| Note: | Images of the original pages are available through Internet Archive. See https://archive.org/details/cu31924002741357 |

IV

This is not a novel, nor a work of fiction; it is based on the facts of the Eleventh Census and other statistical reports, and on the most reliable authorities on these subjects. This book represents the most essential and fundamental features of the nation’s situation. It shows the reasons why your cities rapidly become the property of a comparatively very few persons; why the American farmers lose their ground, and the urban population lose liberty; and why all become absolutely dependent upon a few multi-millionaires. It exposes the conditions in consequence of which the whole nation becomes a nation of mere tenants of farms and homes, paying rents; and, while the wealth increases, the greatest majority of the people come into desperate struggle not for pleasure, but for simple existence.

In order to impart as much knowledge in regard to the situation of the nation as possible, it was found necessary to supply the readers with a sufficient comparison of statistical facts, pointing to the differences of averages made by different authorities on the subject. This comparison has also been introduced for the purpose of indicating certain truths of special value, and for finding the true VIbases of reasonably dealing with the most vital problem of the national existence. This problem involving conditions that cause the commonly recognized social unrest of the present time is a problem which grows in intensity.

Recognizing the difficulty in solving the problem and the danger of the situation, we should not wonder, if the very persons who are always inclined to make discounts in established truths, will be profoundly surprised to know from the final conclusions here presented, that the time of discounts has passed away, and that it is now too late to ignore the facts of so serious significance.

If this work should come to be regarded as a general diagnosis of the diseased situation, we may rest assured that there are many thousands of people who will count it their sacred duty to find the proper remedy for curing the disease of the national organism. For it will be seen that the situation is rapidly growing worse every year with the increase of population, and there must be an end to the disease. Surely, if the increase of the national wealth is becoming less than the continual net incomes of the private monopolies, trusts and combinations, it is not difficult to recognize that the situation is already very bad. It is therefore desirable that every one should carefully learn the situation.

Chicago, April 1, 1900.

| CHAPTER I. | |

| DISTRIBUTION OF WEALTH IN THE UNITED STATES. | |

| Page. | |

| Preliminary: opinions and views | 1 |

| Conclusions of Mr. G. K. Holmes, U. S. Census Expert, illustrated by diagrams and Table I | 5 |

| Conclusions of Mr. Thos. G. Shearman | 11 |

| Diagrams, Table II, and explanation | 12 |

| Conclusions of Dr. C. B. Spahr | 18 |

| Diagrams, Table III, and explanation | 20 |

| CHAPTER II. | |

| STATISTICS OF WEALTH OWNERS. | |

| Statistics of aggregate wealth | 27 |

| Economic classes of families analysed | 28 |

| Holders of wealth, tenants and mortgagors | 32 |

| Reciprocal comparison of contradictory classes | 39 |

| Comparison of the poor and the rich families | 42 |

| Right table resulting from comparisons | 45 |

| Comparison of families in tables of different authorities: averages of family wealth | 47 |

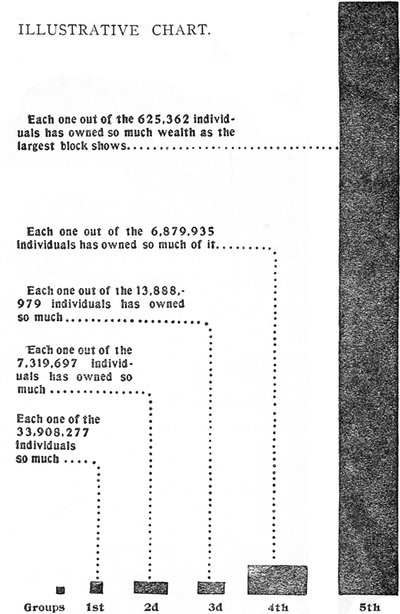

| Illustrative chart showing worth of individuals | 50 |

| CHAPTER III. | |

| THE PROPERTIED AND PROPERTYLESS PEOPLE. | |

| Fundamental difference in number of resources of the propertied and propertyless | 53 |

| Sources of multiple incomes of the wealth owners | 54 |

| VIII(Extent of mechanical forces applied to labor in favor of the wealthy) | 57 |

| A propertyless man himself is a source of multiple expenses in favor of the propertied | 61 |

| Primogeniture replaced by dividogenesure, the principle of dividogenesure defined and explained | 70 |

| CHAPTER IV. | |

| ABNORMITY OF THE SOCIAL SITUATION. | |

| Numbers of the people subject to dividogenesure | 78 |

| (Percentage of the homeless population in cities and towns and of the landless on farms) | 79 |

| The propertyless a great nation | 83 |

| Bread-winners and others in gainful pursuits | 89 |

| Productivity of the American people superior | 93 |

| The people labor in favor of speculators | 95 |

| (Artificial world a witness for justice and rights) | 98 |

| Yearly net gains of the natural monopolies | 101 |

| Rates of injustice of dividogenesure expressed in daily incomes derived from millions of dependent individuals by the wealthy few | 103 |

| CHAPTER V. | |

| THE MORTGAGOR FAMILIES. | |

| Loss of rights precedes loss of property | 110 |

| Statistics of farm and home families in debt | 111 |

| Percentages and numbers of families in debt in the United States after 1890: double table | 116 |

| Increase of mortgages on acre-tracts and lots | 119 |

| Amounts of indebtedness and life of mortgage | 121 |

| Per capita debt and average rate percent on the debt | 122 |

| Annual interest charges on debts combined | 126 |

| Public and other debts in force after 1890 stated | 126 |

| Significance of mortgages: different views | 128 |

| Loss of property by foreclosure of mortgages | 135 |

| IXCHAPTER VI. | |

| CONCENTRATION OF WEALTH IN MONOPOLIES, ETC. | |

| Increase of the national wealth in seven years | 139 |

| Wages: the doctrine of; artificially kept up; the fall of | 141 |

| Net incomes of the natural and mortgagee monopolies from 1891 to 1897 inclusive | 145 |

| Net incomes of monopolizers of rentable houses for the same period | 146 |

| Net incomes of monopolies of rentable farm lands for the same period | 148 |

| Net incomes of some trusts unascertained | 151 |

| Net incomes of the owners of offices, hotels and other rentable properties in the centers of cities | 152 |

| Development of trusts in manufacture and mechanical industries; concentration of capital | 154 |

| Net incomes of manufacture and mechanical trades | 157 |

| Net incomes of mining monopolies | 161 |

| Increase of the propertyless population | 164 |

| Grand total of the total-net-incomes of monopolies, trusts, and combinations in seven years | 169 |

| Excess of the net incomes over the total increase of the national wealth in seven years explained | 170 |

| National and local taxes for seven years paid | 174 |

| Increase of the propertyless and that of national wealth after 1897 up to 1900 stated | 180 |

| Appendix | 187 |

| Index | 191 |

When a heavy mass of clouds suddenly rises in a clear sky, every one thinks that a terrific storm is to follow, displaying a great store of pent up forces. And many people |SIGNS OF THE TIMES.| never make a single mistake in predicting from so ominous a summer sky what is going to take place. Some similar forecasting is now going on within the consciousness of the people. For nearly every one more or less clearly feels that he is heavily pressed upon by some portent in the national life. And every one whose mental horizon is clear enough and wide enough sees, beyond the outward appearance, that something dangerous is stored in the nation. It may be something so unusually great in its force, something so explosive, something so combustible, that with the new century it may terribly shake the world.

It was quite recently when the “North American” of Philadelphia asked the question, “What has the Nineteenth Century in store for Philadelphia?” And by its own admission the replies received were amazing. In summing them up, 2before spreading them at large before its readers, it said:

“Substantial business men, whose names are almost household words, solemnly affirm that with opinions of the new century will come revolution and bloodshed. Leading lawyers |OPINIONS OF BUSINESS MEN.| say the tendency will be toward socialism. Bankers join with labor leaders in forecasting the triumph of the single-tax theory and the consequent overthrow of existing social conditions. That such a tremendous undercurrent of dissatisfaction and unrest exists in this city will undoubtedly come as a shock to thousands of conservative citizens. The opinions given are not those of labor agitators or anarchists. They are the careful expressions of men of wealth and of broad education. The revolutionary suggestions were not shouted upon the street in time of riot and excitement, but were given deliberately while the speakers sat in their well furnished offices, surrounded by comforts and evidences of prosperity.[1]” So then the Nineteenth Century has stored up in the social organism of the nation enough material to produce revolution and bloodshed in the Twentieth Century.

And Mr. Louis Post says in “The Public” of Chicago: “Our leisurely friends of Philadelphia, 3who are to be envied, by the way, and not sneered at, for being philosophical enough and sensible enough to keep so much unwholesome hustle out of their lives—these slow and sober people must have been ‘startled’ by the above ‘revelations’ of the Philadelphia North American, that ancient landmark, now in its 128th year.[2] It was undoubtedly an amazing surprise in view of its age that the answer of its readers was, as you see, ‘revolution and bloodshed.’

If similar questions were presented to the thinking public of the various cities of the United States, we might have thousands of like opinions and all of them would be conditioned by sufficient reasons.

One of the most prominent thinkers of the city of Chicago[3] also quite recently said that “the Twentieth Century will bring to us the bloodiest revolution that human |OPINIONS OF LEARNED MEN.| history ever witnessed.” And his assertion was not less amazing than was the affirmation of the substantial business men of Philadelphia. If it were honest and right to expose the names of men whose confidential conversations led to the same or similar assertions, I alone could make a long list of these names.

They all admit that the nation, as an organism, has long been diseased; its nerves have long been 4abnormally strained. But, like the friends of Philadelphia, they speak about revolution and bloodshed which is but the last and most convulsive stage of any nation’s serious disease. And it is true that, when this stage is reached, it is impossible to avoid the most intolerable operation.

But the amazing feature of such opinions is that different men agree in affirming that revolution and bloodshed is almost unavoidable; yet different men, as I know, |CAUSES OF UNREST.| assign different causes for such an undesirable event.[4] Some say it must come because the population increases and the unemployed laborers increase. Others say that the trusts, combinations, and monopolies must ruin the nation. Still others say that progress and poverty, being very rapid in their diverse directions, must rapidly bring the wealthy and the poor into the state of cut-throats against each other. And only very few men understand that all these causes are but secondary, though working to the same horrible end. While the real, effective cause for revolution and bloodshed, with the nation, is the exceedingly unequal distribution of wealth, and its rapid concentration in a very few hands.

It is this situation that our democratic people will not be able to endure, because they are born |PEOPLE THINK THEY ARE BORN FREE.| 5free, whereas the storing up of wealth in a few hands makes them all economic slaves; deprives them of the privileges they enjoyed; makes them absolutely dependent upon the mercies of the rich, which, if shown to them, they may live; if withheld from them, they must starve to death.

Let us see, then, what it is that the Nineteenth Century has stored up, which is to result in such a terrific convulsion in the Twentieth Century.

The following diagrams present the Logical Premises from which the “revolution and bloodshed,” as a conclusion, must inevitably follow, provided their action is not checked.

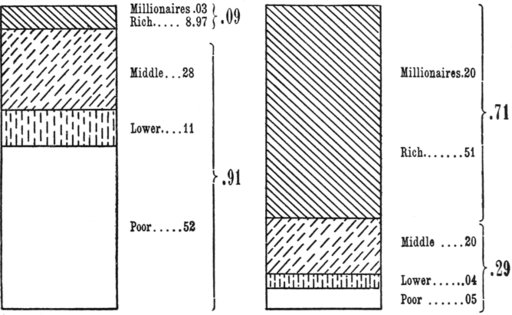

Distribution of Wealth in the United States.[5]

Population: 62,622,250. Wealth: $65,037,091,197.

6“These diagrams showing by percentages the population and wealth distribution in the United States, according to tables compiled by George K. Holmes, U. S. Census Expert on Mortgage Statistics, are from the Encyclopedia of Social Reform.”

The contents of the above diagrams show on the bases of statistics that in 1890 three hundredths of one per cent of the population, |PERCENTAGES OF WEALTH AND PEOPLE.| which are the millionaires, held 20 per cent of the nation’s wealth. Eight per cent and ninety-seven hundredths of one per cent of the population, which are the rich, held 51 per cent of the wealth. The middle class, consisting of 28 per cent of the population, held 20 per cent of the wealth. The lower class, consisting of 11 per cent of the population, held 4 per cent of the wealth. And the poor class, consisting of 52 per cent of the population, held but 5 per cent of the national wealth,[6] as this table shows:

| Percentages of People. | Population in Groups. | Percentages of Wealth | Aggregates of Wealth in Dollars. | Distribution of wealth per head in Dollars. |

|---|---|---|---|---|

| 00.03 | 18,786 | 20 | 13,007,418,274 | 691,867 |

| 08.97 | 5,617,172 | 51 | 33,168,916,461 | 59,041 |

| 28.00 | 17,534,216 | 20 | 13,007,418,253 | 741 |

| 11.00 | 6,888,432 | 4 | 2,601,483,644 | 377 |

| 52.00 | 32,563,644 | 5 | 3,251,854,565 | 99 |

| 100.00 | 62,622,250 | 100 | 65,037,091,197 | 1,036 |

7This illustrative table represents the exact value of the diagrams on p. 5. And nothing is more interesting in this table than the sad differences in the worth of the groups, and especially when their respective wealth is divided per every head. The right-hand column shows that there are 18,786 persons whose aggregate wealth, if divided equally among them, would give $691,867 to each man, woman, and child. And there are 32,563,644 persons[7] in the last group, whose wealth, if equally divided among them, can give but $99 to every person. These two groups present the greatest possible extremes of group-poverty and group-opulence.

The other three groups, as their averages clearly show, are intermediary between the two extremes. |PER CAPITA WEALTH.| And if all the wealth of the nation were equally divided among its population, we could have $1,036 to every man, woman, and child. This per capita wealth indicates that the nation is very rich on the whole, but its riches, as you see, belong to a very few persons.

What then is the difference between a rich man and a poor man, between a rich woman and a poor woman?

If the 32,563,644 men, women and children had 8$100 per capita wealth, then one rich man of the first group of the above table, would be worth more |WORTH OF MEN.| than 6,918 men of the last group of the same table. A rich man’s horse often worth more than 10, 20, 30, or even more, poor men taken together. A rich woman’s finger alone worth more than 10 or 20 poor women taken together, because that finger is often embellished with the diamond rings that cost thousands of dollars. A complete ladies’ dress or a costume often amounts to more than $5,000, and hence it is worth more than 40 or 50 women taken together with their dresses. Such are the differences between the rich and the poor people when they are valued by the dollar.

But the dollar differences cause a great many other differences between the rich and the poor. The poor man is not only poor in wealth, but he is poorer still in social |POOR IN SOCIAL RIGHTS.| rights and privileges. And there is no possibility for the poor to rise up out of his poverty. For he has no resources of wealth which the rich people have; and he has no property of his own; for if he is worth but $99, which is really his house-scarb,[8] he has no productive property at all; he is then absolutely dependent upon the mercy of the wealthy, without which he cannot exist even 9for six months. He cannot acquire higher education and training, because he is encompassed with poverty which furnishes no means for the education that helps men to acquire wealth. Hence, the lack of education keeps the poor in poverty; and this poverty prevents him from getting the helpful education. So that, poverty and ignorance become the bitter enemies of the above millions of individuals in the modern world of progress. Yet the modern poor have a far more potent enemy than poverty and ignorance combined, which we shall see later on.

Meanwhile, we will say here, that the rich are the masters over the poor in the sphere of law, in the sphere of politics, in the club, in the theater, in the church, at home |DOMINANCY OF THE RICH.| and abroad—everywhere; as if all power were given unto them under the heavens over the poor. And how many church-ministers would not give them the same power and the best places in the hereafter? For the very character of sermons in our days depends upon the pleasures of the rich in many churches, because the ministers depend upon the wealthy few more than they depend on the millions of the poor. While all these poor are the rich men’s economic slaves, spending half of their labor energy in favor of the wealthy. That is what the Nineteenth Century has provided for the nation.

10But the above statistical conclusions were by many regarded as “roseate” and “extremely moderate conclusions.” And it was in consequence of this that Dr. Spahr |CONCLUSIONS ARE MODERATE.| was obliged to reiterate the expression: “Since the completion of this study, a volume has appeared that must set at rest all question as to the extreme moderation of the estimates reached.”[9] For it was clear that every new investigation of the distribution of wealth confirmed the fact of a more and more rapid concentration of the national wealth in fewer hands than before. And it is the question of poverty, that spreads like contagion, that the American people have now to deal with, in view of a phenomenal increase of the national wealth which concentrates in the few hands. And it is this question that cannot be set at rest while millions grow poorer and poorer and the propertyless increase in numbers, as we shall soon see.

The people cannot set this question at rest until they know the truth of the different statistical tables, indicating the nation’s situation and destiny. And we cannot rest until we make a series of propositions for the purpose of producing more equal distribution of wealth in this country. And 11even then we cannot rest, until our propositions be applied to the irrational life of the nation, with the purpose of working out justice for the people. When we see all this in their actual life, then we shall rest, as the people shall be regaining their freedom, their property, their resources of income, their rights to work and to enjoy the fruits of their toil. The intelligent people cannot and must not rest before they reach a resting place. They cannot always be deceived by the shallow and selfish arguments which prove that the national wealth increases enormously,—for it so increases only with the few and rapidly decreases with the entire people. But the time will come when the tens of millions will no longer vote for men who deprive them of all rights, self-respect and liberty.

As we shall see later on, the 32,563,644 persons |UTENSILS AS WEALTH.| of the last group of the table I possessed no real wealth at all even at the census in 1890. For though the diagrams represent them as having had $99 worth of wealth to every head, yet this wealth was personal and not productive.

“An estimate of the distribution of wealth in the United States was made by Mr. Thomas G. Shearman |RESEARCHES OF MR. SHEARMAN.| in the ‘Forum’ for 1889, and for January, 1891. It was based on careful estimates of the wealth of 12the very wealthy, a list of which he gave, and estimates of the division of the remaining wealth of the country between the middle class and the poor based on assessors’ returns.”[10]

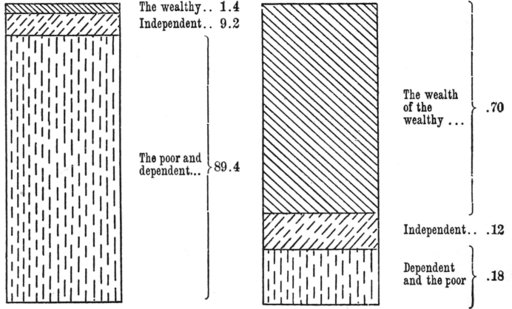

“Mr. Shearman came to the conclusion that 1.4 per cent of the population own 70 per cent of the wealth; 9.2 per cent of the population own 12 per cent of the wealth; and 89.4 per cent of the population own only 18 per cent of the wealth.”[11]

In these conclusions, we have a still greater twist of facts by wrong handling. Now, to illustrate these conclusions as they stand by another set of diagrams, they will be as follows:

Population: 62,622,250. Wealth: $65,037,091,197.

13These diagrams indicate by percentages the exact conclusions of Mr. Shearman in respect to the population and the wealth distribution in this country. The author |LOOSE AVERAGES.| of these conclusions obviously put too much salt of his own into his averages; for, by parceling out the wealth of a number of the well-to-do and rich people, he succeeded in persuading his readers, that, in America, the body of tens of millions of propertyless people, the paupers and the tramps, do not possess, on an average, less than $200 worth of wealth for each person, including women and children of all ages. Whereas, in reality, the wealth from which he made the fictitious averages, belongs to a very few persons of the nation. While an astonishing majority of the people, as we shall see, have no rights whatever to this wealth.

Let us again illustrate the conclusions in a tabular way for the sake of definiteness:

| Percent. of population. | Population in economic groups. | Percent. of wealth. | Aggregates of wealth per group in dollars. | Wealth per head in dollars. |

|---|---|---|---|---|

| 1.4 | 876,710 | 70 | 45,525,973,867 | 51,928 |

| 9.2 | 5,761,242 | 12 | 7,804,450,932 | 1,354 |

| 89.4 | 55,984,298 | 18 | 11,706,676,398 | 209 |

| 100.00 | 62,622,250 | 100 | 65,037,091,197 | 1,036 |

14The first glance at this table and a glance at the table on page 6 show the reader that Mr. Shearman divided the population into three groups; and Mr. Holmes divided it |LINES OF DIVISION OF THE PEOPLE.| into five groups. The bases of division are economic in both tables; but the lines of division are very different with the one statistical authority and the other. If we examine these lines, we shall find that Mr. Holmes’ fifth group consists of over 32½ million persons who, taken together, had been worth a little over 3 billion dollars; so that, each person of the group could have about $99 worth of wealth, as the average of table I shows. The next higher group of the same author, which comprises nearly 7 million persons, had, on an average, more wealth to each person, than each person could have in the fifth group, hence the per capita wealth of the fourth group of people was $377. While the group still higher up in wealth, which consists of little over 17½ million persons, and which had over 13 billion dollars’ worth of wealth, could have $741 to every head, that is, if this wealth were equally divided among them. The second group of Mr. Holmes’ division consists of over 5½ million persons, among whom the poorest ones had, probably not less than $5,000 worth of wealth, as their average worth of over $59,000 shows. Such a division of the population into five economic groups, if every family is 15rightly and honestly valued, presents an immense amount of truth to the public judgment.[13]

But what Mr. Shearman really did with his estimates and conclusions is this: Seeing that the extent of poverty is appalling, he made the division line in the group of |SWEEPING AVERAGE.| well-to-do people; he thus made the group of the very poor extend so far as to comprise nearly 56 million persons; and then, by dividing the wealth of the well-to-do persons among all these millions, he obtained an average of $209 worth of wealth to every pauper, to every tramp, to every man, woman and child,—who have had no wealth, and have had no rights whatever to the wealth they are nominally represented as entitled to.

Consequently, his distribution of wealth among the third group of people is merely on paper, is nominal, is showy, and it does not correspond to reality with reference |ONLY NOMINAL DISTRIBUTION.| to more than 35 million persons as represented in Mr. Holmes’ distribution of this wealth. Mr. Shearman might as well follow the example of Mr. Carroll D. Wright[14] and, by a single effort in calculation, divide among all individuals the 70 per cent of wealth that belongs to his 1.4 per cent of the people. In doing that, he might apportion more than $1,000 worth of it to 16|JESUITS AND GALILEO.| every penniless individual, and then might say, Why, we are all rich, we are the most civilized and righteous people in the world! But such an effort, and such an assertion, however, would not at all alter the real situation; no more than Galileo, when in view of the danger of death, signing the Jesuit verdict in favor of the non-revolution of our planet round the sun, could thereby stop the actual revolution of the earth; for the earth’s progressive motion went on, in spite of the ardent desire and policy of the Jesuits to make it stand still by a verdict. Nothing but an indescribable shock of the earth against another heavenly body can change its principles of motion.

The same is true of the nation. Once the principle of concentration of wealth is left unimpeded in its action, it must work out its end; |DANGER.| it must of living necessity produce revolution and bloodshed. And neither the extremely moderate statisticians, nor the false averages, of even of the meanest falsehood, can prevent its action toward such a horrible result. “You remember the French revolution?” |FRENCH REVOLUTION, ROME.| asked Hon. Jno. S. Crosby of his audience in Binghamton,[15] N. Y., and then he said: “In France all the lands had come into the hands of a few people, the king 17and nobles, and a majority of the people were depending on them for a living. The time came when these down-trodden people rose up and Paris streets ran with blood. Your country will have the same experience if you keep on fooling with the laws of God.

“Rome was once the mistress of the whole world. She lorded it over the other countries. But she fell, and Pliny, her historian, lays the cause of her downfall to land monopoly.”[16] And so it was with ancient Egypt; so it was with ancient Assyria, and so it was with the Byzantine Empire, those great and powerful nations that perished for similar misconduct in relation to themselves.

Exactly so, this young nation also irrationally strides in the way of Rome. The concentration of her wealth in a few hands is now more rapid than it was before the last |RUSH OF THE NATION.| census. That census brought about astonishing conclusions, yet the nation rushes as fast as she can to her ruin. And who can locate the weight of responsibility for her end? Every one seems to think about his selfish interests. Consequently, nothing has been done in the past to evade the ruin; nothing but the greatest national harm is being done in the present; and no fundamental |LOGICAL PREMISES FOR THE YEAR OF....| measure, no rational remedy, no serious 18means appear for delaying it in the future. While the Logical Premises[17] for revolution and bloodshed have been established in the nation’s life, and their forces have been working to that inexorable end.

Now we are ready to present another conclusion that the statisticians of 1890 reached. It deals with the numbers of families, leaving out the individual inhabitants.

We have been assured that the U. S. nation in 1890 consisted of 12,690,152 families, and that each family, on an average, consisted of little less than 5 members, namely: 4.93 members.[18] The distribution of the national wealth among families, therefore, was expressed as follows:

“Less than half the families in America are propertyless; nevertheless, seven-eighths of the families |HALF THE NATION.| hold but one-eighth of the national wealth,” and vice versa. “While one per cent of the families hold more (wealth) than the remaining ninety-nine,” says Dr. C. B. Spahr.[19]

At last we have struck in these conclusions a 19piece of more serious reality. “Less than half the families in the United States are propertyless.” Here you are! “Less than half.” |CONCLUSIONS OF REALITY.| Yet even here, we are far from the fulness of truth. It seems as if the statisticians themselves were afraid to reveal the full truth to the people. And there are many intelligent persons who believe that the pure and complete truth should be known only to God Omniscient, while His creatures must be content to know but particles of truth mixed with falsehood.

As long, however, as the U. S. nation remains a democratic nation, and as long as responsibility for its prosperity or distress and disaster |RESPONSIBILITY OF THE PEOPLE.| rests upon a majority of its people, this people ought to know not particles, but the whole truth of the conditions of their existence. Otherwise the least possible minority of the sharks in human form or the wolves in sheep’s skin, may devour or ruin the greatest bulk of the people.

Let us then illustrate here one of the above conclusions, while leaving the two others for later discussion.

“Seven-eighths of the families hold but one-eighth of the national wealth,” and vice versa, as the diagrams on the following page indicate, where the 12,690,152 families represent 62,622,250 individuals as in the preceding diagrams.

These diagrams represent exactly the truth of the conclusion: “Seven-eighths of the families of this nation held but one-eighth of the national wealth;[20] or seven-eighths of the nation’s wealth was held by but one-eighth of the families.

The table on the next page illustrates some of the details of the above conclusion.

The upper division of that table presents the distribution of wealth among the families, where the two “per family” averages indicate |FAMILIES.| a difference in the worth of more than 11-million families that held $732 each, and the worth of little over 1½-million families that held $35,875 each. So that, 21each family of the latter group was worth as much as 49 families of the former. While the general average of $5,125 shows that, if the national wealth had been equally distributed among all families, every one of them would have had this average amount as its own.

| Proportions of | Number of families in groups. | Proportions of | Aggregate wealth per group, in dollars. | Average wealth per family. |

|---|---|---|---|---|

| 7/8 | 11,103,883 | 1/8 | 8,129,636,399 | $ 732 |

| 1/8 | 1,586,269 | 7/8 | 56,907,454,798 | 35,875 |

| 8/8 | 12,690,152 | 8/8 | 65,037,091,197 | 5,125 |

| Number of individuals. | Wealth—the same in dollars. | Wealth per head. | ||

| 7/8 | 54,794,468 | 1/8 | 8,129,636,399 | $ 148 |

| 1/8 | 7,827,782 | 7/8 | 56,907,454,798 | 7,269 |

| 8/8 | 62,622,250 | 8/8 | 65,037,091,197 | 1,036 |

The lower division of the table represents the same amounts of national wealth, the same population, only individually considered; and both the wealth and the population |INDIVIDUALS.| were divided into eight parts each, in order to carry out the proportions between numbers of the individuals and the wealth they possessed. The result in this division is that 7,827,782 individuals have had an average wealth of $7,269 each man, woman and child, and 54,794,468 individuals had but $148 worth of wealth 22to every head.[21] The difference between the worth of one person of the one group, and one person of the other group, is $7,121 in favor of the rich person. And that, again, one person of the wealthy class, on an average, is worth more than 49 persons of the poor class.

But the most astounding fact is that we have over 54½-million inhabitants of this poverty-stricken class, and we have only a |NUMBERS NEAREST TO THE TRUE ONES.| little more than 7½-million inhabitants of the wealth-swollen class. So that, these 54½-million individuals appear to be totally dependent upon the mercies and motions of 7½-million persons who are steadily growing richer and decreasing in numbers, while the poor are growing poorer and rapidly increasing in numbers. For such has been the growth of economic slavery that the above millions have to combat with.

Besides all this, we have seen the statistical conclusion that, “Less than half the families in America are propertyless,” which certainly |THE PROPERTYLESS FAMILIES APPEAR LITTLE BETTER OFF.| means, that these propertyless families must be found included among the 54-millions of the poor. So that the present average wealth of these millions, which is $148 per every head, was made of the wealth of the upper classes, which average was not at all possessed 23by the poor. The economic conditions of the poor must be still worse than Table III represents them. But we shall find this out in the next chapter; while the conclusion that, “1 per cent of the families hold more wealth than the remaining 99 per cent of them,” nearly corresponds with the conclusion of Mr. Shearman, as represented on pp. 12 and 13.

In the preceding chapter, we have dealt with ready-made conclusions of different statistical authorities, which, by the way of |RESULTS OF THE FIRST CHAPTER.| analysis, revealed to us, that 32,563,644 persons[22] of the population had on an average $99 worth of wealth, according to Mr. G. Holmes; that 55,984,298 persons[23] had on an average $209 worth of wealth, according to Mr. Thos. Shearman; and that 54,794,468 persons[24] out of 62,622,250 inhabitants, with $65,037,091,197 worth of wealth, had on an average $148 worth of wealth apiece, according to Dr. Spahr.

These differences in conclusions indicate that the national wealth is very strongly concentrated with a few persons, and that in order |WEALTH IN THE HANDS OF FEW.| to obtain the nominal average of $148 worth of wealth to every poor person, one has to move the line of division of wealth so far up toward the wealthy few as to include nearly all the people among the masses of the poor. While, without this unfair moving of the line, more than 30-millions of the population would have no real wealth at all. For $56,907,454,798 25worth of the wealth actually belongs to one-eighth of the population, or to 7,827,782 individuals, including men, women and children. And among these, we are told, “1 per cent of the population held more wealth than the remaining 99 per cent held together.”[25] So that the day is not far off when these 99 per cent of the people shall absolutely depend upon the 1 per cent of the rich and far reaching.

Regarded as the Logical Premises of the life of the nation, this extremely unequal distribution of wealth cannot be other than extremely dangerous for the existence |THE SITUATION IS DANGEROUS FOR THE FUTURE.| of the nation as it is, for the logic is inexorable: Whatever you have sown, that shall you also reap, is a saying that cannot be mistaken either by the wealthy or the poor. The situation indicates that this apparently polished nation presents only an enormous working mechanism, made not of steel and iron, but a mechanism of wood, which may be broken into pieces at any future time, in consequence of any insignificant occasion, if it continues to work heedlessly on with a wrong speed against itself. A rational regulation of its speed is absolutely necessary, in order to save it from an otherwise unavoidable destruction. A civilized nation cannot live long without a highly intelligent regulation of all its working principles. 26For, to live a national life is not to play a childish game.

Yes, we have examined the above conclusions, but we have not realized the entire truth of the situation. For we were told that, |THE SITUATION IS WORSE THAN INDICATED.| “Less than half the families in America are propertyless,”[26] which clearly means that the distribution of wealth among the people is much worse than we have a right to suppose upon the basis of the stated conclusions of 1890. As these conclusions differ from each other in contents, we have the moral right to re-examine the varying statistical tables that testify of the same distribution of wealth. And we have a right to find the naked truth in the mass of materials we have, and to look it straight in the face, if we can.

But before proceeding to compare the main tables of statistics, it will be well to show what the wealth of the nation in 1890 consisted of. Accordingly, the table on the next page represents eight items into which the wealth was classified. And it represents the summary of all kinds of wealth that was found existing in the United States in the year of the 11th census. While the next table, following it, represents the history of the accumulation of wealth, by application of the labor 27energy of the people upon various resources of land.

“The census valuation of real and personal property in the United States (Alaska excluded) in 1890[27] was prepared by J. K. Upton,” as follows:

| Real estate with improvements thereon | 1 | $39,544,544,333 |

| Live stock of farms, farm implements and machinery | 2 | 2,703,015,040 |

| Mines and quarries, including product on hand | 3 | 1,291,291,579 |

| Gold and silver coin and bullion | 4 | 1,158,774,948 |

| Machinery of mills and product on hand, raw and manufactured | 5 | 3,058,593,441 |

| Railroads and equipments, including street railroads | 6 | 8,685,407,323 |

| Telegraphs, telephones, shipping and canals | 7 | 701,755,712 |

| Miscellaneous | 8 | 7,893,708,821 |

| Total (United States) | $65,037,091,197 | |

| Years. | Aggregates of wealth. | Per capita wealth. |

|---|---|---|

| 1850 | $ 7,135,780,228 | $ 308 |

| 1860 | 16,159,616,068 | 514 |

| 1870 | 30,068,518,507 | 780 |

| 1880 | 43,642,000,000 | 870 |

| 1890 | 65,037,091,197 | 1,036[28] |

28The last historic table shows that the accumulation of wealth by the nation has been phenomenal, and equal to the expense of labor |INCREASE OF WEALTH PHENOMENAL.| energy which was embodied by the people into that wealth. And if the amount of wealth existing in 1890 had been equally distributed among the people, every man, woman and child, would have had more than $1,000 of it, or exactly $1,036 as the nominal per capita distribution of it by Mr. Carroll D. Wright indicates.

Let us, however, see the actual distribution of wealth, as it was in 1890:

| ESTATES.[30] | Number (of families). | Aggregates of wealth per class in dollars. | Average wealth per family. |

|---|---|---|---|

| The wealthy classes, $50,000 and over | 125,000 | 33,000,000,000 | 264,000 |

| The well-to-do classes, $50,000 to $5,000 | 1,375,000 | 23,000,000,000 | 16,000 |

| The middle classes, $5,000 to $500 | 5,500,000 | 8,200,000,000 | 1,500 |

| The poorer classes, under $500 | 5,500,000 | 800,000,000 | 150 |

| Totals | 12,500,000 | 65,000,000,000 | 5,200 |

29It is difficult to understand why this important table has been published in round numbers almost throughout. It is, however, not at all difficult to see that it represents an extremely unequal distribution of the wealth among the American people.

And in order to restore the figures of this table so as to bring the whole into accord with the last census, it is necessary to regard the |EXTREMES TO BE EQUALIZED.| size of each family at 4.93 members, as the census represents them. In doing this, it is also necessary to restore the round numbers, supplying all omissions in the aggregate totals and in the wealth of the groups. Before giving a further explanation, then, the restored table will appear as follows:

| Economic classes of families. | Number of families. | Aggregates of wealth per class in dollars. | Average wealth per family. |

|---|---|---|---|

| The wealthy classes, $50,000 and over | 126,750 | 33,000,000,000 | 260,355 |

| The well-to-do classes, $50,000 to $5,000 | 1,394,250 | 22,676,863,197 | 16,264 |

| The middle classes, $5,000 to $500 | 5,584,576 | 8,522,541,600 | 1,526 |

| The poorer classes, under $500 | 5,584,576 | 837,686,400 | 150 |

| Totals | 12,690,152 | 65,037,091,197 | 5,125 |

30Now, this restoring has been made up by borrowing $323,136,803 from the wealth found in the 2d group; and again by adding $37,091,197 worth of wealth which was omitted in the round numbers of the total aggregate of wealth. These two amounts, consisting of $360,228,000 in the restored table, have on the basis of the original averages been distributed among the families of the 3d and the 4th groups. So that the 3d group of families appears to be richer by $322,541,600; while the 4th group by $37,686,400; and the 2d group appears to be poorer by $323,136,803 worth of wealth. Hence, we have made the 1st R. table represent the distribution of wealth by $360,228,000 more equal than the author of the original table has actually found it to exist.[31]

On the other hand, in restoring the numbers of family-members to the census average of 4.93, we |FAMILIES MADE EQUAL TO CENSUS.| add about 7 members to every 100 families of five members each, as Dr. Spahr represents them. This addition of 190,152 families to the whole renders the average-family and the total number of families in the United States exactly as they were given by the census in 1890.

But in restoring this table to the census status, 31we do not for a moment disregard its original value, as the most reliable work, nor do we think of making an argument, or anything of the kind, in favor of anybody, upon the ground of the surface restoration. No, there is a deeper sense and a deeper ground in the restored and the next table, and we have an abundance of other material for our purpose of showing the truth. Meanwhile, this restoring of the 1st table that had omissions, has been necessary for many reasons, and because it seemed to many thinkers as probably an extreme representation, though it was true to the facts. For these thinkers desired that the distribution of wealth should be more equal than it has really been.

And, further, holding a conservative position, it was necessary too to avoid a serious disturbance in the original averages of the family wealth found by Dr. Spahr, thus making the table comparable with another table, which is the most important one, because it indicates the tenants of farms and homes and the owners of mortgaged farms and homes.

Furthermore, the restored table may serve as a means of comparison of its classes of different worth with the corresponding classes in the following table, based upon the eleventh census facts. Accordingly, the next table represents the families of different worth which were classified upon the same economic bases as in the table of Dr. Spahr.

32

| Holders of Wealth. | Number. | Value in Dollars. |

|---|---|---|

| Tenants of farms and homes | 7,871,099 | 2,837,049,500 |

| Owners of mortgaged farms and homes worth less than $5,000 | 1,483,356 | 2,614,955,764 |

| Owners of free farms and Homes worth less than $5,000 | 3,078,077 | 10,946,616,952 |

| Owners of farms and homes worth $5,000 and over | 1,257,620 | 48,600,000,000 |

| Totals[33] | 13,690,152 | 64,998,622,216 |

We have read on pp. 11 and 12 that, when Mr. Shearman made his list of statistics of wealth distribution, “that his table was based on careful estimates of the wealth of |METHODS OF RESEARCH.| the very wealthy; while the wealth of the poorer classes was estimated on the bases of assessors’ returns;” just as the table of Dr. Spahr, p. 28, which represents the very wealthy families in the 1st group, the well-to-do in the 2d, and the poor families in the 3d and 4th groups. This arrangement and representation of the families evidently agrees with that of Mr. Shearman, and proves the fact that both distinguished authorities used the same or similar methods in studying the 33actual distribution of wealth, and in representing their conclusions to those that were anxious to know of the distribution.

But the 2d statistical table, on the preceding page, was based upon the carefully averaged conclusions of Mr. G. K. Holmes, the U. S. Census Expert on Mortgage Statistics in 1890.

“Mr. Holmes,” as the author of the 2d table says, “follows a method contrary to that of Mr. Shearman, and by estimating the wealth of the poor, arrives at the wealth of the rich. He finds that .03 per cent of the people own 20 per cent of the wealth; 8.97 per cent of the people own 51 per cent of the wealth, and 91 per cent of the people own only 29 per cent of the wealth.[32]

“The fact that Mr. Holmes is not a partisan either of conservatism or radicalism, gives to his estimates an unwonted value. As published in the Political Science Quarterly,” says the Editor of the Encyclopedia of Social Reform, “and in the Journal of the Royal Statistical Society, these estimates have resulted in these four groups of families seen in the 2d table, p. 32.”

We agree with Rev. W. Bliss and others in regarding the estimates of Mr. Holmes as exceedingly valuable, because without them we could neither have known the |IMPORTANCE OF HOLMES’ WORK.| number of the tenant families, nor the number of the mortgagor families, in the 34United States. And hence, we could not have known the seriousness of the situation in the economic conditions of the nation. While having the table based upon his estimates, the reader may, at the very slight examination of the first two groups of it, reflect and know the great danger implied in them for the nation. And it is this table that can tell the number of the propertyless families in the United States, even without regarding any further material on the subject.

But the first trouble about this table[34] is, that the author of it has omitted $38,468,981[35] worth of wealth from the aggregate wealth of the group 4, for the sake of roundness |FIRST DIFFICULTY.| in the great numbers, I suppose. Otherwise it is impossible to admit that the omitted wealth did not belong to anyone in the United States at the time of his making up the table. So that, restoring the $38,468,981 worth of wealth to the 4th group, we find its aggregate amounting to $48,638,468,981 worth of wealth. And it thus begins to correspond with the great masses of wealth owned by the first two groups in the 1st table, p. 28 or 29. This omission cannot be regarded as a serious one; but, to reach a definite conclusion, we must restore it.

The second trouble in the same table, p. 32, is, 35that the total of families in it contains exactly 1,000,000 families more than the nation consisted of in the year 1890. For there were 12,690,152 families in the United |SECOND DIFFICULTY.| States, whereas the second table represents 13,690,152 of them, an absolutely round number having been added to some group of the families. As this table has been published since 1896, it may be that the author of it had a reason to add one million families to the 1st group, because, as the population has increased, so the families without property have also greatly increased during the seven years since 1890. And he is undoubtedly right in his calculations as to the growth of the propertyless. The statistics of 1890, also, represented an ample ground for similar calculations on the part of anyone who has studied them.

The estimates of Mr. G. Holmes, however, do not warrant the conclusion that there were 7,871,099 family-tenants of farms and homes in the United States in 1890. For, whatever degree of moderation |NOT SO MANY TENANTS.| might be in his estimates, this number of the propertyless families could not have existed at that time in the United States. For, if so many propertyless families had been in existence ten years ago, a thousand presidents at this time might lose their heads in view of the national troubles that could result from that abnormal situation of so 36vast an extent. The individuals that now howl about an unusual prosperity might be the indirect butchers of human flesh before they themselves are butchered. No, we drop out the surplus million families from the 1st group of the 2d table, and the table will be more correct as follows:

| Holders of Wealth. | No. of Farms. | Value in Dollars. | |

|---|---|---|---|

| Tenants of farms and homes | 1 | 6,871,099 | 2,837,049,500 |

| Owners of mortgaged farms and homes worth less than $5,000 | 2 | 1,483,356 | 2,614,955,764 |

| Owners of free farms and homes worth less than $5,000 | 3 | 3,078,077 | 10,946,616,952 |

| Owners of farms and homes worth $5,000 and over | 4 | 1,257,620 | 48,638,468,981 |

| Totals | 12,690,152 | 65,037,091,197 | |

The conclusions in the first two groups of families of this table now appear as trustworthy as the entire conclusions of Dr. Spahr in the 1st table, p. 28 or 29; and, that |TRUSTWORTHY CONCLUSIONS.| the first two groups, made up on the basis of Mr. Holmes’ estimates, actually surpass everything in statistical importance for this country, no one will doubt, when he has read this work. 37For the first group represents the tenant-families that hire their farms and homes from others, being themselves propertyless. And the second group represents families that are in debt, and that are also rapidly becoming propertyless, as we shall see in Chapter V.

The differences between the 1st and the 2d tables, however, appear very great. The 1st table shows that the national wealth is quite abnormally concentrated in a |DIFFERENCES IN THE TABLES.| comparatively few hands, represented by the first two groups. The 2d table shows that the same wealth is more equally distributed among the families of the last two groups, than is true in the 1st table. And it is the 2d table which was compiled from the estimates that by some men were regarded as extremely moderate, and, therefore, inconsistent with the real situation of the people.

It is certainly not difficult to misrepresent the whole situation even without intending to do any wrong to the nation. For the right or the wrong representation of realities |COULD BE MADE UNINTENTIONALLY.| depends very greatly upon the handling of the averages in the distribution of wealth among the people. The census facts or the assessors’ returns may be right, as well as the classifications of these facts or returns. And yet the final representations of them may be twisted, either 38according to the desire of the statisticians or according to the abstract rules of arithmetic. So that these rules and desires may be satisfied, but the realities may easily be obscured, and even the greatest national dangers may be concealed under an improper use of the averages.

Thus, we have seen the average of Mr. Shearman, which, including some of the well-to-do families among millions of the poor, makes these poor appear as if every |OR WITH A BIAS OF WILL.| one of them possessed $209, because Mr. Shearman’s average covered nearly 56-millions of individuals.[36] While Mr. Carroll D. Wright,[37] describing the problem: “Are the rich growing richer and the poor poorer?” makes a single average on the basis of the entire population. His sweeping average actually and correctly makes, not only the 56-millions of the poor of Mr. Shearman, but every pauper, every tramp, and everyone in hundreds of the lunatic and other asylums, worth $1,036 of wealth. Whereas, in reality, 1 per cent of the population held more wealth than the remaining 99, as Dr. Chas. Spahr has proved.[38]

Now, something similar has taken place in the 3d group of the 2d table, where more than 3-million families are represented as the “owners of free farms and |A DEGREE OF MODERATION.| homes worth less than $5,000.” And, consequently, 39the difference between the 1st table and the 2d table in the wealthy groups appeared. The 2d table contradicts nearly all statistical authorities and has been spoken of as based upon extremely moderate conclusions. It is, therefore, necessary to show the degree of moderation implied in its distribution of wealth.

The fact that all families in the United States |FIRM BASIS OF CLASSIFICATION.| were classified according to their economic worth, as families worth $5,000 and over and $5,000 and under, gives us the best basis for a comparison of the two contradictory tables of the great authorities.

Let us first see the inconsistency in the groups of families which represent the middle classes in the two tables.

| Families worth $5,000 and under. | Number | The wealth of | Averages. |

|---|---|---|---|

| Difference from the number below | $2,424,075,352 | ||

| Middle classes of the 1st R. table[39] | 5,584,576 | 8,522,541,600 | 1,526 |

| Free owners of the 2d orig. table[40]. | 3,078,077 | 10,946,616,952 | 3,556 |

| Difference from the number above | 2,506,499 |

40Now, the restored group of the middle classes of the first R. table should be absolutely in favor of diminishing the differences in the worth of the identical families and in |INCONSISTENCY POINTS TO TRUTH.| their number. Yet the two groups reciprocally exclude each other by their opposite terms. So that, the comparison shows that the greater number of families has much smaller amount of the aggregate wealth; and the lesser number of families has much larger amount of the aggregate wealth; and that the difference in family-numbers is greater than 2½-millions in favor of the group of the 1st table; and the difference in the wealth, nearly 2½-billion dollars worth is in favor of the group of the 2d table. Hence, the opposite terms of the two economically similar groups can in no way coincide with one another.

This being so, it is not difficult to find out the true situation as to the actual distribution of wealth which ought to have been represented by the 2d table. The alleged moderation of this table has |AVERAGES ARE THE CAUSES.| been brought about by the same influence of averages which we have seen in the conclusions of Mr. Shearman.[41] One average of this gentleman has covered 89.4 per cent of the population, and thus made the wealth of the richest of them to be distributed among the millions of the very poor. 41The 89.4 per cent includes nearly 56-millions of individuals, whose aggregate wealth amounts to 18 per cent of the national wealth, and apportions $209 worth of it to every individual. But if you exclude only 20 per cent out of the 89.4 per cent of this great mass of people, selecting the wealthiest of all for the exclusion, you will thus have 69.4 per cent of the people left with less than 9 per cent of the national wealth. Your average then will be altogether different; it will cover masses of the poorest people, and every one of them will have less than $99 worth of wealth.

It is by a similar inclusion of a number of the well-to-do families among the group of “owners of free farms and homes” that the more equal distribution of wealth |SOME OF THE RICH AVERAGED WITH THE POOR.| has been obtained in the 2d table. Otherwise, this table could represent a more melancholy array of facts than the presentation of these facts which appeared in the first table. But, however bitter the truth may be, it is always better to taste it than to be ignorant of its existence, because one falsehood must create thousands of other falsehoods, and, accumulated and multiplied into a tremendous mass, these falsehoods may lead the nation to self-destruction even as many other nations were led to it.

Dividing again all families of the nation into the families worth less than $5,000, and families worth 42|THE SAME ECONOMIC BASES OF THE AUTHORS.| over $5,000, we shall now compare these two classes of families in both tables upon their common basis. And, as this basis presents the very bottom of statistics, the comparison therefore cannot fail to show us the very naked truth as to the actual distribution of wealth which has partly been obscured by the 2d table.

| Families worth under $5,000. | Number of families. | Aggregates of wealth in dollars. |

|---|---|---|

| First three groups of the 2d table[42] | 11,432,532 | 16,398,622,216 |

| Last two groups of the 1st R. table[43] | 11,169,152 | 9,360,228,000 |

| Differences from the 2d table | 263,380 | 7,038,394,216 |

| Families worth $5,000 and over. | Number of families. | Aggregates of wealth in dollars. |

|---|---|---|

| Two first groups of the 1st R. table[43] | 1,521,000 | 55,676,863,197 |

| The fourth group of the 2d restored table[42] | 1,257,620 | 48,638,468,981 |

| Differences from the 1st R. table | 263,380 | 7,038,394,216 |

43As you see, the comparison of the families of the same worth in the different tables shows that the poor classes of the 2d table are larger by 263,380 families, and richer by $7,038,394,216 worth of wealth, |DIFFERENCES REVEALED.| than they are in the first table. On the contrary, the comparison of the wealthy classes that consist of families worth $5,000 and over, shows that the 1st table is larger by 263,380 families, and richer by $7,038,394,216 worth of wealth, than the same families in the 2d table. Hence, the concentration of wealth in the first table is by $7,038,394,216 worth greater than it is in the 2d table. And it is clear that this amount of wealth is closely connected with the 263,380 families of the well-to-do classes. The question, therefore, is, Where could Dr. Spahr find so many more families worth $5,000 and over, than Mr. Holmes has found?

We know that both these great authorities dealt with the same primary facts of statistics, though Dr. Spahr dealt with them as they appeared in the Surrogate Courts, thus raising the value of the |BASAL FACTS UNALTERABLE.| facts. And we know that these facts or returns represent the worth of every family, just at it actually was at the time of the 11th census. Supposing then that the above families were represented as worth $26,723 each, could Dr. Spahr make each one of them worth $4,000 of wealth, 44with the purpose of including them among the millions of families worth $5,000 and under in each case? And could he thus rob the 263,380 families of their ownership of wealth, in order to make the distribution of wealth so abnormal as his table shows it? No, sir; this is an utter impossibility on anyone’s part. And Dr. Spahr represented the above families among those that were worth $5,000 and over in each case, and that is what anyone ought to have done in his place.

While in the case of the second table, the little more equal distribution of wealth appeared not because it was actually so, but because the above 263,380 families, with their $26,723 worth of wealth |UNREAL BASIS OF MORE EQUAL DISTRIBUTION OF WEALTH| on the average, unintentionally or accidentally, were included among the families worth less than $5,000. Consequently, their aggregate wealth, amounting to $7,038,394,216 worth, has been nominally distributed among the group of “owners of free farms and homes worth less than $5,000” to every family. This inclusion was as easily performed as was the inclusion of the well-to-do among the poor by Mr. Shearman. We therefore subtract the above families and their wealth from the 3d group and add them to the 4th group of families worth $5,000 and over, in order to show that these families and wealth belonged to another class of the people, as follows:

45

| Holders of Wealth. | Number. | Value in dollars. |

|---|---|---|

| Tenants of farms and homes | 6,871,099 | 2,837,049,500 |

| Owners of mortgaged farms and homes worth less than $5,000 | 1,483,356 | 2,614,955,764 |

| Owners of free farms and homes worth less than $5,000 | 2,814,697 | 3,908,222,736 |

| Owners of farms and homes worth $5,000 and over | 1,521,000 | 55,676,863,197 |

| Totals | 12,690,152 | 65,037,091,197 |

Now this table represents the very essence of statistics on the distribution of wealth which was |TABLE MOST VALUABLE.| worked out by the two contradictory authorities. The 4th group of it contains the 263,380 families with their aggregate wealth, and equals the first two groups in the 1st R. table, these two and that being made of the families—each worth $5,000 and over.

It should be noticed here, that neither the 263,380 families that we have now included in the proper group of the table, nor their aggregate wealth, had anything to |GROUPS SIGNIFICANT.| do with the groups of mortgagors and tenants in the 2d table. These two groups of families have been separated from the influence 46of the free owners of wealth, by being debtors and tenants, who have a definite significance of their own in the statistics. And this is the reason why the subtracted families worth $5,000 and over could only be lodged in the 3d group of families worth below $5,000 under its wholesale average.

It should also be remembered that, though the 4th group of the last table represents an enormous amount of wealth, yet there are hundreds of thousands of families in it which are worth but few dollars |THE WEALTHY ONLY FEW.| over $5,000 worth of wealth. So that, the real concentration of that enormous amount of wealth remains in the possession of less than half a million families, as these facts have been represented by Mr. Shearman and the others in the first chapter. And nothing can be said against the accuracy of the careful estimates of the wealth of the very wealthy by Mr. Shearman and the other authorities.

In order to have a more definite idea of the distribution of wealth, let us compare both tables on one page, and remember that if the group wealth were equally divided among the group-families, each family could have such amount of it as the averages indicate. And mind that the next two tables, being based upon the same census facts, represent the results of careful comparison of the original ones.

47

| Owners of Wealth. | Number. | The wealth of | Average. |

|---|---|---|---|

| The poorer classes under $500 | 5,584,576 | $ 837,686,400 | $ 150 |

| The middle classes $500 to $5,000 | 5,584,576 | 8,522,541,600 | 1,526 |

| The well-to-do classes $5,000 to $50,000 | 1,394,250 | 22,676,863,197 | 16,264 |

| The wealthy classes $50,000 and over | 126,750 | 33,000,000,000 | 260,355 |

| The totals. | 12,690,152 | 65,037,091,197 | 5,125 |

| Owners of Wealth. | Number. | The wealth of | Average. |

|---|---|---|---|

| Tenants of farms and homes | 6,871,099 | $ 2,837,049,500 | $ 413 |

| Owners of mortgaged farms and homes worth less than $5,000 | 1,483,356 | 2,614,955,764 | 1,762 |

| Owners of free farms and homes worth less than $5,000 | 2,814,697 | 3,908,222,736 | 1,388 |

| Owners of farms and homes worth $5,000 and over | 1,521,000 | 55,676,863,197 | 37,117 |

| The totals. | 12,690,152 | 65,037,091,197 | 5,125 |

It should be noticed again, that the differences in the family averages of the corresponding groups 48of the two tables, depend on the differences in the |AVERAGES OF FAMILIES’ WORTH DIFFER.| numbers and in the aggregate wealth of the same groups of the tables. And these differences could not be avoided, since the two authorities have made a different classification of the families of different worth.

But the comparative importance of the two tables consists in the fact, that the last group of the 1st table shows the extremely abnormal concentration of wealth in |THE RICH AND THE POOR GROUPS.| the hands of 126,750 families, which possess more wealth than the remaining 12,563,402 families do, on the one hand. While, on the other hand, the first group of the 2d table shows that there have been 6,871,099 families without real property; and the second group shows, that there were 1,483,356 families in debt and in danger of losing their properties, and that both these groups of families have been in the state of economic slavery to the wealthy few. But we shall examine their conditions of existence later on.

“The distribution of private property in Great Britain and Ireland in 1891,” was such that it was said “that less than 2 per cent of the families of the United Kingdom |THE PROPERTYLESS IN BRITAIN.| hold about three times as much private property 49as all the remainder, and that 93 per cent of the people hold less than 8 per cent of the accumulated wealth. There remains, therefore, nearly 6,000,000 families”—i. e., 30,000,000 individuals—“or more than three-fourths of the people of Great Britain and Ireland, without any registered property whatever. They have indeed their household goods, but the total value of these can hardly exceed £100,000,000,”[44] which is little over $16 to every individual.

“The ownership of land is an important factor in the social condition of a people,” says Mayo Smith.[45] And “if we contrast the |DISTRIBUTION OF LAND IN FRANCE AND ENGLAND.| peasant proprietorship system of France, with more than 4,500,000 owners of land, with the landlord system of England, with its 325,000 owners, the social as well as the economic influence must be very different”[45] in the two nations. Certainly the French people feel and enjoy economic freedom, while the British people are pressed down by an economic slavery.

In fact, the statisticians seem to agree that the distribution of wealth, even in Paris, the capital of France, and in Berlin, the capital of Germany, is proportionally much more equal than it is in the nation of Great Britain or in that of the United States, although it is natural that the largest cities, as a rule, have the distribution of wealth much worse than the nations behind them.

ILLUSTRATIVE CHART.

Every block here represents a comparative average wealth of one man, woman, or child of the respective groups in the 2d Corrected Table, p. 51; while the figures above show the numbers of individuals owning one block each, as indicated.

51While the thirty millions of British people have on the average $16 worth of wealth, the American people of the same class have somewhat more of this kind of wealth than the British, as the last table, individually regarded, shows the average property of every person of the families. It is as follows.

| Holders of Wealth. | Individuals. | The wealth of | Average. |

|---|---|---|---|

| Tenants of farms and homes | 33,908,277 | $ 2,837,049,500 | $ 83 |

| Owners of mortgaged farms and homes worth less than $5,000 | 7,319,697 | 2,614,955,764 | 357 |

| Owners of free farms and homes worth less than $5,000 | 13,888,979 | 3,908,222,736 | 287 |

| Owners of farms and homes worth $5,000 to $50,000 | 6,879,935 | 22,676,863,197 | 3,296 |

| Owners of farms and homes worth $50,000 and over | 625,362 | 33,000,000,000 | 52,769 |

| The totals. | 62,622,250 | 65,037,091,197 | 1,036 |

The average of $83 worth of personal property in the 1st group of individuals here is a little too large, because, subtracting the surplus million 52families from this group,[46] we have left the wealth |THE POOREST CLASSES, 1890.| of it untouched. In any way, this group contains 27,117,000 individuals having on the average $30 worth of property each, according to the last group of families in the table of Dr. Spahr.[47] It does not, however, make a great difference on the whole, because the group of tenants, since 1890, has undoubtedly increased up to 38,837,849 without having been able to add anything more to its aggregate wealth.

The increase of the propertyless accrues from the natural increase of the population, and from the loss of the mortgaged properties |CAUSES OF THE INCREASE OF THE PROPERTYLESS| by foreclosure of the mortgages in the 2d group, and from the immigration of the propertyless foreigners[48] without special means; while the people of the 3d group have sunk by thousands into debt from having mortgaged their properties; and only about a million families of the last two groups have been exceedingly prosperous, as we shall understand the situation later on.

The statistical authorities told us that “Less than half the families in the United States are propertyless,”[49] and we desire to know the chances for, and resources of, their living; and what it means to be a propertied person or to be a propertyless person upon earth.

Let us see the clear distinction between the |CONDITIONS OF LIFE OF THE PROPERTIED AND PROPERTYLESS.| state of a property owner and the state of a propertyless person; between the conditions of life of the former, and the conditions of life of the latter, and how both are affected by and related to these conditions.

First of all an owner of property and a propertyless person, are, on an average, perfectly equal in that they have physical strength, and in that they have equal rights to use or to apply that strength somewhere |EQUAL IN PHYSICAL STRENGTH.| upon the wealth of an owner of wealth. And here we meet the first difference between them: An owner of property has a chance to apply, and to spend his strength upon his own 54property; if, for instance, this property is land that gives him any kind of returns in exchange for his |THE ONE HAS, THE OTHER HAS NO CHANCE.| labor and toil. The propertyless person has neither this chance nor this right to toil anywhere, unless he pays for the opportunity of using his strength, by dividing the results of his labor between himself and the owner of wealth who permits him to draw some income from the resources of his own property or wealth. So far, the advantage of the propertied person is such that he has twice as much right in his strength, and twice as much chance to profitably use his personal strength.

Now, every one knows that whatever the wealth of a nation may be, it is primarily derived from land which is the only inexhaustible source of riches, or, of derived wealth. And when a person gets |LAND PRIME ORIGIN OF WEALTH.| into his possession a portion of land, whether it will be in a city, town, or in the country, he then obtains a number of resources for his life; he becomes a propertied man, and he can apply his strength, his skill or his intellect upon his own property and thus reap the fruits of his labor. The land then is the first store of wealth; but it almost never yields anything to man, unless he labors, works upon it, with a hoe, a plough, a scythe or some other implement that aids him to draw greater returns from his land. Again, if iron, 55for instance, is primarily derived from land, then |LAND MAIN FACTOR OF WEALTH.| when it comes to the forge, where the hammer, the anvil and the other tools aid the blacksmith to make an ax out of the rough iron, the ax will be of a greater value than the material he used for it. But what really made the ax is his personal strength and the skill that were aided by the tools he used. These tools with the blacksmith, and those implements with the farmer are economically called |SKILL SECOND FACTOR OF WEALTH.| “capital,” because they aid to draw more wealth by the labor of man. It follows, that land is the main factor of wealth; that human energy or labor is the next factor of wealth; and that capital, as aiding labor and land to produce more wealth than they can yield without it, is the third factor of wealth. Money is not regarded as direct capital here.

As capital is a very important source of income to a propertied man, and as it is perhaps not clearly understood by all, let me illustrate this factor of wealth by introducing more examples of it.

Capital from an economic standpoint is that wealth which produces farther wealth, or simply aids to create farther wealth. A needle is capital, because it aids to |CAPITAL THIRD FACTOR OF WEALTH.| make a shirt that costs more than the material used for it. A sewing machine is capital of more effective kind than the needle used 56by hand, because it aids to produce more wealth than the tailor or the seamstress can produce without it. A lathe is capital, because it not only shapes the round forms of any material more accurately than |MACHINERY, TOOLS, ARTIFICIAL WEALTH.| the artizan would ever be able to make without it, but it greatly saves his time on every piece of the work; thus saving time it aids in producing more wealth. A factory, as a whole (including the building and machinery), is capital, because all the machinery, all tools and instruments used in it produce farther wealth from the raw materials, and serve as sources of income to the owner of this property. Under the care of the stock-raiser, cattle are capital, because they grow and multiply; but the meat or beef is utility, because it may be unproductively consumed.[50] Agricultural implements, as well as the fertilizers, like guano, phosphates and many others are capital, because they increase fertility and increase the produce of land, which makes a greater 57income in favor of its owner. A thousand different machineries and special instruments might be introduced here to show that each one of them has been invented for the purpose of aiding to create more wealth out of less wealth. And that all of them and every one, when used by an owner of wealth, is a definite source of income and of profit to him, because it aids his own skill and energy to obtain greater returns in exchange for his labor and mind, than he can obtain without it.

But the most effective factor in aiding to produce more wealth and a much greater income for an owner of wealth is the energy of steam or any other mechanical force, applicable to various forms of labor |MECHANICAL FORCE; INCREASE OF STEAM.| and completely obedient to the bidding of man. “Steam power has increased in the United States from 3½-millions, in 1860, to 17-millions horse power in 1895; while in Great Britain and Ireland it has increased from 2½- to 13-millions; Germany from ⅞- to 7⅔-millions, and in France from 1 to 5-millions horse-power. The increase of this capital has been most manifest in manufactures,” says Dr. Henderson.[51] But it should be remarked at once that no one of the families worth below $5,000 could apply these millions of horsepower of steam force upon their properties. This energy has all the time been a profitable source of 58great income in favor of the families that made the wealthiest group in the tables of statistics, whereas the others have had but little crumbs of its increase of wealth. The mechanical force, as every one knows, is in service of the capitalists.

But when we look into the limits of towns and cities, we find millions of rentable properties of all possible kinds; and every factory, |SOURCES OF INCOME.| every storehouse, every shop and every dwelling house there is a sure source of income to the propertied man. The very sweat-shops, where the working people can not, on an average, live longer than 28 years—even these dens of poison and pestilence are inexhaustible sources of income and profit to their owners.

As to the town and city lots, they are all sources of greater or less income to the men who own them. Whether these lots of land are occupied by |SOURCES OF INDIRECT INCOME.| anything or are remaining waste, makes little difference, because as the town population increases, their values also increase in proportion as the city population and its business increase; the owners of properties towards centers of the cities are usually bound to be rich out of the resources of rent. Even a simple house, somewhere about the marginal line of a city or town is usually a source of indirect income to its owner, because he and his family may have a comfortable shelter in it, without 59which they would pay the rent for another’s house,[52] and would carry on all other expenses of life, just as they do in their own house, in which they save the rental money for some other purposes of living.

Now then, whatever property you may think of—whether natural or artificial, whether animate or inanimate, that a person has possession of—it is always wealth, and a source of income in his favor. |WEALTH CREATED BY LABOR.| The natural wealth is the land, wherever it may be in convenient places, it may always provide one or more resources of income in exchange for the application and expense of strength or skill of labor upon it. The artificial wealth includes all capital, whatever it may be, it is capital, if it can assist the labor energy to double, triple or multiple the income and profit, drawn from the natural resource to which the labor-strength is applied. The rentable house or any other building is artificial wealth. And it is also a source of income to its owner who, by a use of skill and by an application of labor energy, can make his source of income give a multiple yield, in return for the expense of his personal strength upon it.

Thus, the indirect and direct resources of a propertied 60person, therefore, are always many and complete when he works out the wealth himself. |COMPLETE AND INCOMPLETE INCOMES OF PROPERTY OWNERS.| By complete I mean this, that whatever his intelligence and strength can draw out of the source they are applied to, it is always his and is always to his benefit. An incomplete income or yield from a source of wealth, to its owner, will be this, that, if he hires the energy, or the skill of another person to apply upon his property, then his income is incomplete, because he has to pay for the hired labor energy as well as for hired skill. In this way an owner of wealth of any kind may even divide the yield and the product of the source of income into halves.

But as long as a person is an owner of wealth, an owner of capital, and an owner of physical and mental energy, he is a possessor of |PROPERTY GUARANTY OF LIFE.| resources; his labor energy and his existence are then fully guaranteed for himself, his wife, and children by his wealth, because wealth or property becomes a direct source of income, when he himself labors on it, and an indirect, when he rents it to others. A propertied man, therefore, is safe forever by the resources of his property, which yield incomes and profits for sustenance of the highest possible life, highest education, freedom, and enjoyment.

But what about the propertyless man? How 61many resources, or how many sources of income |HAS THE PROPERTYLESS ANY SOURCE OF INCOME, ETC.?| has he for his own life, the life of his wife and children? What sources of income has he for education, for bread and butter, for clothes and dress, for their shelter and his own? What resources has he for his sustenance in this world, when the entire world tends rapidly to be the property of a very few persons?