

Offering reliable, fresh, new merchandise at the lowest

possible wholesale prices.

Offering large assortments of merchandise to select

from.

Offering efficient service and quick deliveries.

Buying from the Army and Navy Co-Operative Company

means more sales and larger profits.

Write for our Prices on Such Articles

as you may need.

ARMY AND NAVY CO-OPERATIVE COMPANY

NEW YORK STORE AND GENERAL OFFICES

16 East 42nd Street, near 5th Ave., New York

Store

1123-5 So. Broad Street

Philadelphia, Pa.

Store

721-7 17th Street N. W.

Washington, D. C.

TABLE OF CONTENTS.

|

PAGE |

| Post Exchange Methods |

1 |

| Desiderata. |

|

| Charge Sales |

2 |

| General—Method of Making—Daily Check Summary—Recording—Consolidating

Credit Transactions—Settling Dead and Live Records. |

|

| Cash Sales |

29 |

| General—Cash Book. |

|

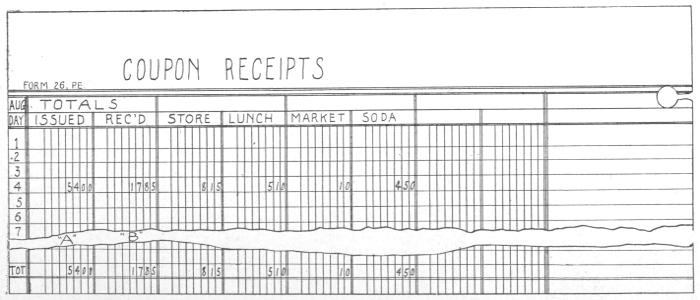

| Coupon Sales |

33 |

| General—Kinds of Coupons—Frauds—Regulations—Issuing—Pay

Table Procedure—Coupon Sales. |

|

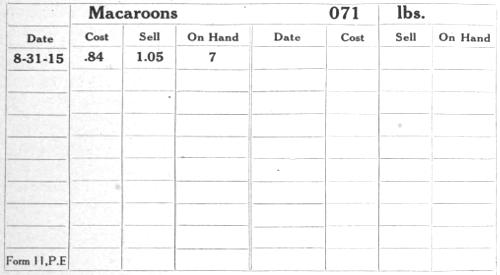

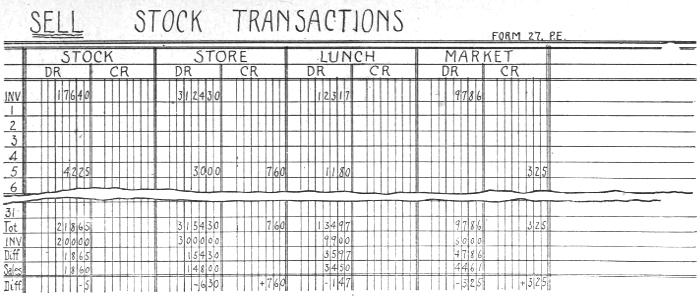

| Stock Records |

50 |

| General—Inventories—Merchandise Purchased—Transfers Between

Departments—Consolidating Transactions—Checking

Stock and Sales. |

|

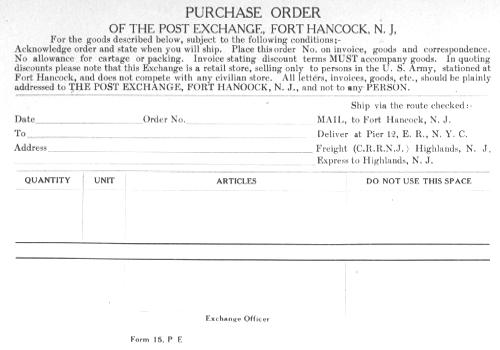

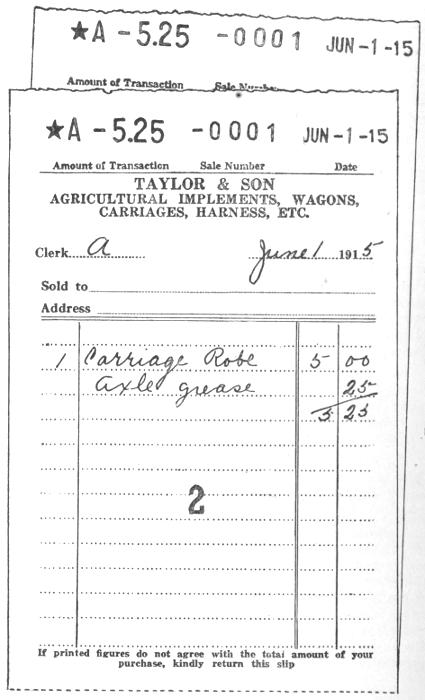

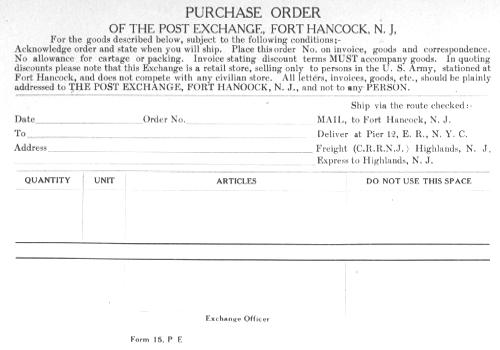

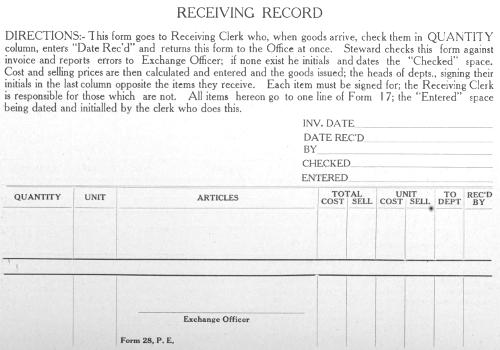

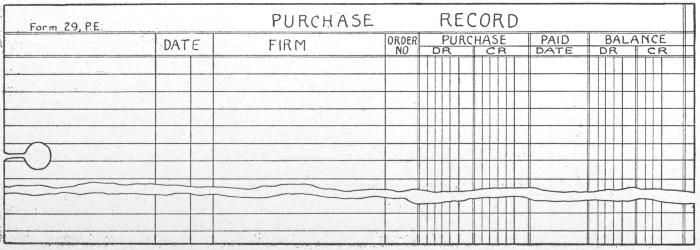

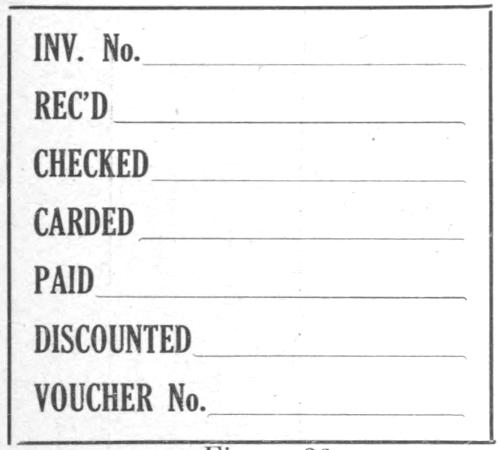

| Purchase Records |

60 |

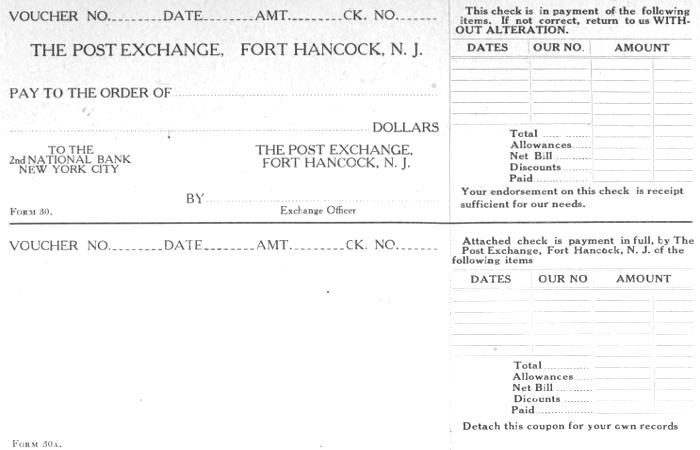

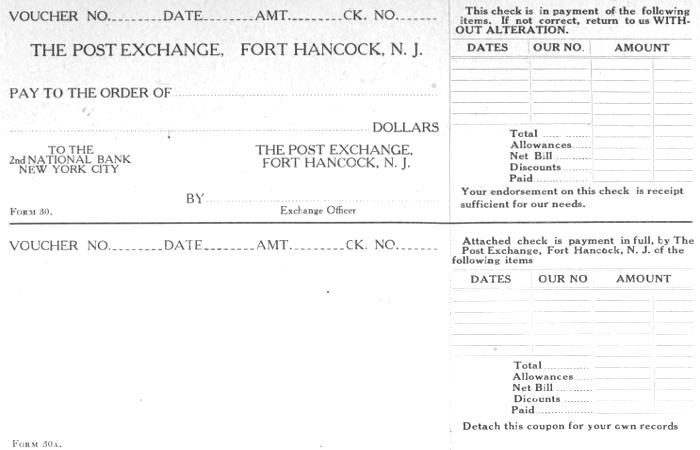

| General—Purchase Orders—Purchase Record—Payments—Voucher

Check System—Cash Disbursements. |

|

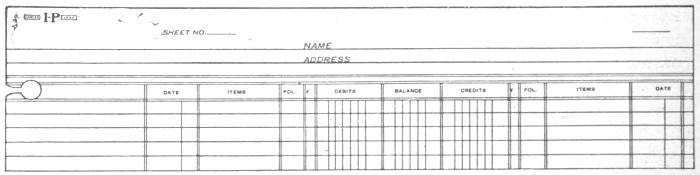

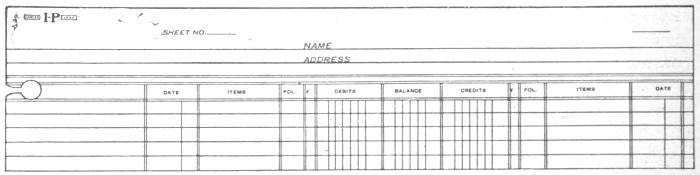

| The Ledger |

72 |

| General—Make-up—Ledger Accounts—Posting the Ledger—Balancing. |

|

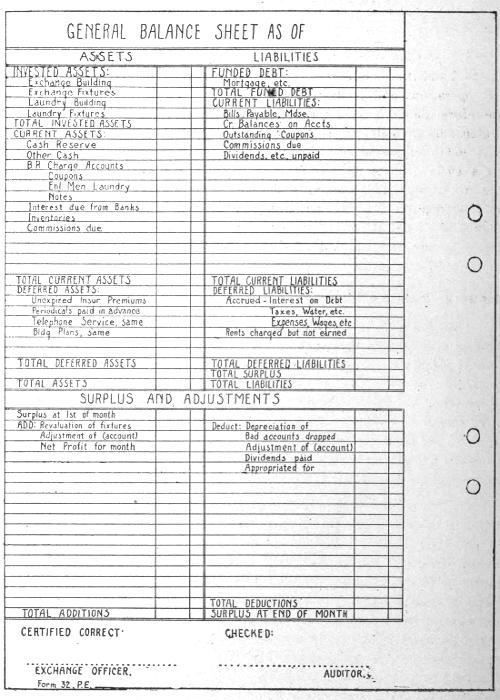

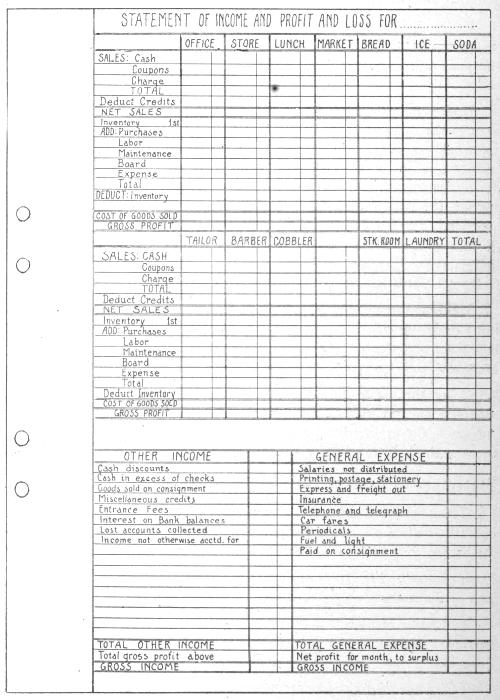

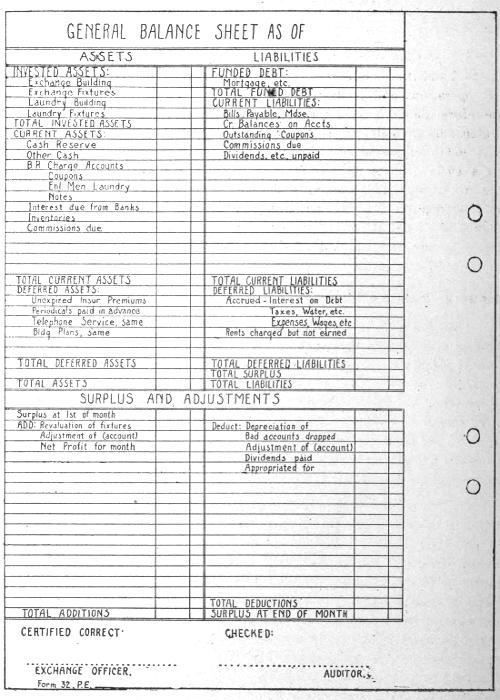

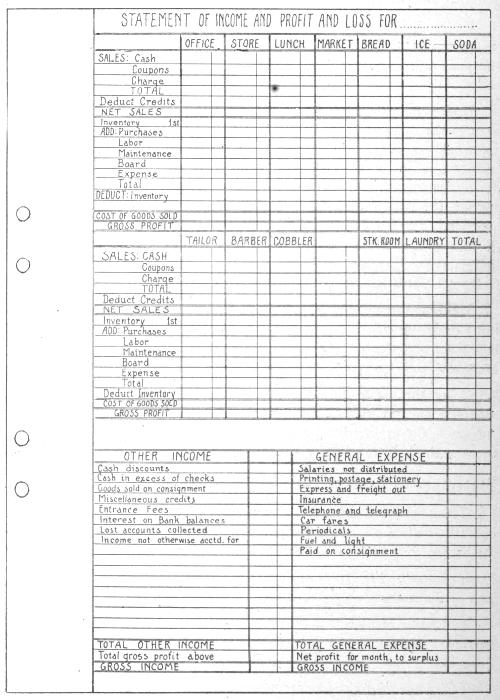

| Monthly Statements |

81 |

| General—General Balance Sheet—Surplus and Adjustments—Statement

of Income and Profit and Loss. |

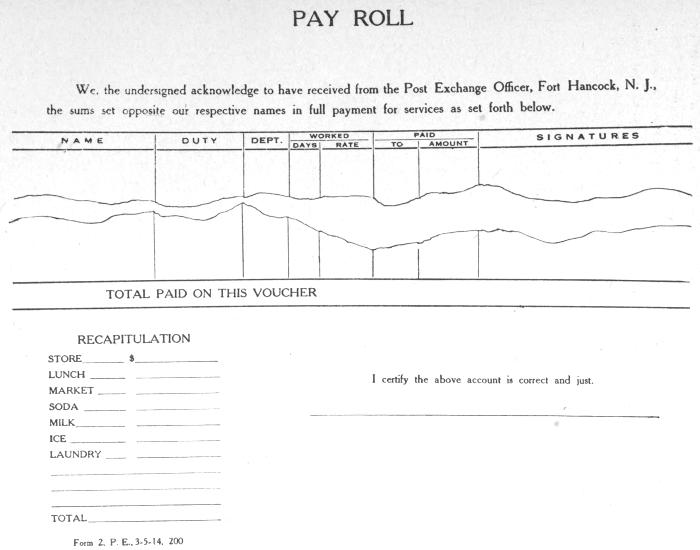

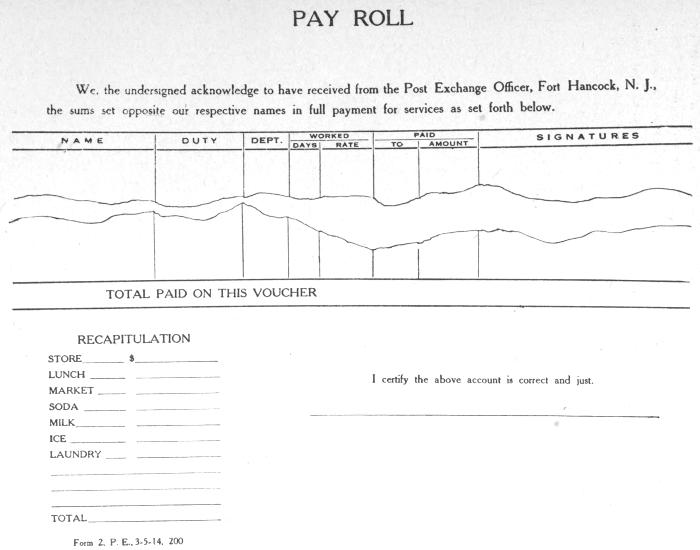

| Pay Rolls |

87 |

| Figuring Selling Prices |

89 |

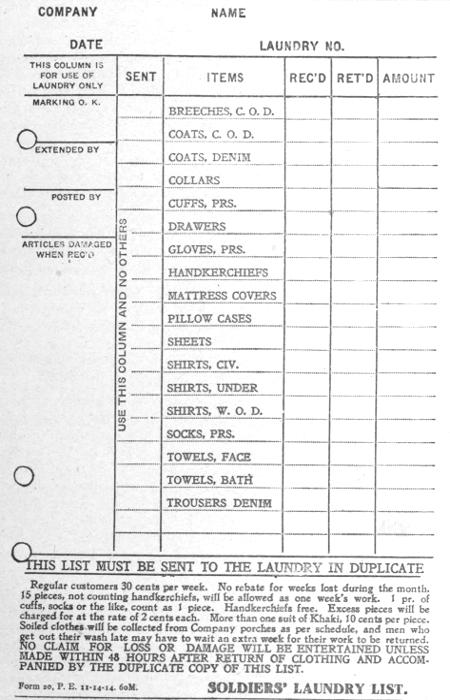

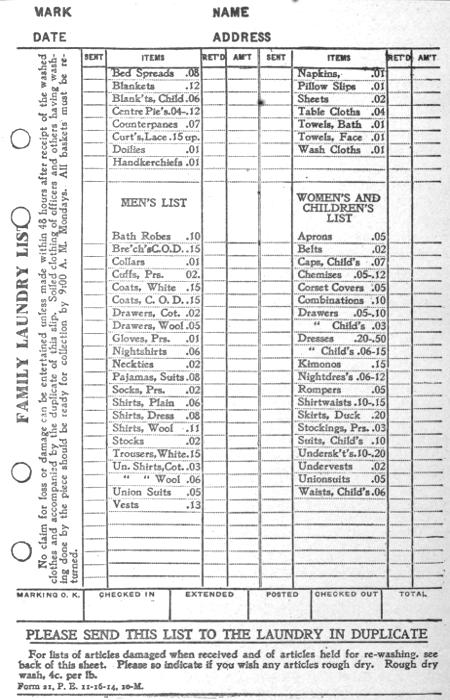

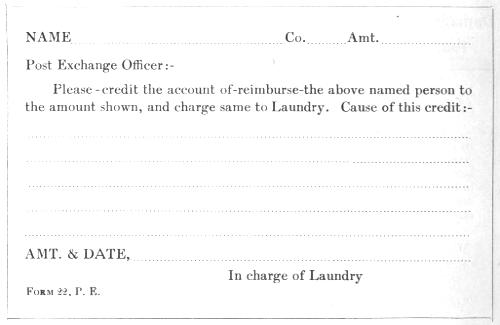

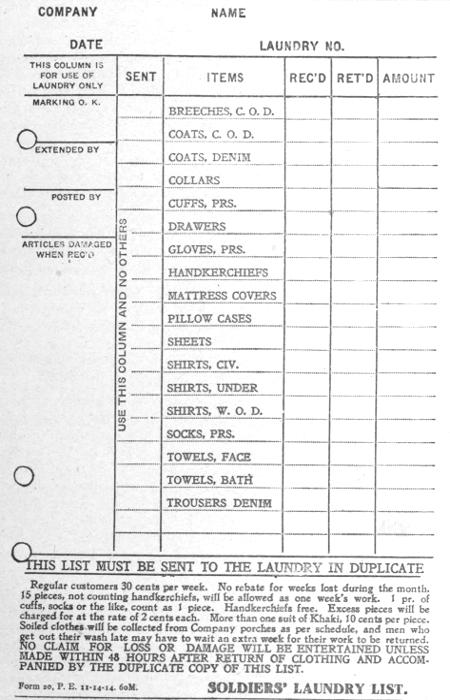

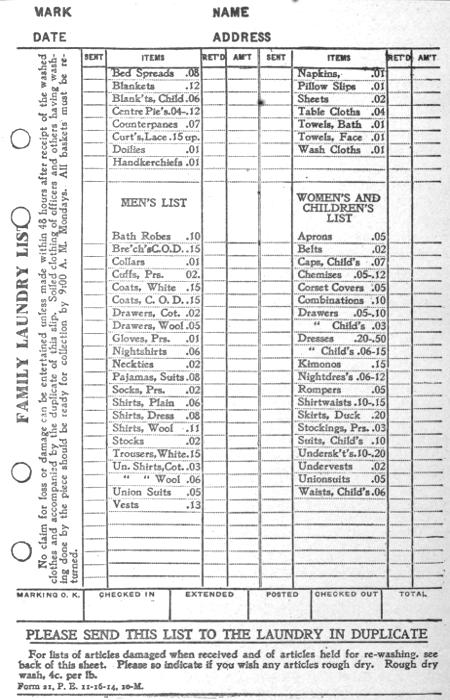

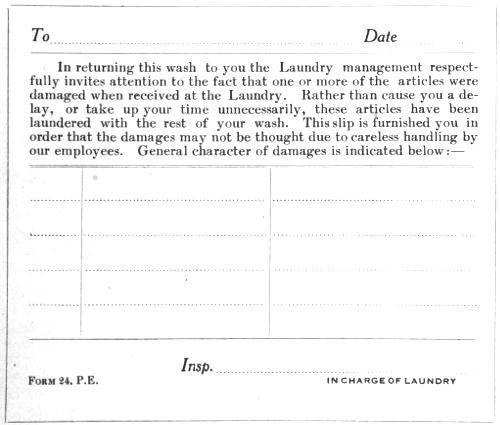

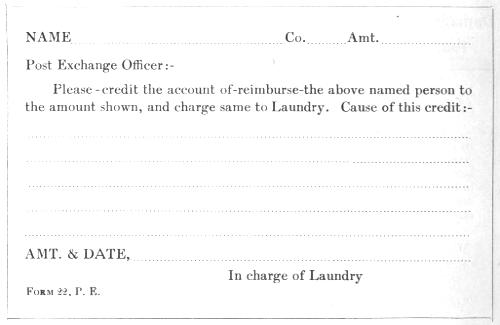

| Laundries |

92 |

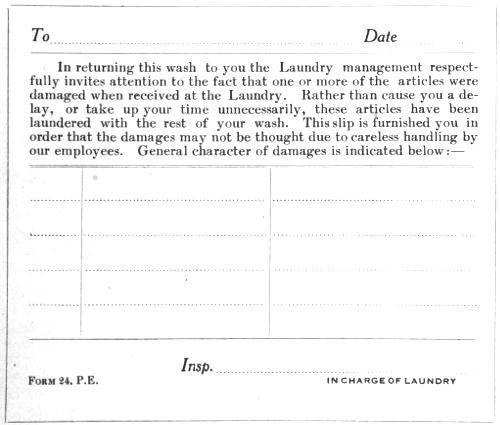

| General—Bills Receivable—Piece Work—Damage Report—Claims—Inventories—Pay

Rolls—Miscellaneous Books. |

|

| Auditing |

99 |

| General Duties Auditor’s Statement. |

|

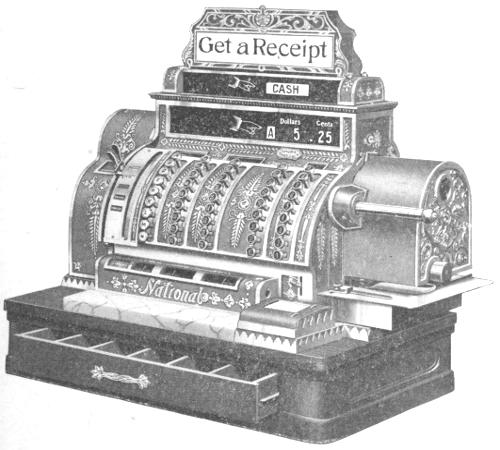

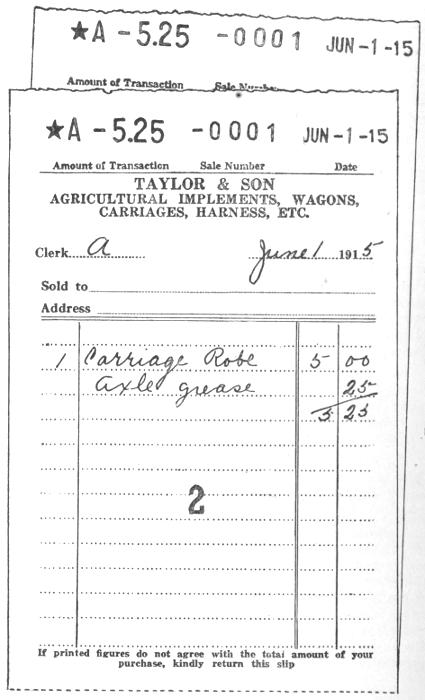

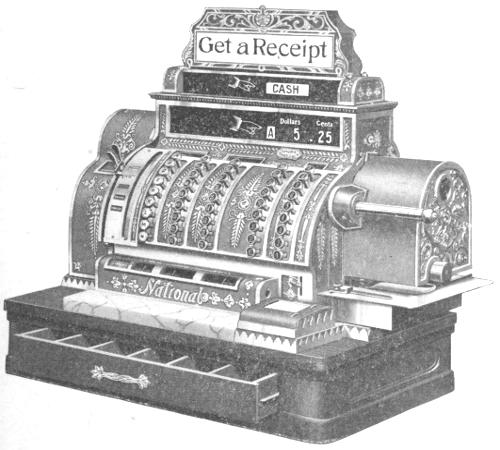

| Cash Registers |

103 |

| Conclusion |

106 |

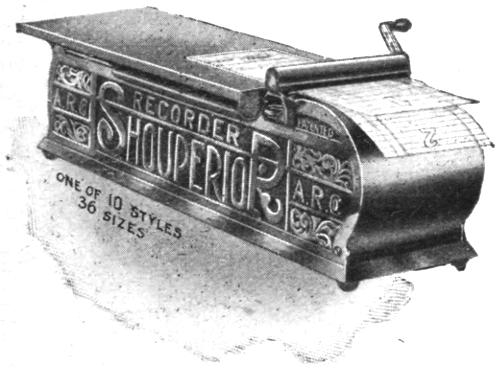

ECONOMICAL

Use roll printed stationery

and carbon, eliminating assembling

of loose printed

blanks and carbons—all automatic—no

wasted effort.

EFFICIENT

Whatever is written upon the

original appears fac-simile on

the duplicate and triplicate

alike. A loading consists of

about 500 sheets.

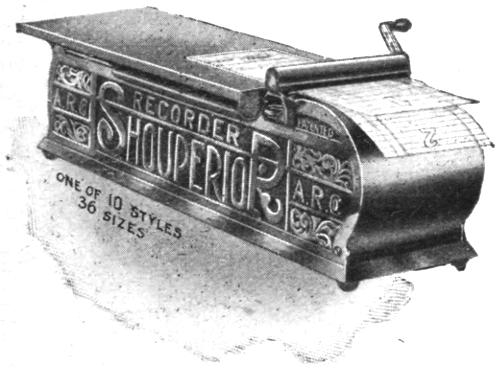

SHOUPERIOR MANIFOLDER

RECORDER

In use in U. S. Army Posts, Naval Stations and ships for ten years.

POSITIVE ALIGNMENT AND REGISTRATION

The SHOUPALIGNER our newest device has special features of automatic

alignment and registration of the form with automatic measured throw and stop.

Absolutely essential where duplicates and triplicates are printed, requiring exact

registration and alignment with the original. Our Service Department serves you

with the most economical and efficient systems for the results desired.

AUTOGRAPHIC REGISTER CO., HOBOKEN, N. J.

ALL BLANK FORMS

SHOWN IN

POST EXCHANGE METHODS

CAN BE OBTAINED

AT LOWEST PRICES, AND IN

ANY QUANTITY

FROM

THE EAGLE PRESS, PORTLAND, ME.

PIONEER PRINTERS TO THE ARMY

ENGRAVING

STEEL DIE EMBOSSING

PLATE PRINTING

POST AND ORGANIZATION

STATIONERY

THE EAGLE PRESS

Portland, Me.

[1]

POST EXCHANGE METHODS.

The general methods of conducting a Post Exchange are laid down

in official orders and considering the categorical nature of these orders

it would seem that the systems in all Exchanges should be almost identical.

Such, however, is far from the truth, as there are almost as many

systems as there are Exchanges, and a person in charge of one Exchange

might have to learn considerable new matter before he would be able

to administer the affairs of another Exchange. This variety of systems

also causes trouble to auditing officers, exchange councils and to inspectors

when they have occasion to go over the books. Some of the

systems are unsound in minor particulars, and most of them are poorly

designed. All trouble of this nature could be avoided by devising a standard

system and installing it in all Exchanges. The advantages of such

a proceeding would be manifold and there would be no important disadvantages.

In this essay an attempt has been made to evolve such a

system, one applicable to any Exchange, representing the best points of

many Exchanges and including at all possible points the labor saving

results of modern methods. The system here described is not the embodiment

of theory alone, but has been through the test of actual trial

and has given thorough satisfaction.

In devising any such scheme we must presuppose certain desiderata:—

1. The Exchange Officer can spend but a small portion of his time

in the Exchange, and yet he must have accurate knowledge of what the

business is doing. It is therefore essential that our records shall show

accurately and concisely all the data that are necessary to a full understanding

of the condition and operations of the business.

2. It is not enough to have a system which will enable us to render

a clear statement at the end of the month, we should be able to close our

books at any time and get out our financial statement in the minimum time.

3. Our system should be such as to minimize the possibilities of

peculation. It is often said that there is no system which cannot be beaten,

but there are systems which cannot be defeated for any great length of

time. Therefore, our system must reduce to a minimum the time during

which graft or theft can work undisturbed.

4. The system must be so simple that it will not require exceptional

ability at any point in order that its provisions may properly be carried[2]

out. This makes it easy to break in new clerks, and enables them to perform

their duties in a more satisfactory manner.

5. The system must not be so cumbersome that it will delay the

making of sales. This is highly important. Every reader of this will

undoubtedly have vivid recollections of his experiences in department

stores, “waiting for change.” It is better to lose a dollar than to disgust

our customers and drive them elsewhere.

The above requirements cannot but cause our system to be somewhat

more expensive than that used in a “one-man store”. In the latter

instance, as a proprietor will not cheat himself, the third requirement has,

in general, no effect. The other requirements, however, will still hold,

and even gain in importance. How many merchants have we seen who

thought they knew all about their business, but who in reality knew very

little. They did not even realize that slipshod methods curtail credit and

beget losses of various sorts.

In describing this system we shall take up the various features in the

order in which they will be found easiest to install. For instance, charge

sales are discussed first because, regardless of the system of handling

these sales that may be in use by any Exchange, it will be found that to

change to the system here described, before changing any other part of

the system, will cause no confusion in the other books. In other words,

if your system be changed according to the order in which the different

parts are discussed herein, you will find that you have gradually installed

a system which may be entirely different, yet you have caused no confusion

in your books by the transition.

CHARGE SALES.

General.

This item includes the sale of merchandise to (1) officers, (2)

civilians, (3) enlisted men authorized to buy on credit. Such sales are

practically cash, being paid, usually, within a very short time.

The practice of extending credit to civilians is not encouraged by the

authorities and the Exchange Officer should secure permission beforehand

in case it is desired to transact this kind of business. In some cases of

isolated posts it is to the best interest of the government that civilians

employed or living on the post be allowed credit at the Exchange, as it

might otherwise be impossible for the Government to retain their services

or for the civilians to subsist themselves. It is to take care of such cases

that this feature is mentioned. In opening a charge account with a

civilian, care must be exercised to prevent a probability of loss to the

Exchange, as one bad account might wipe out the profits from all such

accounts for a considerable time. If a civilian is deserving of the privilege[3]

of purchasing at the Exchange he should have no objection to conferring

with the Post Exchange Officer and making satisfactory arrangements

with his employer.

With enlisted men, the case is more difficult. In general, the soldier

makes his credit purchases by means of coupons. But if the Exchange handles

some such proposition as an ice delivery route, it is impossible to do

business with the patrons thereof by means of coupons of the ordinary

kind. The right method is to apply to the proper authorities for permission

to extend to married soldiers credit to such amounts as may be recommended

by their organization commanders. If this is not done, and credit

other than in the shape of coupons is allowed enlisted men or if coupons

or credit in excess of one-third of the man’s pay be allowed him, the

inspector will object to it, as either of these two proceedings is held to be

unauthorized. However, when there are no other stores in the vicinity,

it seems but reasonable to think that the Post Exchange, instituted purely

for the benefit of the enlisted man, should be allowed to extend credit to

such married soldiers of good reputation as may be dependent upon it

(and the Commissary) for the necessities of life. As the married soldier

is usually a non-commissioned officer of long and honorable service (sometimes

a first sergeant or non-commissioned staff officer) with one or more

children; as the bulk of his pay is usually spent for articles ordinarily

carried in stock by the Exchange; as the Exchange is the result of beneficent

legislation and the regulations concerning same should therefore be

interpreted in a liberal manner, it follows that there is a great deal of

justice behind a proper application for permission to make charge sales

to such selected men.

In case such permission is obtained, request should be made on the

various organization commanders to write a letter of the following purport:—

Fort Jay, N. Y., Mar. 1, 1914.

From C. O., Co. H, 57th Inf.

To Post Exchange Officer.

Subject, Credit to Enlisted Men.

1. Request that the following named members of this organization be given

credit at the Post Exchange not to exceed the amount set opposite their

respective names:

| 1st Sergt. James E. Sullivan |

$ 20.00 |

| Sergt. Ralph R. Strouse |

16.00 |

...

(Sgd.) T. R. Jones,

Capt. 57th Inf.

[4]

Method of Making Charge Sales.

At the time each charge sale is made, the clerk notes the transaction

on a “Charge Sales Slip,” provided for the purpose, noting the date, name

of customer, name and number of articles sold, the total price of each

item, the total amount covered by the slip and the initials of the salesmen.

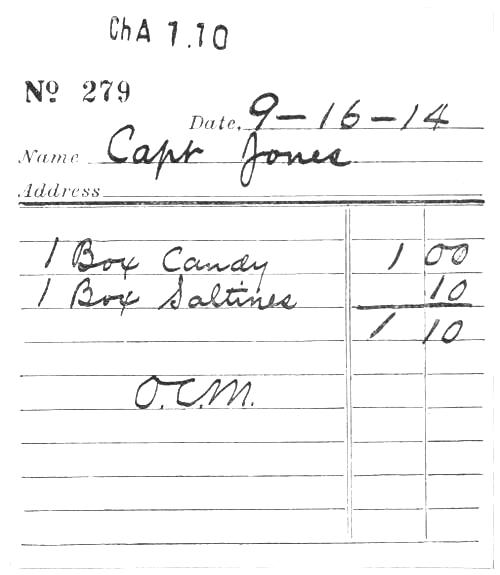

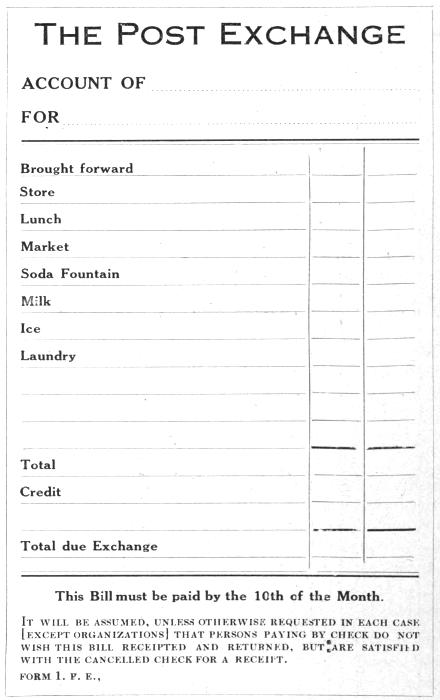

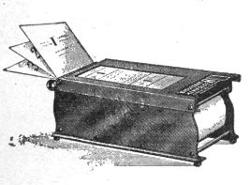

See Fig. 1.

Figure 1, (Reduced in size)

[5]

It has become almost a rule that the purchaser shall receive a copy of

this record of sale. Sometimes, he does not receive it until after he has

paid his bill at the end of the month, a procedure followed in many clubs

and similar organizations. It is probably better in Post Exchange work

to furnish the purchaser with a copy of the charge sales slip at the time

the purchase is made, as most of our customers wish to keep track of their

accounts and also, as will be shown later, this method may be made to promote

honesty in salesmen who might be tempted to be otherwise. As it

is, of course, essential that we retain at least one copy of this sales slip, it

follows that the use of some sort of manifolding device is necessary.

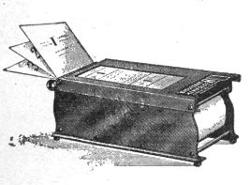

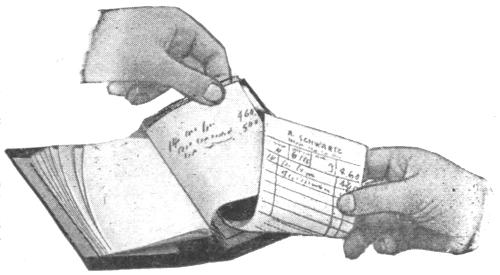

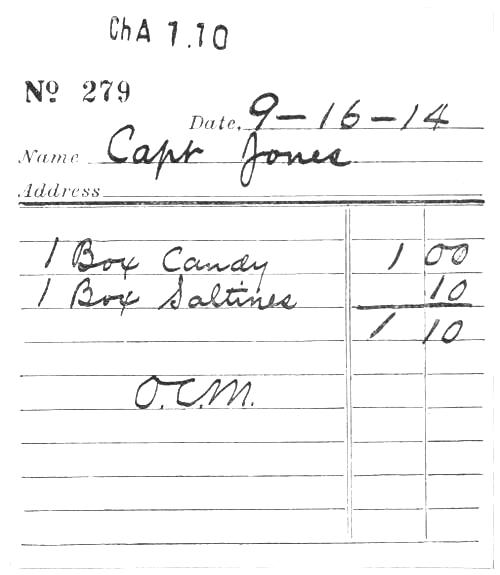

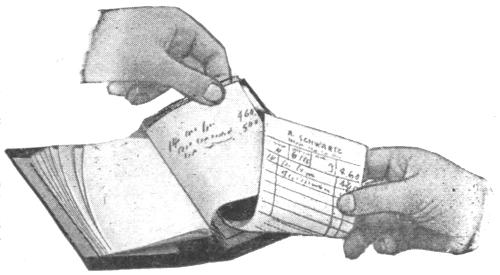

There are many such devices on the market, among which may be mentioned

as representative, the manifolding sales book and the autographic

register. The former is shown in Fig. 2 and the latter in Fig. 3, from

which their methods of operation are apparent.

Figure 2.

It is patent that some

such scheme should be

adopted for use in every

Exchange, no matter

how small that Exchange

may be. The advantages

of any of these systems

(even a simple duplicating

pad) over the painful

and inefficient method of

recording all such sales in an old

fashioned sales record book must

be evident to every one. The particular

system adopted is of minor

importance so long as it is thoroughly

adapted to the circumstances

of the case involved. The

following table is arranged for the

purpose of permitting a comparison

of two systems; one involving

the use of manifolding sales

books and the other using an autographic

register.

Figure 3.

[6]

| SALES BOOKS vs |

CASH REGISTER |

| 1. Can be carried by the salesman, thus saving steps for

him. |

1. If a cash register is used the salesman must go to it to

record every sale, and therefore if the Manifolder is located

at the cash register no unnecessary steps are taken. |

| 2. Cost of 100 duplicating books of simple design with

total capacity of 5000 sales is $6.50. Triplicating books more

expensive. No first cost for machinery. |

2. Rolls of paper are used; cost of rolls for duplicate

records of 5000 sales is from $4.50 up, depending upon the

amount of special printing on the rolls. Each machine like Fig.

3 costs, retail, about $15.00. |

| 3. Practically no counter space is necessary for using a

sales book. |

3. A convenient place must be left on the counter for use

in recording sales. |

| 4. Uniformity in size of slips results in facility in

handling and filing. |

4. By exercise of reasonable care the size of the slips

approaches uniformity closely enough. |

| 5. The various copies of a slip made from a sales book are

more apt to be “in register”—that is, the various lines and

spaces of a lower sheet are more apt to be exactly under the

corresponding ones of the upper or original sheet. |

5. Sometimes trouble and the expenditure of a sales slip

results from the various rolls getting “out of step”. This

accident, however, is easy to remedy. |

| 6. The slips can be tampered with, by dishonest salesmen,

unless a “slip-printing” cash register, or some special device

is used. |

6. By using a machine in which the triplicate roll is wound

up inside the machine as it is used, no tampering with the

sales records is practicable. |

| (If triplicate records are desired) |

| 7. We may use either two sheets of carbon paper[1]

or only one double-faced carbon sheet below a tissue duplicate

and over an opaque triplicate. |

7. We ordinarily use at least two sheets of carbon paper,

and all copies are opaque. The machine is adjustable, and will

either duplicate or triplicate according to the number of rolls

used. It can also be used with a transparent roll. |

| 8. If two carbon sheets are used, both must ordinarily be

shifted for recording each successive sale. |

8. The carbon sheets once fixed in the machine require no

further attention except when they are worn out or the rolls

renewed.[7] |

| 8a. By using a transparent duplicate and a double faced

sheet of carbon paper, the latter is the only sheet that

requires handling. |

8a. But the slips do not protect us so well because the

sales are not recorded on the back of each slip (by reversed

impressions) as well as on the front. |

| 8b. In this case, by leaving the transparent slips in the

book we can easily check the consecutive numbers of the slips

and see that all are accounted for. |

8b. By not tearing off the lowermost sales slip, but

leaving it attached to the roll until the end of the day, we

obtain a single strip of sales slips recording all the charge

sales of the day. They need not be checked for consecutive

numbering unless there is a break in the strip. |

| 8c. By previously clipping off the corner of these tissue

sheets the book becomes self-indexing and in opening the book

we turn automatically to the place for recording the next

sale. |

8c. In tearing off the record of each sale we automatically

prepare the machine to record the next sale. |

It is seen that the advantages and disadvantages of these two systems

nearly counterbalance and that the particular system adopted must depend

greatly upon the opinions of those in charge of the Exchange. In the following

description, the use of triplicating records will be assumed.

In order to facilitate the assorting of the slips handed in by the various

“Departments” of the Exchange, it is a good idea to assign distinctive

colors to the original charge sales slips of each. (Of course, if there is a very

large number of departments, this idea would have to be applied with

discretion, as it is hard to recognize certain colors at night by artificial

light.) For example, let the original sales slips used in the store be white;

those in the market, buff; those in the shoe shop, pink, etc. The duplicate

slips should have their own distinctive color and this color should be the

same for all departments. If a triplicate slip is used, it should be of still

another color and the same for all departments. Following out this

scheme, the utility of which will appear presently, a color scheme might

be as follows:—

| Department |

Colors Assigned to Charge Sales Slips |

|

Original |

Duplicate |

Triplicate |

| Store |

White |

“Newspaper” |

Yellow |

| Market |

Buff |

” |

” |

| Lunch |

Salmon |

” |

” |

| Tailor |

Green |

” |

” |

| Barber |

Blue |

” |

” |

| Shoe shop |

Pink |

” |

” |

If a system of distinctive colors similar to the above is not adopted,

one of two things will be necessary in order that we may identify the slips[8]

of each department, unless we wish to do so by wasting the time in

deciphering the articles on each slip and decide therefrom the name of the

responsible department; we must either have the names of the departments

printed on their respective slips when they are made, or these names must

be marked on the slips when the sales are made. Neither of these methods

is as efficient as that involving the use of various colors, which tells automatically

to what department that slip belongs. By using distinctive colors,

the printer would set up only one form for printing our whole assortment,

and our printing bill would be correspondingly reduced.

In this connection, it might be stated for the benefit of the uninitiated

that ordinarily the principal items in our bills for printing, especially in

the case of blank forms, will be found to consist of the cost of “composition”,

“make-up”, “lock-up”, and “make-ready”. These operations are

necessary if but one form is printed; they need cost us no more if 50,000

copies are printed. Paper is comparatively cheap, so it usually costs us

little more to print 5,000 copies than to print 1,000. So we can see that

in the case of blank forms the cost per unit varies inversely as the quantity

ordered at one time. Hence, if we need such forms as sales slips, of

which we may use hundreds per day, we should order, say, a year’s supply

at a time. Other forms or sheets that are used once a week or once a

month must be ordered in lots sufficient to last for a longer time. As we

take these up on our Stock Record, such purchases in large quantities will

not disturb the worth of the Exchange.

An appreciable amount in the cost of our printing can be saved by a

skillful arrangement of the matter on the form. An experienced man can

sometimes draft a form so that the charges for printing it will be half

what it would cost to print the same form arranged by a thoughtless or

inexperienced person. Tabular work costs money, and so also does

“special rulings”. Experience or consultation with a practical printer is

the only real guide in this matter.

If any form is used in large numbers, it will pay to have electrotypes

made, and “repeat orders” printed therefrom. Forms that are seldom used

should not be electrotyped, as they will probably require some alteration

by the time a new supply is needed. An electrotype costs about $0.25 for

the first square inch and about $0.04 for each additional square inch. Here

is another opportunity for the exercise of judgment. Suppose we have a

large form with printed heading and footing, but nothing in the middle of

the sheet; it would be wasteful to electrotype the whole form, only the

heading and the footing should be so treated. Now, let us consider the

money wasted by having the name of our post printed on each bit of

stationery! It is easy to see that this is in some cases a positive disadvantage.[9]

Suppose, for example, that Form 8, Fig. 1, fills the requirements

of Exchange methods. If a dozen Exchanges order a supply of these

forms and (as they usually do) thoughtlessly require that the names of

their respective posts be printed on same, they each pay a great deal more

than they would if they allowed the printer to make an electrotype of this

form and run off all the jobs from the same plate. It is hard, if not

impossible, to find any real reason why this extra matter should be placed

on many of our forms. Coöperation in matters of this kind would go far

toward cutting down some of our “overhead charges” in Post Exchange

work, and to secure such coöperation is one of the objects of this paper.

Still another way to minimize our printing bill is to adopt standard

sizes for our forms and to use, wherever possible, the same kind and color

of paper. Paper comes in sheets of certain sizes and if the printer has to

waste a part of each sheet in printing our forms, we shall have to pay for

it. Uniformity in size also leads to facility of filing. Incidentally, money

may be saved, in some cases by having two or more forms printed together.

For example, suppose we have three forms, A, B and C, to be printed on

the same stock, and we wish 5,000 A; 10,000 B; and 15,000 C. If ordered

separately, these would entail 30,000 impressions. Suppose, however, that

they are ordered at the same time, and that the forms are of such sizes

(not necessarily equal) that they may be printed together on one sheet

and cut apart afterwards. In such a case, a saving might be made as

follows:—Set up each form once, make, one electrotype of Form B and

two of Form C; place these with the originals and there will result, in one

“form” three Forms C, two Forms B, and one Form A, and a “run” of

5,000 impressions will print the lot ordered. There is a saving of the cost

of running 5,000 Form B and 10,000 Form C less the cost of electrotypes

(if they are not on hand) and of the extra work of locking up and making

ready same. Of course, such a procedure assumes that a considerable

supply of forms, say, not less than a total of 5,000, is ordered at one time.

For a fewer number, there would be no saving unless electrotypes were

already on hand.

To return, now, to our sales slips. It will be noted that our triplicate

copies are the same for all departments. They are kept in rolls, if manifolding

machines are used, or if triplicating sales books are used, the tissue

paper sheets that are left in the books form our retained record. In the

cases of both the triplicate and the duplicate copies, a cheap grade of paper

is allowable on account of the little handling these copies have to withstand.

Also, there is no reason for their being susceptible of rapid assorting according

to departments. The duplicates are also identical for all departments,

they go to the customer at the time of sale. In case there is a

discussion about any particular slip, the items thereon will show conclusively[10]

to what department it belongs, as will also the initials of the salesman.

On the other hand, it is a positive advantage to have all duplicates of a

distinctive color, different from that of the originals. Suppose a customer

buys a pair of shoes from the store and later returns them. We should

then give him a slip crediting him with the shoes at the selling price. To

do this, all that is necessary is to fill out a regular charge sales slip in the

usual manner except that the word CREDIT is plainly marked on the slip.

The clerk then gives the customer the original of this credit voucher and

files the newspaper duplicate in the usual way. Upon sorting the slips that

night, the duplicate would be noticed, on account of its difference from

the other slips handed in and would thus prevent mistakes. Likewise, if

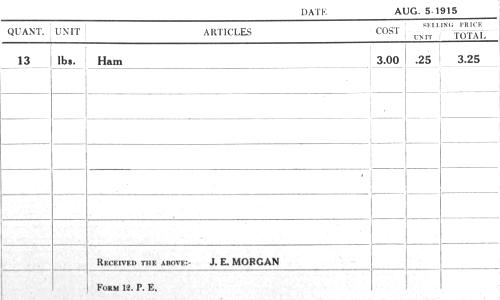

it became necessary for, say, the lunch room to buy a ham from the market,

the market attendant could make out his charge sales slip as usual, giving

the duplicate to the lunch room attendant with the ham. That night, the

appearance of this grayish duplicate among the salmon originals handed in

by the lunch room attendant would immediately call attention to the transaction.

It might be stated here, at the risk of lapsing into the axiomatic,

that such a transaction, although favored by some exchanges, is not good

business. It should be of rare occurrence and even then needs special

treatment. The proper procedure in such cases would be to have the

Market turn the ham back to the Stock Room, receive credit for it and

then let the Lunch Room draw the ham at the cost price. This point is

more fully discussed in connection with Stock Records.

After the attendant has recorded the charge sale in the proper manner

and given the duplicate slip to the purchaser, he still has to dispose of

another copy (or two other copies if triplicating records are used). The

original should be speared onto an ordinary file, each clerk having his own

filing hook in a convenient but inconspicuous place. The triplicate is left

in the sales book or on the roll, as the case may be. In addition, the clerk

should be required to ring up the sale on the cash register. This is, of

course, very important, and heroic measures should be adopted to insure

the recording of every sale, of whatever kind, on the cash register. Means

to this end can readily be devised. The subject of cash registers is a very

important one and is discussed in detail elsewhere.

The above operations are described at some length, but in reality, they

are simple in the extreme: a customer makes a purchase, the clerk records

the sale, rings up the amount on the cash register, gives the customer his

goods and a copy of the sales slip and sticks the other copy on his file. If

the cash register prints tickets, he may drop the ticket in his compartment

of a box or drawer provided for the purpose, or preferably, give it to the

customer.

[11]

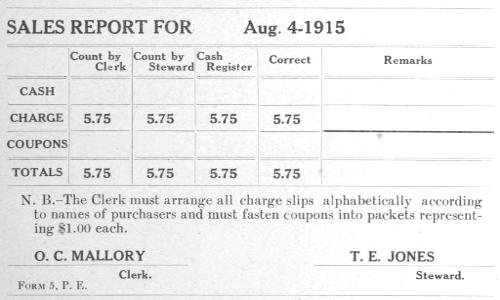

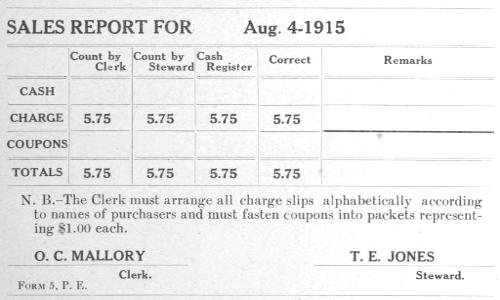

Daily Check of Charge Sales

After the day’s business is over, each clerk gathers up all his receipts

for the day and assorts them into three piles, representing the cash, coupon

and charge sales, respectively. He then makes out his sales report on

Form 5 as shown in Fig. 4. This report should be printed on the face of

an end-opening envelope measuring not more than 4¼ × 10 inches, thus

forming a convenient receptacle for the coupons, charge slips and cash

turned in. The printed form should be, say, 7½ × 3 inches. As these

envelopes are not subjected to rough usage, being used but once, any kind

of cheap paper will serve the purpose. It might be well in certain cases

to have the envelopes match the color of the original charge sales slips for

that department, but ordinarily, this would be found an unnecessary refinement.

After making out this sales report, the clerk places in the

envelope the cash, coupons, etc., and hands it to the Post Exchange Officer

or to the Steward, if so authorized. (For obvious reasons, the Exchange

Officer personally should receive and check the receipts the night of pay-day

and at intervals during the month, even if the Steward is ordinarily authorized

to do so.) The Steward or Cashier has meanwhile unlocked the

cash register, noted the readings of the record wheels and taken out the

tape showing the printed record of sales.

Figure 4. (Reduced in size)

Now, assuming that triplicate records are used, the Steward takes the

triplicate copies—either book or roll—“throws” them or checks them for[12]

numbering, to see that all are accounted for, and totals their value on the

adding machine. By comparing this total with that shown by the appropriate

wheels of the cash register, he ascertains if all charge sales have

been rung up. If these two agree, all is well, so far. If they do not agree,

a note is made of the discrepancy for use in connection with the operations

hereafter described.

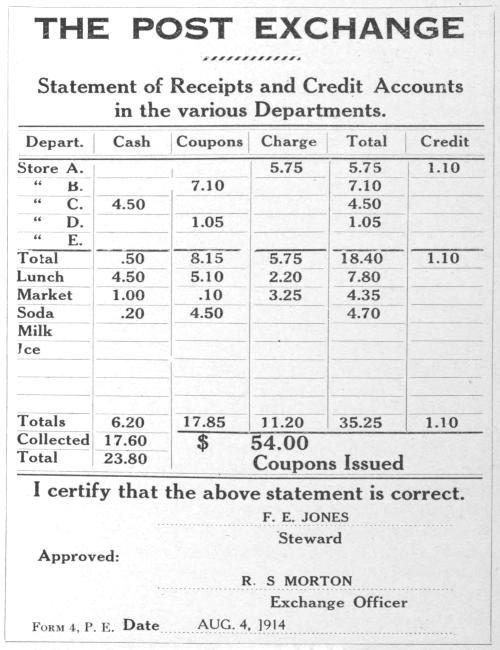

Figure 5, (Reduced in size)

By this time, the clerks should be ready to hand in their reports and

receipts. The Steward fills out the rest of Form 5 as called for by the

various columns and abstracts these reports to his Form 4 as shown in[13]

Fig. 5. This form should be printed on a card measuring 3½ × 8⅜ inches,

to permit convenient filing. If printed on thin paper, it will have to be

filed on a Shannon file which is not so convenient in the long run. These

cards should be of fairly good stock, as they are a part of the permanent

records of the Exchange, but should be no heavier than necessary. The

Steward carries down the totals on Form 4 and compares them with the

three separate totals shown by the cash register. Restricting ourselves to a

discussion of the charge sales, we see that if the total of the triplicate slips,

the totals of the clerks’ reports and the total shown by the cash register all

agree then the charge sales statement shown on Form 4 is correct. If

there is any discrepancy in this or any other column of Form 4 the mistake

should be found and corrected before the clerks are dismissed for the

night. Suppose, for example, that the cash register shows a total of $20.60

charge sales for the day and the total on Form 4 is $21.90. The first step

is to have the clerks make sure that their reports correctly state the actual

amount of charge sales slips turned in. If they are correct, then some

clerk has probably forgotten to ring up one or more sales. To trace the

fault, let the Steward read off all the charge sales from the record tape of

the cash register, calling off at the same time the letter of the clerk who

rang up each sale. These can be compared with the triplicate copy of the sales

slips, or the assembled clerks can be required to note the sales accredited

to them, the grand total of which must equal $20.60. In this manner, the

error is definitely located. On the other hand, suppose the cash register

shows $21.90 and the total on Form 4 shows $20.60. The effect is that

produced by a clerk being short $1.30 in charge sales slips after he has

actually made the sales. The same procedure as before will locate the

mistake. If he cannot produce the slips (or cash or coupons as the case

may be) or satisfactorily explain the mistake, the clerk in error should be

required to make good the discrepancy. Discrepancies in cash and coupons

can be located and remedied in the same manner. It is important that the

clerks be required to participate in the task of locating mistakes and to

make good on errors, otherwise there will be no incentive to careful work.

When the totals of the clerks’ reports check against the cash registers,

the next step is to check the former against the receipts in cash, coupons

and charge sales slips actually turned in by the respective clerks. The cash

should, in fact, be counted immediately upon being turned in, checked O. K.

on the clerks’ reports and put in a safe place. The charge slips handed in

by each clerk are compared with the strip from the adding machine (on

which the clerk has added up his slips before making out his report)

checked against the report and put aside for filing. Coupons are handled

in the same way except that they are sealed in the envelope and put in a[14]

secure place until the Exchange Officer personally can burn them. This

matter of destroying coupons should never be delegated to any other

person. In view of the fact that the receipts turned in by each clerk

should, and usually do, check exactly with his report, this particular routine

is recommended, as it allows the dismissal of the clerks before commencing

the work described in this paragraph. In case of mistakes, the simple

expedient of making the clerk at fault assist in the work for a few evenings,

is usually sufficient to prevent a repetition. In large Exchanges, where

the coupon and charge sales are large, it is not customary to total the

charge sales slips and count the coupons until the next morning. If the

receipts turn out to be greater than called for by the reports, the surplus

can be taken up by entering on a single line of Form 26 (described hereafter),

whenever the books are closed (or oftener, if desired) an item showing

what departments are credited with these excess coupons, exactly as if it

were another day’s transactions. Such entry should, however, be prefaced

by the words, “excess coupons”. Shortages should be collected from the

clerk at fault, thus making the reports correct. The Exchange Officer

should occasionally make the coupon and the charge sales counts himself.

It would be unbusinesslike, if the coupon or charge sales are heavy, to

require the Exchange Officer, the Steward or any other high priced man

to waste his time counting coupons or any other similar task. A less expensive

employee should be detailed for this purpose. For such unskilled

labor, a boy at $10.00 per month who can run errands, etc., would be a

profitable investment in many cases, thus leaving the expensive employees

free to do more important work.

Too much stress cannot be placed upon the importance of insuring the

correctness of the data entered on Form 4. If the above mentioned checks

have been applied, there should be no trouble in any phase of our charge

accounts.

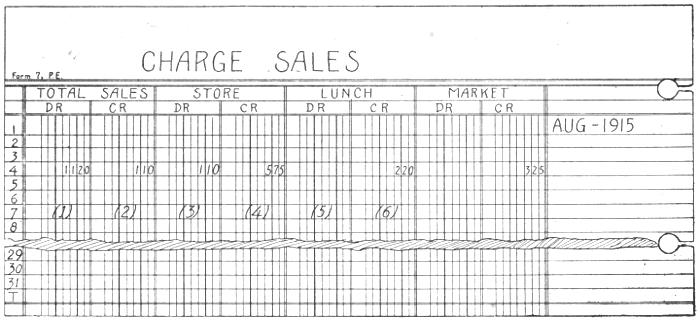

Daily Summary of Charge Sales.

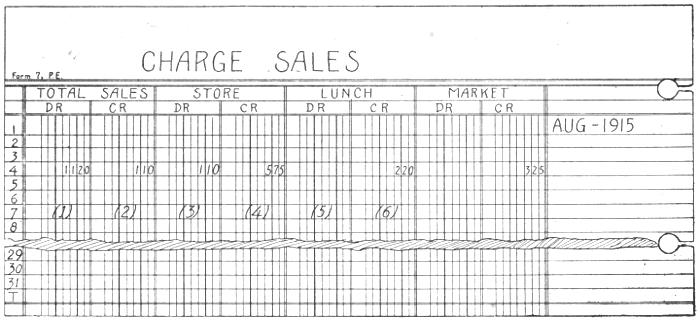

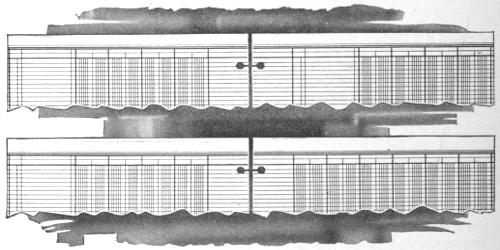

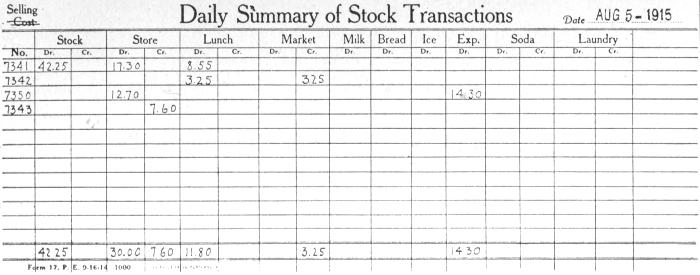

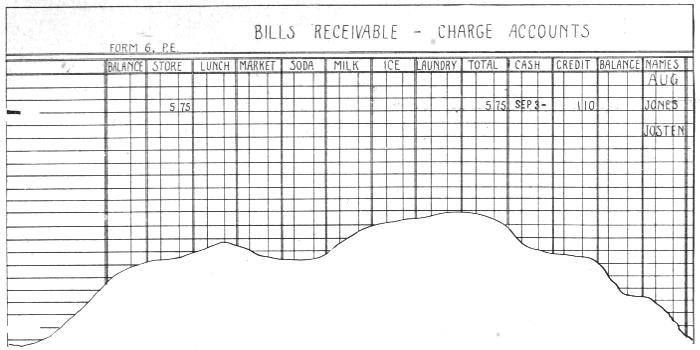

Figure 6. (Reduced in size)

For various self-evident reasons, we use Form 7, shown in Fig. 6, for

showing a month’s charge sales. This form gives us in a most convenient

shape, a summary of that part of our (daily) Forms 4 that relates to our

charge sales business, it safeguards us against the loss of any Form 4 and

facilitates posting our ledger accounts. This form is kept up to date, the

charge sales from Form 4 being entered thereon daily, and therefore, affords

us a most efficient aid in closing our books at any moment. At the

end of the month, or whenever the books are closed, we find the totals of

the columns of Form 7 and post these totals as lump sums into the ledger.

For example, the total of column 1 is posted as a debit in the ledger against[15]

Bills Receivable, Customers; the total of column 2 as a credit to the same

account. The total of column 3 should be posted as a debit against the

Store account in the ledger, this being for articles returned to the store by

our customers; the total of column 4 is posted as a credit to the store

account, being for articles sold from same, etc. These sheets, constituting

Form 7 are 11 × 14 inches, and cost $1.75 per hundred without printed

headings; a sectional post binder to fit them can be bought for $3.75. The

sheet is the same on both sides and will, therefore, take care of seven

departments if we use the whole width of the open book. This will be

found ample in most cases. It is useless expense to have the headings, etc.,

printed on the sheets, because a single sheet with neatly written headings

can be made to serve as a sort of index for a great many sheets, provided

they are mounted above it and are trimmed off just below the headings

“DR.” “CR.”, and also trimmed on the outside margin so that the date

figures on the lowermost sheet will serve as an index to the lines of the

upper sheets. This labor and money saving point will be more fully discussed

later.

[16]

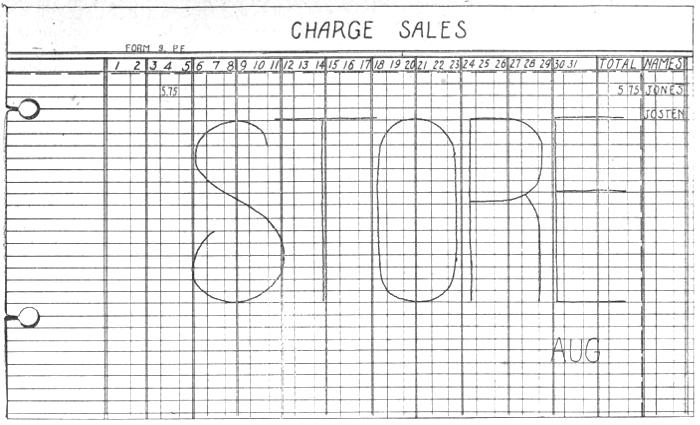

Recording Charge Sales Slips.

After these slips have been checked against the clerks’ reports, they

must be sorted out and filed according to the names of the purchasers.

For this work, have two card index drawers, each fitted with a set of

guide cards marked on the tabs with the names of our charge customers.

As each slip is found, file it behind the proper name. We first take all

the “Store” slips and file them in this manner; we then go through this

“sorting drawer” and total the slips belonging to each customer and enter

these totals in the column representing that date on Form 9, (see Fig. 7)

opposite the names of the respective customers. At the same time, we

insert the sales slips diagonally in their proper places in the other or

permanent filing drawer. The total of these entries on Form 9 should

equal the total charge sales credited that date to the Store on Form 7.

If it does, the slips that have been placed diagonally can be shoved down

into the proper places as we are through with them; if it does not, they

can easily be removed for further examination. This daily check should

invariably be made for each department. We proceed in like manner with

respect to the other departments, each department having its own sheet or

sheets like Form 9. It is evident that this form gives us a summary of all

the charge sales made each day from each department, showing the

amounts sold to each of our customers. At the end of the month, each line

is added across and the total entered. The “Total” column is then added

up and compared with the total obtained by adding together the figures[17]

(representing the daily totals) on the bottom line. If these two totals

check against each other and against the total shown on Form 7, the

account may be considered correct and is a record of the daily transactions

between our customers and the department considered.

[18]

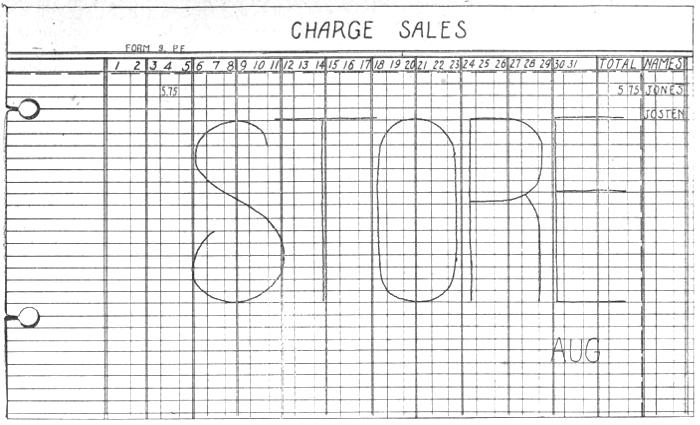

Figure 7. (Reduced in size)

The book in which we bind our Form 9 is known as the “Charge

Book”, and it may be well to explain here the physical make-up of this

important book of record. It is, of course, on the loose-leaf principle,

being of the type known as a “sectional post binder”. It costs $2.50 and the

ruled sheets (without special printing) cost $1.00 per hundred. It is,

however, to the manner of handling the sheets of the book that attention

is especially invited. The old fashioned way would be to enter the names

of our customers down the left hand margin of each sheet until all were

entered, put the name of the department and the month and year at the

top of the sheet and the days of the month at the tops of the successive

columns with the heading “Total” at the right of the sheet. Thus, if we

had five departments and enough credit customers to require six sheets

for the list, we should have to prepare thirty sheets in this manner every

month. Now, to show how we can eliminate unnecessary work by the

exercise of a little forethought, let us assume that we have started our

record in this manner. Now take six copies of Form 9, trim them along

the heavy broken lines shown in Fig. 7, and bind one of these sheets in

front of each of those we have previously prepared. It is obvious that

the book is now ready for another month’s entries without any preparatory

writing or numbering whatever other than labelling each new sheet in

some convenient place with the month and department to which it pertains.

Of course, to care for the five departments, we should have to do this for

all five sets of sheets that we originally prepared. It follows that, provided

our list of customers does not change, this same operation of inserting

trimmed sheets would constitute the only labor necessary to continue

this record for an indefinite period.

After considerable experimenting and actual trial in service, the following

described scheme has been evolved for handling this record in an

efficient manner. While no claim is made that it is perfect, it is believed

that it will give thorough satisfaction wherever it is given a fair trial and

will save many hours of labor in keeping the books.

1. Take a sheet, Form 9, and enter the names of your charge customers

in alphabetical order, commencing on a left hand page. To allow

for future changes, leave a blank line before each name and one or two

blank lines at the bottom of the page for sub-totals, etc. For clearness

and permanence, these names should be put in from a black “record” typewriter[19]

ribbon. Write in the headings of the various columns as shown on

Form 9. The object in placing the “total” column near the outside margin

is to have it next the customer’s name, thus minimizing the chances of

error in taking out the wrong total when we make our postings at the end

of the month.

2. If our list of charge customers will require more than one sheet,

take another Form 9 which we shall call Sheet No. 2 and proceed in a

like manner, using the same side of the sheet as before. This should be

repeated until all our charge customers are entered. Several blank lines

are left at the bottom of the last sheet. Thus, when we have finished and

have inserted the sheets in our book, we shall have a complete list of our

charge customers all recorded on the left hand pages of our book, that

side of each sheet that forms the right hand pages of our book being blank.

3. Now, in order to utilize these blank pages, thus avoiding unnecessary

waste, we proceed as follows:—Open your book between Sheets 1 and

2; page 1 will then be on the left and page 2 on the right. This page 2

should now be prepared in a manner exactly similar to that used in preparing

page 1, except that the customers’ names are on the right hand

margin with the total column next inside. This is clearly shown in Fig. 7.

4. Prepare the blank sides of the other sheets in a similar manner

and we shall then have two complete lists of our charge customers, one

occupying the left and the other the right hand pages of our book, the

confronting pages being practically symmetrical.

5. Let us assume that the Exchange has five separate departments in

which charge sales can occur. We cut five sheets along the heavy broken

lines shown in Fig. 7 and insert them between pages 1 and 2. Five more

trimmed sheets are inserted between sheets (whole sheets) 2 and 3, and

so on for the rest of the book. In order to identify these sheets if accidentally

removed from the binder and to facilitate the making of entries,

we print on each of them in large letters, the name of the department and

the month to which they refer. This is best done lightly with red ink as

shown (in black) in Fig. 7 where the sheet is marked STORE—AUG.

This red ink lettering will not obscure the black ink figures subsequently

made.

6. Let us agree to use the left hand pages for the first month’s account

and the right hand pages for the next month’s account. Let us take the

first trimmed sheet and mark it “STORE—JAN” on one side, and

“STORE—FEB” on the other. Do similarly for the sheets reserved for

the “market”, “lunch room”, and other accounts. The sheets containing the[20]

typewritten headings are not used for recording sales, but are used for

guide sheets, for reasons to be set forth later.

It is easy to see from the preceding description that our charge book

is a running account, and being always up to date, can be closed at short

notice. When two months’ records have been entered, the trimmed sheets

are lifted and filed, as will be described hereafter. Fresh trimmed sheets

are again inserted in the proper places and the record proceeds as before.

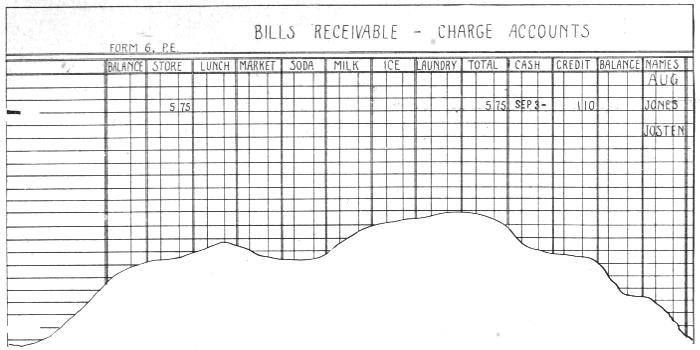

Consolidating Charge Sales Monthly.

The form in which we have placed our daily records of credit sales

lends itself very readily to a process of summation or consolidation. The

manner of doing this is as follows:—

1. Prepare a second double list of our credit customers exactly as

described above, except that the columns, instead of being headed with the

days of the month, are labelled with the names of the various departments,

as shown in Fig. 8. Let us call this Form 6. Blank sheets trimmed along

the heavy broken lines, shown in Fig. 7, are inserted as before, no recording

being done on the typewritten sheets—they are simply guides or indices

to the various lines and columns.

Figure 8. (Reduced in size)

2. All these sheets are bound in a separate book to facilitate the work

of posting at the end of the month. Experiment seems to prove that this

is better than binding these records in the same book with the charge

sheets just described. This, for the reason that a clerk is apt to waste too

much time in continually turning pages back and forth and is also more

liable to make errors in posting.

3. Immediately after the end of the month, Form 7, is checked against

Form 9 as previously described. We then take, say, the “store” charge

sheets (Form 7) and enter on Form 6 the total that each customer owes

the store. We do the same for every other department, also entering the

balance remaining unpaid from last month in the column provided for the

purpose. We also record in the proper column any credit we have given

our customers during the month for goods returned, overcharges, etc.

4. By using the adding machine, we find the total of each department’s

column on Form 6; it should equal the total charge sales for that

department reported on Forms 7 and 9. If it does not, the error must be

found and corrected before proceeding further. These totals, when correct,

are entered at the foot of their proper columns on the last sheet of

the record. Now add these column-totals on the machine and enter the

result in pencil at the foot of the “Total” column on the same last sheet[21]

of this Form 6 record; it should check against the grand total of the charge

sales for the month reported on Forms 7 and 9.

[22]

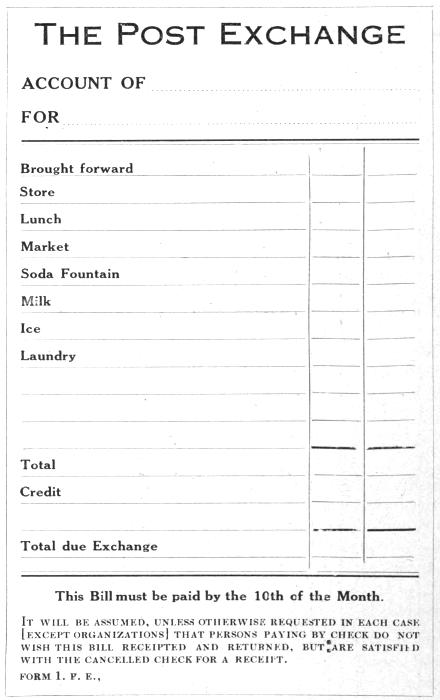

Figure 9. Actual size

5. When all postings to our Form 6 are complete, we station one

clerk at the adding machine and one is prepared to make out our monthly

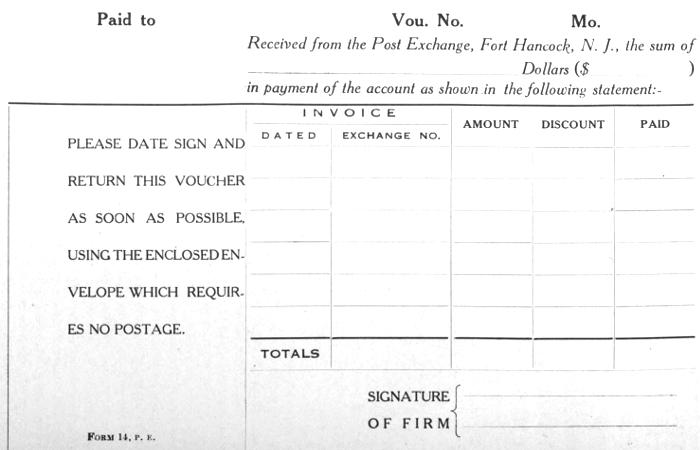

bills or statements of account, using Form 1, shown in Fig. 9. Some person

reads off Form 6 the name of each customer and the total charges[23]

against him by each department. These items are added on the machine

and simultaneously entered by the bill clerk on Form 1. The adding machine

operator reads the total of the items he has added, which total is

entered by the bill clerk on his Form 1 and by us in the column headed,

“Total” on our Form 6.

6. Any credit due the customer is read off to and entered by the bill

clerk on the statement. He then figures the balance due the Post Exchange,

which balance should agree with that figured independently by the person

reading from Form 6.

7. When the last bill has been made out, take the printed strip from

the adding machine and find the sum of all the totals that have been read

off by the operator. This sum should equal the pencil total described in

Par. 4 above and checks the correctness of the account. If a “Duplex”

adding machine is used, this does not require extra work. If the accounts

do not “jibe” and the error cannot be found, take in rotation the charge

slips that you have filed against each customer and add them on the machine,

making a separate total for each customer. This should locate the

error. If the accounts check, however, (and they should if the previous

checks have been made properly) this laborious operation is unnecessary.

All our bills are now ready for mailing, and they are made out correctly.

In order to obtain the full benefit of this method, our bill forms

should require the minimum amount of writing. The form shown in Fig.

9 gives satisfaction. It is a 3 × 5 inch card and therefore fits standard size

card index drawers; it is easily handled and will go into a note size penalty

envelope without folding. The appropriate month can be stamped in and

the name of the customer entered during spare moments throughout the

month, so that the only work necessary at this time is to write in the

figures. If the lines of Form 1 are “typewriter spaced”, that is, six to the

inch, and the form is not too heavy, it can be placed directly in the adding

machine and the various amounts printed on the card. The names of the

various departments should be printed on this card in the same order in

which they occur on Form 6. In fact, much work will be saved if some

specific scheme of sequence or relative order among the different departments

is invariably followed.

The writer does not know of a more economical or efficient system

of handling the bug-a-boo of “getting out our monthly bills” than that

just described. Sometimes, a “duplicating bill-book” is used, but it is a

wasteful and inefficient method when compared to this. One of the principal

advantages of the system lies in the fact that it is unnecessary to keep

a private ledger account for any of our charge customers. If we were to[24]

do so, we should simply repeat information that we already have. It will

be remembered that we have filed away our triplicate record of each day’s

charge sales, which record describes in detail the particulars of every sale

made on that day. From this, should the necessity arise, we can reconstruct

our whole charge sales record for the month. We have also on file

(until the bill is paid) another copy of each charge sales slip, filed according

to the names of customers, which, in itself, constitutes one side of the

ledger account that would be kept under the old system. These, together

with the records previously described, amply warrant the abolition of

customers’ private ledger accounts. Another great advantage of this

system lies in the ease and rapidity with which the books can be closed at

any time.

Attention is invited to the note at the bottom of Form 1. This is a

labor saving item that is in accord with the practice of many up-to-date

houses—to regard a canceled and endorsed check as the best form of receipt.

Hence, if a customer pays his bill by check, it is unnecessary to

receipt the bill and return it to him, our endorsement on his check constitutes

his receipt. This same procedure can be made to apply to companies, etc.;

also, if the company commander will use the sales slips as his

sub-vouchers for the expenditure.

Credit Transactions.

We shall now take up the procedure to be followed in recording any

and all credit which we allow to customers for overcharges, goods returned,

etc. It is apparent that such transaction must occur in any business.

Accurate track should be kept of them and they should be handled

in the most efficient and time-saving manner possible. Each such transaction

results in a credit against our Bills Receivable and a charge or debit

against the particular department involved.

As before stated, the clerk who receives the goods that are returned to

us makes out a charge sales slip, marks it “CREDIT” and keeps the duplicate,

giving the original to the customer. It is usually the rule that nobody

other than the Steward or the Exchange Officer himself has authority to

give customers credit in this way. In the evening, the clerk hands in these

credit slips with his report. When the Steward makes up his report on

Form 4, after verifying the clerks’ reports, he simply enters these credits

in the last column on his Form 4, totals them and describes each separate

credit transaction on the back of his report. All the data relating to the

charge sales (and credits given) during the day that are shown on the face

of Form 4 are abstracted to the appropriate line of Form 7, which latter

sheet gives us in concise form all the data we need concerning our charge[25]

sales for the month. The credit slips are gathered up and placed with the

filed charge sales slips relating to the person who returned the goods to us.

At the end of the month, preparatory to making out our bills, all credits

are entered in the column headed “Credit” on Form 6, and are checked

against the totals shown on Form 7. This avoids the necessity of entering

each credit transaction on a separate line of Form 7 as such transaction

occurs. Even if the credit slip were lost, no error should result, because

we check the total credits entered on Form 6 against the total credits on

Form 7 before we start making out our bills. If these do not agree, we

must check both Forms 6 and 7 against the credits shown daily by the

various Forms 4. We also have another check in the triplicate copy of the

credit slips that has been filed away.

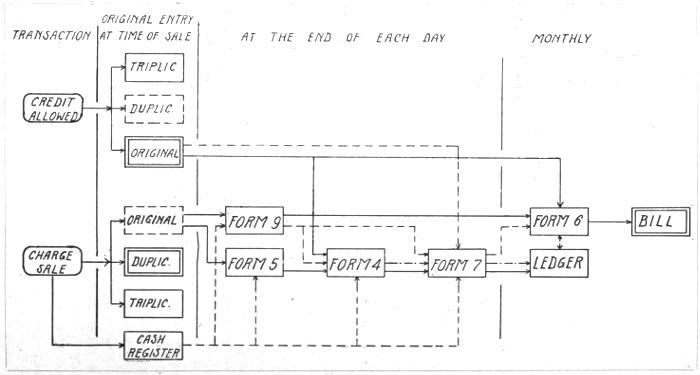

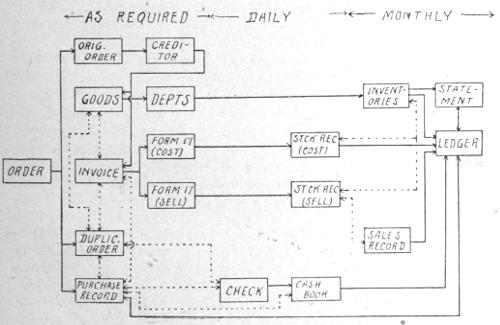

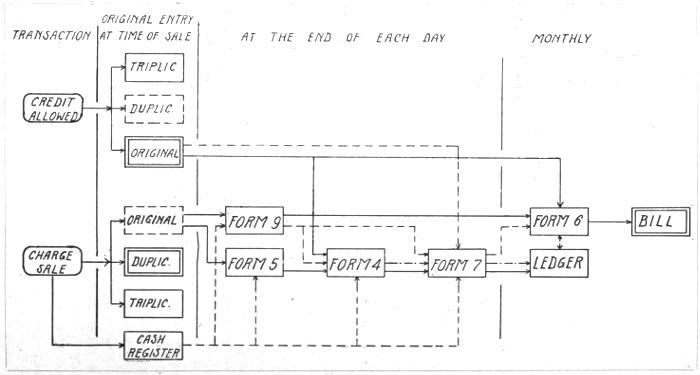

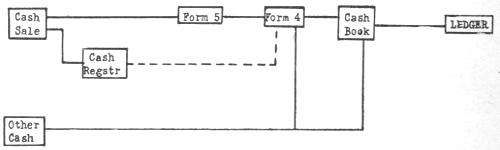

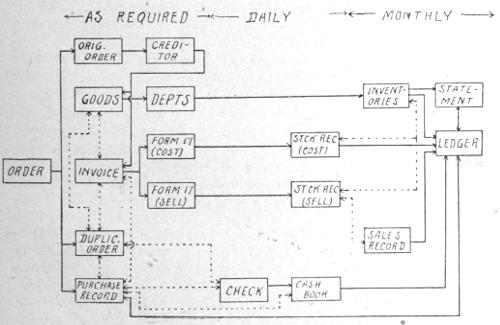

Below is a graphic chart which shows how to handle this system of

charge accounts. It shows how the various records experience a continuous

process of summation until they finally reach the ledger and the customer’s

bill, and how the accounts can be checked as we go along, thus

avoiding errors. Solid lines show posting operations, broken lines show

possible checking operations.

Settling Charge Accounts.

When any of our charge customers pays his bill, we make an entry in

our cash book, giving to each such payment a separate line. We enter the

amount of the payment in the column headed “Net Cash” and also in the

column headed “Customers”. We do not enter any of this amount in the

columns referring to the various departments because they have already

been credited for their proper shares through the charge sales records and

to do so again in the cash book would manifestly give them double credit

for each charge sale. We also stamp “Paid” in the “Cash” column of

Form 6, using a dating stamp that will fit neatly into this column. One

using red ink is preferable. If only a part of the bill is paid, we enter in

this column the amount received, extend the balance to the proper column

and, at the proper time, carry it forward to next month’s account. Some

book-keepers of the old school will keep a “blotter” or some such book

wherein these payments are first noted, copying them at their leisure into

the Cash Book. As the Cash Book is a book of original record, this is not

only wrong, but is incidentally unnecessary labor and hence to be avoided.

When payments like these come in, they should be taken directly to the

book-keeper, who should immediately enter them in the Cash Book.

[26]

Figure 10.

All such payments occurring on any one day are entered in a lump

sum under “Collections,” on the Form 4 for that day. In fact, all cash[27]

received, whether from paymasters’ collections on payrolls or any source

other than cash sales by any of our departments, is taken up on Form 4 as

“Collections”. If a bill is paid before the end of the month, it is treated

exactly the same as if it were paid afterward, except that the date is

stamped in a different colored ink. It does not confuse our accounts,

because the amount paid is entered in the “Customers’” column of the

Cash Book and the total of this column is posted at the end of the month to

the credit side of Bills Receivable, Customers, in the ledger. The “Customers’”

column in the Cash Book is solely for receipts from our charge

customers and for nothing else.

If, at any time, we wish to find the total charge sales, we simply find

the total of the amounts shown on Form 7, subtracting credits, if any. We

also use the total sales credited to the various departments on Form 7 in

making up our monthly statement for the auditing officer and for the Inspector.

To find out at the end of the month the amount due us on account,

we turn to Bills Receivable, Customers, in the ledger, where the

balance should show the correct amount. This amount should check with

the “Total” column on Form 6 reduced by credits allowed and payments

received prior to the end of the month.

Dead and Live Records.

It will be remembered that all our Forms 9 were placed in one book

and our Forms 6 in another, and that each Form 9 was to be used for

two months, that is, used on both sides. After both sides have been used

these forms are transferred bodily to the book containing our Forms 6, and

placed between the Forms 6 referring to these months. Fresh Forms 9

take the place of those transferred, thus keeping our book “alive” and

placing our dead records where they will be less in the way. The logic of

this is evident when we remember that we use our Charge Book (Form 6)

only at the end of the month, whereas, we use our Form 9 book every day.

As regards Form 8 (charge sales slip) our rolls of triplicate sales

slips for the month should be marked on the outside of each roll with the

date and the name of the department to which each pertains and kept in a

convenient place until the auditing officer has finished his work for that

month, when they should be stored together in some place where they can

be consulted if desired. They should be preserved for such length of time

as may be required by regulations or local laws, depending upon which is

the greater. The original slips may be treated in one of two ways; they

may be sent to the customer with his bill at the end of the month, or they[28]

may be sent to him after he pays his bill. It is felt that the first method is

by far the better.

Forms 5 for the month should be preserved until the auditor has finished

with them, and it is perhaps advisable to keep them until after the

next visit of the inspector. Our Forms 4 are very important and should be

kept until after the inspector has inspected the accounts of the Exchange, if

not indefinitely. Forms 6, 7 and 9 are a part of the permanent records of

the Exchange and should be preserved indefinitely.

The foregoing description of this system of handling charge accounts

may sound formidable to the layman, but in reality, it is not so. As shown

in the graphic chart (Fig. 10) it is a logical system, proceeding in a simple,

orderly way from the charge sales slip to the ledger and the customer’s

bill. It belongs to the class of book-keeping called “controlled accounts”—each

part of the system knits evenly into the others, and there is a continual

process of summation going on throughout the records. There is no

duplicated work and every step is one of definite progress towards the goal.

It will be found to fulfil the requirements we imposed at the beginning of

this essay. It has actually proved its worth wherever installed. It is

equally adapted to the large and to the small Exchange. Due to the many

available opportunities for checking the correctness of results, mistakes are

easily located and corrected. However, if the checks described are applied,

especially those relating to Form 4, there should be little excuse for a mistake

to appear in any of the higher accounts.

[29]

CASH SALES.

In the light of the preceding discussion of charge sales, our methods

of handling cash sales can be disposed of in a few words. In all cases of

such sales, the clerk simply gives the customer his goods, receiving the

money therefor, makes change if necessary, rings up the amount of the sale

on the cash register and places the cash therein. The most important part

of this transaction, insofar as our system is concerned, is described in the

next-to-last clause. If the salesman once rings up the correct amount on

the cash register, the store is sure that the transaction is closed, and closed

properly. Means to this end will be discussed under the heading of “Cash

Registers”.

It is customary to loan, secured by various kinds of receipts, a suitable

sum to the heads of the various departments of the Exchange for the purpose

of making change. In some cases, it may be advisable to require them

to make a cash deposit to cover these amounts. When the Cashier or

Steward is under bond, it is feasible to turn the “change money” of the

whole Exchange over to him, taking his note for it.

After closing at night, each clerk enters his cash sales on his sales

report (Form 5, Fig. 4) and hands it, together with the cash receipts, to

the Steward or other authorized recipient. The latter counts the cash

immediately, checks it on the clerk’s report and places it one side until the

total cash is checked. He then transfers the item to his own Form 4,

(Fig. 5) and compares the totals for each department with the cash register

readings for those departments, entering the latter, if they are shown

separately for each clerk, on each clerk’s report in the spaces provided for

that purpose. Discrepancies are handled as previously explained under

Charge Sales.

Cash Book.

When the cash is checked and the Steward’s report is correct, he copies

the amounts of cash sales for each department into the Cash Book, putting

each amount in its proper column. All the cash receipts from all the departments

for any one day go on the same line in the Cash Book. On the

other hand, credit nothing in the Cash Book to a department except a cash

sale. Every other receipt of cash from whatever source is recorded in the

Cash Book, also, a separate line being given to each transaction. For instance,

as before explained, whenever one of our charge customers pays his[30]

bill, we give him a separate line in the Cash Book, entering this amount in

two columns, first under “Net Cash” and also under “Customers”.

The Cash Book should have on the “Received” or debit side (the left

side) columns for the following items:—Date, Explanation, Vou., Net Cash,

a column for each department of the Exchange, Customers, Creditors, Interest

and Discount, and at least two spare columns for entering the pay-day

collections, etc. The books should not be too bulky as many cash

books are, and should, of course, be built on the loose leaf plan. A cash

book cannot be designed to suit all cases because of the varying number

and kind of departments pertaining to different Exchanges. However, it

is easy to secure uniformity of principle and method, which is the main

thing. The only point that need vary between different Exchanges is the

number of columns in the book and the headings to same.

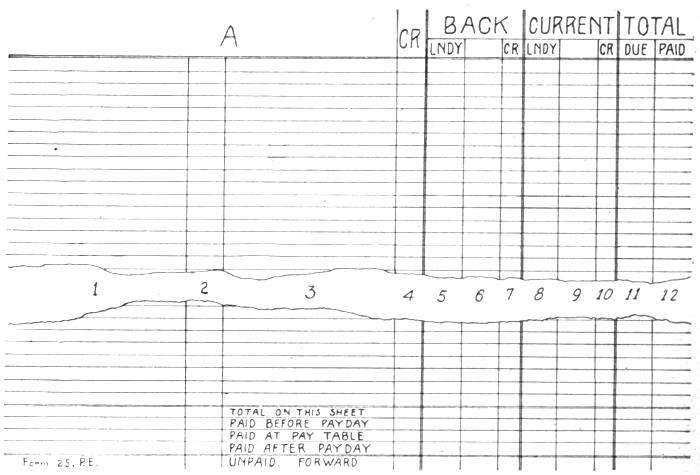

Figure 11. (Reduced in size)

A cash book will be rather expensive if we have it made precisely as

we want it, especially if we have the column headings printed in. There is

no doubt that printed headings make a neater book, but in many cases, the

advisability of incurring the extra expense is open to doubt. Considering

the great variety of stock pages published by various manufacturers, there

is rarely an excuse for ordering specially ruled and printed sheets. Special

ruling are very expensive, especially when we can order but a small supply.

It is found that the sheets shown in Fig. 11 give perfect satisfaction. The

lower sample, having 20 columns, will take care of almost any Exchange,

and by trimming off the two outer columns of the right hand page, we can secure

a capacity of 36 columns. This would prevent us from keeping Cash Received[31]

and Cash Disbursed on pages that confront each other, but as the

number of pages used for the former usually exceeds greatly those necessary

for the latter, this objection has little weight. If convenience so dictated,

there is no reason why the two sides of the Cash Book or Cash

Account could not be kept in different parts of the book or even in separate

books. This would lead to economy of pages.

The upper of the two forms shown in Fig. 11 would be suitable for small

Exchanges where a large number of columns are not required, as the left

hand side could be used for cash received and the right for cash disbursed.

Several of the right hand pages would have to be wasted each month on

account of the greater number of entries on the debit side. Some Exchanges

use a form similar to the upper one of Fig. 11 except that it is

printed and ruled to order and contains a greater number of columns than

that shown in the cut. The writer knows of one Exchange that has as

many as twenty columns on each side of its Cash Book. Such forms, however,

are exceedingly expensive and should be considered more or less of a

luxury. The forms shown in Fig. 11 cost $1.75 per hundred retail (without

printed headings) and measure 11 × 14 inches, being 11 inches on the

binding side. A sectional post binder to fit any number of these sheets can

be obtained for $3.25 retail.

The Cash Book is used to give a detailed record of all cash transactions.

On the left hand or debit side is entered all cash received and on

the right hand or credit side is entered all cash paid out; the difference in

the sum totals of the respective sides showing at any time the amount of

cash on hand. All items on the credit side of the Cash Book are posted to

the debit side of some account in the Ledger and vice versa. (Bank

drafts, sight drafts and checks belong in the cash account; notes and time

drafts belong to Bills Receivable and Bills Payable accounts.) Our posting

is done only when the books are closed, at the end of the month or

when necessity arises, thus saving an enormous amount of work. As we

keep no private ledger account for each of our creditors or customers, it

follows that the totals of each column in our Cash Book are posted as

lump sums to the credit of or as a debit against the ledger accounts of Bills

Receivable, Bills Payable, or one of the Exchange’s departments, etc. All

miscellaneous receipts that do not properly belong to one of the departments,

customers, etc., are taken up under “Interest and Discounts”.

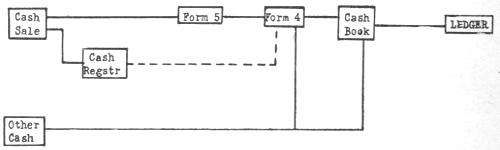

An important advantage of this method of handling our cash sales is

that we are preparing, as we go along, all the data that will be required by

the Inspector. A discussion of the Credit side of the Cash Book is postponed[32]

until the subject of Purchase Records is taken up. The above described

operations are shown graphically in Fig. 12, where the heavy lines

represent operations of recording or posting and the dotted lines show

possible checking operations. The item of “Other Cash” is, of course,

checked against Form 25, Form 6, or elsewhere, depending upon circumstances.

Fig. 12.

[33]

COUPON SALES.

In General.

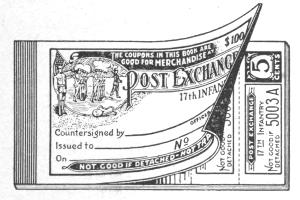

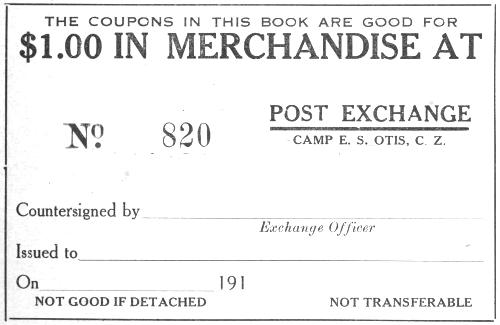

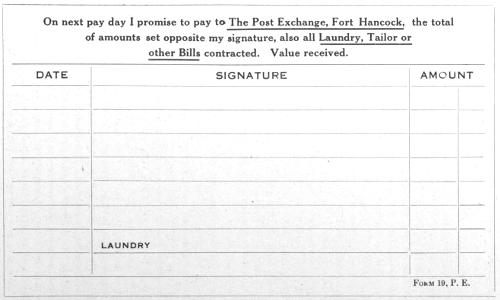

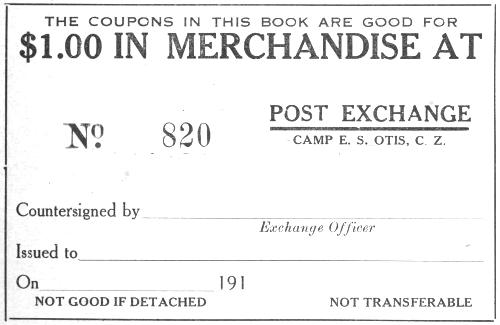

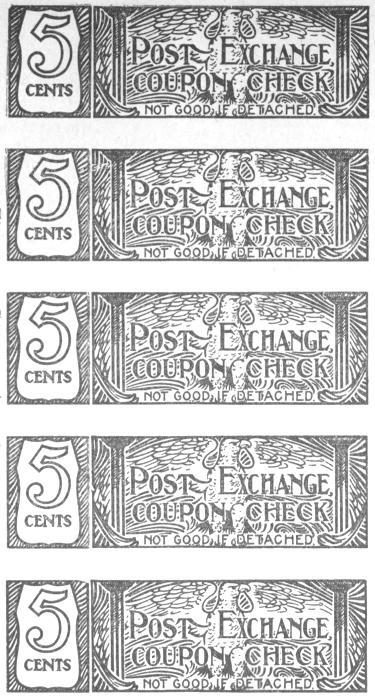

Figure 13, Cover (Reduced in size)

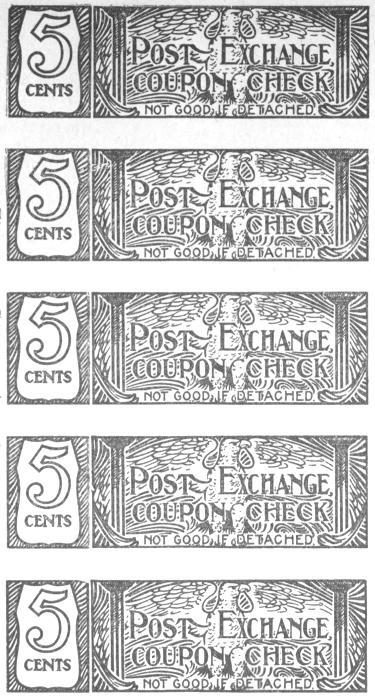

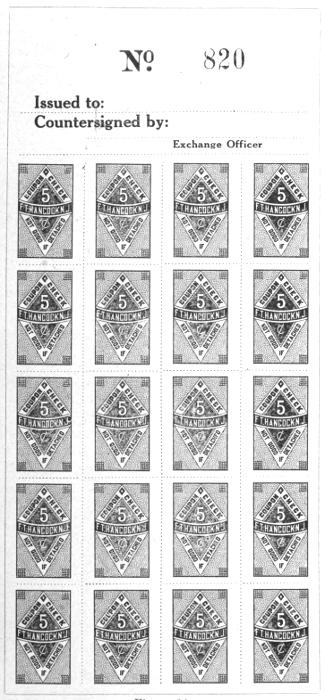

Figure 13, Coupons Actual size

Coupons, as it may be superfluous to explain, are credit slips sold to

enlisted men by the Exchange. They are sold on credit, being secured by[34]

notes signed by the purchasers; these notes constituting a lawful lien on

the drawer’s pay are supposed to be redeemed at the next pay day. The

credit slips can be used at any time for purchasing articles at the Exchange.

Exchanges formerly used metal coins or “checks” for this purpose, but it

was considered inadvisable to permit credit to be so easily counterfeited,

transferred, etc., hence the use of paper coupons has become universal,

being covered by mandatory orders in certain circumstances.

Kinds of Coupons.

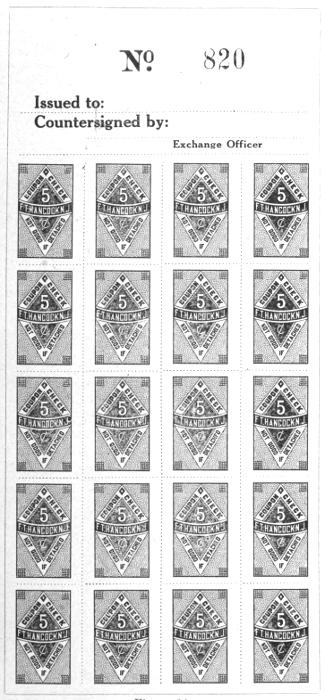

There are two classes of coupons, the first being the well known

“Coupon Book” shown in Fig. 13. These books are made in various denominations

ranging from one to five dollars. They are composed of a

cover and several interior pages, the latter being divided by perforations

into five coupons each, representing values of five, ten or twenty-five cents,

depending upon the value of the book. For instance, a $1.00 book contains

three sheets, two composed of five 5c coupons each and one composed of

five 10c coupons. On the cover of each book is printed the serial number

of the book, its value and blank lines for the insertion of the signature of

the person to whom issued, the signature of the Exchange Officer and the

date of issue. It is also customary to have printed on the cover the words

“Not Transferable”. In some cases, on the back cover of each book is

printed a promissory note which, after being signed by the soldier, is torn

off and kept by the Exchange authorities until the value of the book is

collected in cash from the soldier. A variation of this scheme is to have a

separate sheet in each book so printed that it will perform a like function.

In either case, it is expected that when the book is depleted, the clerk

making the last sale shall take up the cover of the book in order that it may

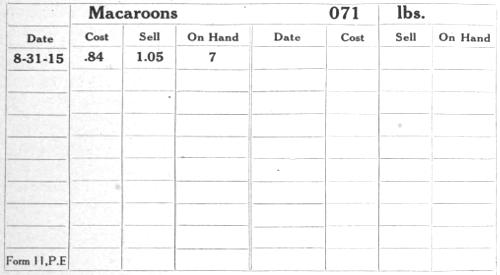

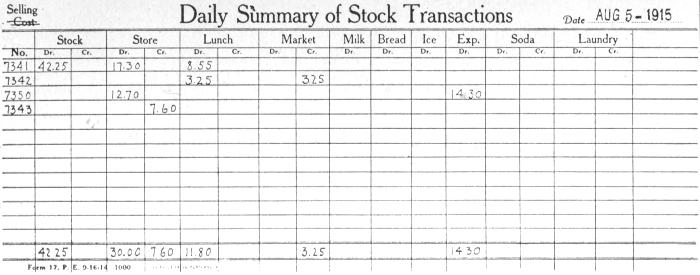

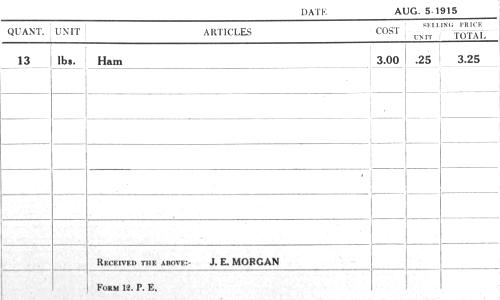

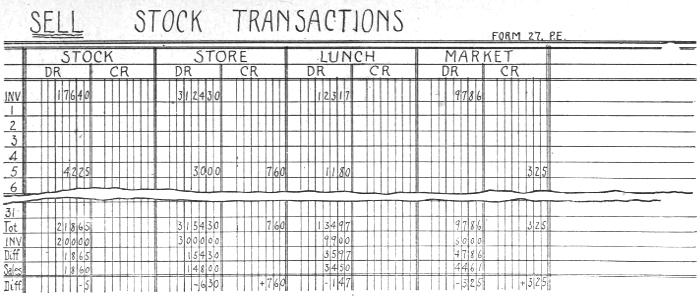

be filed in the Exchange for such period as the Exchange Officer shall