Figure I.

The Project Gutenberg EBook of Social Comptabilism, Cheque and Clearing

Service & Proposed Law, by Ernest Solvay and Prof. Hector Denis

This eBook is for the use of anyone anywhere at no cost and with

almost no restrictions whatsoever. You may copy it, give it away or

re-use it under the terms of the Project Gutenberg License included

with this eBook or online at www.gutenberg.org/license

Title: Social Comptabilism, Cheque and Clearing Service & Proposed Law

Author: Ernest Solvay

Prof. Hector Denis

Release Date: May 30, 2014 [EBook #45824]

Language: English

Character set encoding: ISO-8859-1

*** START OF THIS PROJECT GUTENBERG EBOOK SOCIAL COMPTABILISM ***

Produced by Richard Tonsing, Adrian Mastronardi and the

Online Distributed Proofreading Team at http://www.pgdp.net

(This file was produced from images generously made

available by The Internet Archive/American Libraries.)

1896

(Extract from the Annals of the Institute of Social Sciences)

BRUSSELS

AT THE INSTITUTE

11, RUE RAVENSTEIN, 11

1897

Bruxelles.—Imp. écon., N. Vandersypen, rue de Trèves, 38.

Table of Contents provided by Transcriber

SOCIAL COMPTABILISM ITS PRINCIPLE AND GROUND OF EXISTENCE

SOCIAL COMPTABILISM (COMPLEMENTARY NOTE)

THE CHEQUE AND CLEARING SERVICE

APPENDIX

PROPOSED LAW

PROPOSED LAW DEALING WITH THE ORGANISATION

By Ernest SOLVAY

Would it be possible, in a society constituted as ours is, to replace the agency of money by another agency which would have its advantages without its inconveniences, and which could be considered as theoretically perfect,—in other words would it be possible to replace the agency of money by a system which would be the final expression of possible improvement in this matter and the definitive point to which social economics ought necessarily to tend? This is the subject which we propose to consider.

The paper Social comptabilism and proportionalism[A] which was the starting point of the Institute of Social Sciences of Brussels, was necessarily done in a premature fashion, the subject being regarded from too general a point of view, so as to be harmful to a true explanation of «comptabilism» properly so called. It laid itself open to criticism and lays itself open still; it does not satisfy all those who wish to go deeply [Pg 2]into the question. On these accounts we deem it our duty, after what the Institute has already published with reference to it, to return again to the subject, limiting ourselves to purely monetary and account-keeping grounds, and an exclusively theoretical explanation of the conception which, connected as it is with the inductive researches of our fellow workers we have submitted to their consideration.

In the first place let us examine into the use of money in society, and to whom it is of use; we will next consider if it is indispensable.

Money presents itself to us as being an indispensable instrument for effecting transactions which are not mere acts of barter, and it presents itself also as having rendered possible,—and this is of capital importance as the sequel will show,—the registering, the writing down or account-keeping of the transactions, if one may so say, which barter did not permit.

Money is exclusively of use to those who enter into commercial transactions. Thus a man who could sufficiently provide for himself in everything without any such transactions, would not have to make any use of money; a landed proprietor may have a considerable fortune and have only a small monetary need, whilst a merchant whose fortune may be much less will find himself in a very different situation: for the greater part of his fortune consisting of merchandise, continually renewed, and consequently engaged in circulation, his monetary need will be considerable. It may therefore be said that the need of money is proportional to the need for commercial transactions.

Beyond what we have just pointed out, has money fulfilled, or does it fulfil any other purpose? We shall see.

If, from the beginning, we could have had a system allowing us to exactly register transactions, would money have been indispensably necessary? In a word, is money in point of fact the particular element in such transactions which caused the writing of them down, or, in reality does not its use hide an agency entirely independent of money? Let us examine this.

But we cannot do so without offering as a necessary preliminary a few words in explanation of the term «trans[Pg 3]actions», which we have already used and which will continue to be employed in this paper to the exclusion of the word «exchanges».

In our opinion exchange properly speaking,—true exchange and free from the alloy of any foreign element whatsoever, has never been anything but barter; and as soon as the system of barter was left and that of money entered upon, the exchange system was rather abandoned for another system quite different, than that one form of exchange was simply substituted for another form of exchange. And if we have continued afterwards to make use of the word «exchange» it is due more to the force of habit than in order to define the actual condition of things.

What in reality fundamentally characterises barter, is that it is an exchange, carried out on the spot, of goods immediately usable by the two parties, each of them giving one usable thing in order to enter into possession of another; whilst that which fundamentally characterises the operation of selling and buying, by means of money, is that it constitutes an exchange of goods carried out on the spot, of which one form only can be immediately used by one of the parties, the other party obtaining not a real thing but an instrument by which he will be able to procure it. So that the party who has received the money, the seller, has only thus obtained a power to make subsequently an inverse operation, that is a purchase where and when it pleases him. The operation of selling and buying is then nothing less than the exchange of a thing for a power. But can we still make use of the word «exchange» to define such an operation? We do not think so, and it is for this reason that we substitute for it that of «transaction.»

The word «exchange» has continued to be employed after having quitted the system of barter to enter upon the system of buying and selling, by means of money, just as the expression «money» has continued to be used to describe bank-notes, which are only paper having the power of money, as money is an instrument having the power of «things.» Thus we have here an example of the general rule, that the evolution of ideas[Pg 4] and of facts, is always more rapid than that of the words which represent them.

Our opinion with regard to «exchange» will be found all the more justified since it will be seen later on that the power conferred by money upon the seller does not exclusively belong to the monetary system, but that it can be obtained, and that theoretically it always could be obtained, in quite another way, without exchanging anything, without having anything to do with money, by simple entry, registering or writing down of figures on paper which is not exchanged, but which remains in one's own hands.

Let us now come back to the question.

We proceed to show that the relative value of things is independent of the unity of value chosen, and that the transactions can be registered, written down, abstraction made of the real, actual value of the material support which has served to fix this unity.

In a general way and within possibly narrow limits, very different and variable according as the case may be, given the existence in actual society of fortunes and desires of all degrees of importance, one can, in principle, admit that theoretically, the value v of a thing or of a certain quantity of goods, is proportional to the average d of the desire to possess it, which the men demanding it have, either on account of its use, or from any other reason, multiplied by the number h of these men and divided by the number o offered of this thing; these three factors d, h and o not being probably in other respects determinable with precision.

We shall then have for the formula of value:

v = u × dh/o

u being a coefficient of proportionality depending on the unity of value adopted.

It will be seen that the term dh/o represents in reality the account of the conditions of the supply and of the demand at[Pg 5] the moment and at the place where the value is determined[B]. In substituting E, we have a new term expressive of the value:

v = u × E.

The relatively fixed value of the precious metals has made it possible for the unity of value to be determined on and easily represented by means of a certain quantity of metal, and the actual monetary system is the result, the value of all things having been henceforth expressed by means of the monetary unity identifying itself with the unity of value determined on. But it may in consequence be remarked in looking closely into this, and it is important to do so, that this result has been reached not because the thing: «metal money», has made its appearance, but because thanks to it, a common denominator of the value of things in general has been employed which did not exist before.

Now, as we shall see, this common denominator does not of necessity remain invariably tied to the thing, money, or more generally to any sort of material support which has served to define it at a given moment. Once fixed it may be considered independently of this support; becoming thus a permanent quantity in time and space, taking in consequence the character of a common measure of the transactional value of things and being employed as a unity of measure of that value[C].

In reality this hypothesis could only be made when there was no such thing as money, and a system of barter exclusively prevailing, those engaged in making transactions might have said to themselves. «Let us choose a common denominator of the [Pg 6]value of things that we may write down our transactions, and not be any longer obliged to carry on the exchange of usable things when we do not want them, let us take for example the value of a kilogram of wheat here at ... to day, the ... as common denominator and let us calculate directly the value of all other things by this unity.

»Evidently every other thing would be worth as many times this unity as we see men would give kilograms of wheat to possess it, and thus the numerical value of things would be easily established.

»Let us agree further in future always to express the value of things by this initial value of the kilogram of wheat, a value which has only existed during the preceding operation, and which strictly can only have existed for an indefinitely short time, but which can be considered as absolutely permanent, and apart from any necessity of occupying ourselves with the variation of value undergone in time and space by the kilogram of wheat itself.»

It will result that if v' is the value of a thing at any period and at any place of which the originally fixed value was v, the relations will be:

| v = u × E | v' = u × E | ||

| whence: | v'/v = E'/E | and | v' = v × E'/E |

that is the value v of a thing at any time and place is equal to its initial value simply multiplied by the proportion of the terms which represent the conditions of the supply and demand at the two periods under consideration.

Let us note, that, as it should do the formula v'/v = E'/E shows that the unity is eliminated when the point in question is the estimate of relative values.

It is needless to say that we do not insist on the practical possibility of the determination of the coefficients E and E', which intervene in the preceding formula. We have in effect said that the factors d, h and o, do not appear to us determinable; we limit ourselves simply to showing here, the theoretical possibility of the system.

What is important to remark is that in proceeding, as we have just pointed out, in all estimates of value and in consequence in the registration of all transactions, the variation in the value of the material support, corn, metal, etc. of the unity adopted does not intervene in any way.

It will be further seen and we would insist on this point, that the common denominator of the value of things takes in this system, by the fact of its invariability, the character of a common measure; that it can in consequence be taken as unity, and considered in an abstract way.

In fact this unity served once in a certain place and at a given moment to fix the initial value of things. From that moment it separates itself from the material thing which served to define it, which has momentarily represented it, and which has served as a support in our mind to effect the operations necessary to the relative fixing of the value of things. These operations made, it is of little consequence if the value itself of the kilogram of wheat varies, as is the case with the value of every thing else. Its initial value was for ever fixed, it can be taken as absolutely permanent and immutable,—the fundamental condition which a unity of measure ought to satisfy.

In like manner original values of all kinds are equally constant quantities and anyone from among them might be taken as unity.

In due course the actual values of things alter; varying continually, and it is the same with the kilogram of wheat or with any support whatever that has served to define the unity. The new values will always express themselves numerically by means of the fixed unity, although that has ceased to have a material representation. In practice the new numerical values will be obtained very easily; from the theoretical point of view they are fixed by means of the formula already given:

v' = v × E'/E

a formula which by the way, shows that if it happened that for anything at any moment and at any place, the elements d, h and[Pg 8] o took values such that the term (d' × h')/o' should return to a value equivalent to its initial value (d × h)/o, the value of this same thing would again become identical with its initial value.

This formula shows that the value of things is only relatively to be taken for it varies ceaselessly, shifting to as great a degree as supply and demand itself, just as human desire often does,—it is only mathematically fixed in time and space, we would again repeat for an infinitely short period.

This being so it is evident that it becomes possible to put down in writing all transactions by means of the unity determined on. And if this writing down of transactions can be made under a legal form, that is, can be carried out under conditions which have the effect of conferring on the seller a legal right, corresponding to what the thing is worth to him who acquires it, and here we enter into the conception of «social accountancy», it becomes useless, superfluous and even harmful to make a material use of the thing representing the unity of the value adopted.

It is thus that from the beginning, from the very time barter is abandoned and it is no longer necessary to give a kilogram of wheat to obtain possession of a thing, that at that very moment a writing down would confer on the holder of a thing a right representing a value equivalent to it and permitting him to effect under the same conditions new transactions.

If things can thus take place, it will be seen how absurd it becomes to persist in the custom of representing materially a unity which should be detached from the support which has served to define it at a given moment, and which no longer appears as anything but an abstraction permitting in a homogenous manner the arithmetical representation by figures, of the value of things, relatively and individually. This abstract unity ought to be detached from every material tie.

On the other hand, it becomes evident that money does not in the least constitute the indispensable element for effecting transactions. And if at the distant period to which the intro[Pg 9]duction of money goes back it had been possible to tell beforehand that transactions could be written down in a simple but legal manner, after having fixed as above indicated the numerical value of things by the use of a unity essentially invariable, an enormous error in principle would have been committed if to the unities admitted as estimates of value had been given, as is actually the case now, a representation of them in gold and silver,—the franc, the mark, the pound sterling.

The usage of money has taken from the unity of value that character of invariability which it ought necessarily to possess.

This unity being associated in point of fact with a real article of merchandise, society has been exposed either to want, or to have too much of the matter thus become the indispensable element of transactions, to suffer in fact monetary contractions and dilations, the results of the traffic which necessarily takes place, results which, for a nation producing the precious metals, like the United States does, may possibly end in disaster.

A confusion must necessarily be brought about between the conventional fixed value attached to pieces of gold and silver money and the actual variable value of the very matter of those pieces. The conventional value of a piece of silver corresponds to the value we have called its initial value, and we have seen it was possible to preserve to that initial value the character of absolute permanency. But how can its invariability be assured if a material support is given to it open to incessant fluctuations of value resulting from all the speculations to which what ever can be bought and sold is submitted?

The very fact of the association of the unity of value with an actual marketable article takes away all stability from the base of our estimates of the value of things. If the price of any commodity,—for example, some article of food or manufacture,—rises in comparison with what it was 50 years or a century ago, it is often asked whether the augmentation is real or only apparent and due to the diminution in the value of the metal which supports the unity: it results clearly from what has been advanced that the variation in the value of metal goes for nothing[Pg 10] if, it be well understood that the quantity of money in use is supposed to remain exactly proportioned to the needs of the transactions. But when monetary contractions take place, the implement necessary in transactions is wanting, the value of things in general falls, for those who are engaged in making transactions offer their goods at a reduced price to get the monetary implement without which they cannot effect their operations. It would evidently be the same if this implement instead of being in gold or silver, was in wood or paper; and still the same if it was represented only by comptabilist unities.

Directly it is conceded that man must make transactions then, if an implement is indispensable to that end, be that implement paper or comptabilist unities, he will make sacrifices to procure it and will for this object part with some of his wealth, and therefore the value of things will in a general way fall. While if this implement is in excess, that is if there is monetary dilation, as excess of the implement is of no service to the great bulk of those who transact business, who only want what is necessary to effect their transactions and nothing more, it will be found that the value of things cannot be affected by this as it is in the preceding case.

We would say that if this implement is in paper, or represented by accountancy unities, its excess would do no harm, nor have any effect on the value of things, when in the contrary case as we have just seen, this value would fall. But if it is in gold or silver and instead of being stored up in the iron safes of the banks it circulates amongst those who transact business, these last will seek to get rid of it, not because as in the preceding case it is a mere implement of transaction, but as a valuable metal, and in consequence of withdrawal of this kind the value of things will be raised.

When we say that the value of things in general would rise in a case of monetary dilatation occurring in the way we have put it, and that it would fall in the case of monetary contraction pure and simple, it is because we are allowing that the supposed want or excess of money would make itself generally felt amongst those engaged in transacting business. If it only affected a[Pg 11] special class of such persons, if gold or silver were only wanting or only circulated amongst them, it is needless to say that the rise or fall in prices would only affect the commodities in which their special property exactly consisted. We believe it right to attempt to give as logically deduced from the preceding formulas this note of precision in a rather complex question, which, as we think, has not always been rightly looked at, and that, in consequence of the fact that in money, a marketable article of variable value, is associated with a unity which ought to be invariable.

In our epoch of exact science and profound insight into phenomena and things, it is no longer possible to err on the very basis of a question of an interest so general and so vital as this relating to the monetary system. The suppression of such a defective instrument as money and its substitution by a mere simple writing down of transactions, but legally guaranteed,—a system which we have entitled «Social Comptabilism» demands the study of every economist who wishes progress independently of any dogma, doctrine or party. The time is at hand in which by the force of circumstances it must be carried into effect in highly civilized countries. Germany, almost entirely educated to-day, should have no reason to oppose its adoption, if she saw clearly the advantages which social comptabilism presents and the difficulties and inconveniences which would disappear on its use. It would be a great error to imagine that any kind of economic revolution is necessary to establish it. In Belgium M. De Greef[D], in his «Essais sur la monnaie, le crédit et les banques», has shown how simple, logical and profitable it would be to approach it by rapid strides resting on the fundamental principle of «social comptabilism»,—the guarantee of property. M. H. Denis[E] in his work on the «Organisation et le Fonctionnement du service des chèques et des virements à la Caisse d'Epargne postale de l'Empire d'Autriche», shows how such comptabilism has been [Pg 12]already approached in what chiefly relates to deferred payments, in a great country, which although it does not generally lead the way in progress, seems to have correctly apprehended what relates to the machinery money masks and wrongly represents.

We shall only add one more observation in justification of the way we look at the matter, it is that in our country there is in principle at the present time in the financial organisms patronised and guaranteed by the State, all that is needed to realize «social comptabilism». Does not the National Bank of Belgium, as well as the Bank of France, among our neighbours to the west, issue bank notes,—and from our point of view, these notes represent unities of comptabilist value—to all those who offer them sufficient guarantees. In exchange for a deposit of securities, or for well known signatures, paper is obtained, notes equivalent to metal money:—this is already on the road to social comptabilism.

In place of that, let these banks issue notes, counters—only possible to be used once—or rather bankbooks containing leaves or fractions of leaves, or squares having a meaning equivalent to that of notes or counters, or able in some way easily to realize that meaning, and which would be simply obliterated in case of transactions accomplished and the working of comptabilism is fully seen although only at the threshold of the system.

Let the State then enlarge to the utmost degree possible the power of these banks to issue such notes or cheque books; let these be authorised to accept mortgages, deposits and all guarantees from third parties or others, whether directly or more indirectly by the intervention of other public organisms appointed to the work, or even analogous private organisms, of a solvency secured beyond all doubt; let this issue be made for any amounts, however small; let these establishments be even authorised to issue notes similar in form, but blank, or account-books to people without means and only usable on the understanding that all that results in connection with them is at the risk and peril of those transacting business, and we have arrived at comptabilism complete and definitive, even to the point of suppressing the copper coinage.

It is evident that in this way society as it is at present organised, can demonetize the precious metals and establish social comptabilism without in principle having to make any revolution whatever in its present position, it has only largely to increase a portion of its machinery, already existing and in full swing. To sum up, it is a question of a simple change in the machinery of transactions and all society is interested in the realization of such a progress purely mechanical and functional, which moreover has no connection with any doctrine, opinion or party, and is no new invention whatever.

In conclusion, and at the risk of repeating ourselves, in order to explain our idea under all its forms, and to render it accessible to every mind, we think we cannot do better than to recapitulate it in formulating some articles which set forth in principle the basis on which legal arrangements could be made on the hypothesis that the legislative power should determine suddenly to decree the application of «social comptabilism» such as we have defined it in basing it on the guarantee of property, on the employ of account books, with debit and credit entries, and on the use of a stamp or punch to inscribe or obliterate figures.

The articles recapitulate the essential principles of the reform from a point of view wholly general, the only one in this notice we have proposed to examine, leaving for the present absolutely out of consideration details of application which have to be studied and which might vary infinitely.

It is needless to say that we by no means believe that a reform like this can be realized at once, we rather think that it will come by stages, as is always the case in every fundamental change relating to any established order of things.

The intermediary phases would probably be the adoption of the system of comptabilism already in operation in Austria, principally for defered payments, as it is explained in the work of M. H. Denis, already cited (it would be only necessary to add to this system the guarantee of the State, based itself entirely on the guarantee of individual property, in order to enter into the plan of «social comptabilism»), and on the other hand,[Pg 14] a large extension of the issue by the State of paper money for that which concerns current payments as proposed by M. De Greef (it would suffice to add the system of stamping as equivalent to signature, the limitation of the use of paper to a single operation, and its regular return to the Accountant's Office, for to make such reforms equally a part of the plan of «social comptabilism»).

1.—From ... the monetary system shall be replaced by the comptabilist system.

2.—The National Bank shall become a comptabilistic establishment, commissioned to deliver to individuals, to societies, etc., account books, divided into leaves and squares having a certain significance for the credit, and leaves and squares having a certain significance for the debit, in which the signification of the transactional operations effected, and which at present involve the use of money, shall be stamped[F] respectively to the credit and debit of the account-books of each of the operators in account unities equivalent to the actual franc.

3.—The accountant-general will deliver either blank account-books, or account-books having a certain sum inscribed to the credit of the account-book.

4.—The transactional operations inscribed in a blank account-book will be effected at the risk and peril of the operators. Every-one will be able to obtain such an account-book.

5.—Contrariwise, the transactional operations inscribed in a credit account-book will be made under the guarantee of the National Bank, but only in so far as they concur with the sum inscribed to the credit of that account-book.

6.—Every-one can obtain credit account-books, for a certain sum, either in mortgaging some corresponding property in favour of the Bank, or in offering to it the guarantee of a third party, who should have agreed to a similar mortgage, or ...

7.—An account-book out of use or obliterated, or of which the sum appearing to its credit is exhausted, will be returned to the accountant-general; should such returner of an account-book have a balance, then the accountant-general will open an account in the official books, and enter this balance to that account.

8.—Every individual whose account-book balance is to his [Pg 16]credit will be able to obtain credit account-book for a maximum sum equivalent to this balance, if he offers a corresponding mortgage either as before stated, on an existing property, or on property he may acquire by means of the sum thus inscribed to the credit of his account-book.

What has preceded shows how simple, unobtrusive, passive is the part played by the accountant-general.

The books containing the figures signifying what transactions have been effected either to the credit or debit side, with the figures attached identifying those who have made the transactions, are remitted to him.

He adds up the credit and debit account and, if there is a balance, enters it to the account of the possessor of the account-book. That is all. If he comes across mistakes or errors, he rectifies them, notably if he discovers that the statements of the account-books do not agree with the corresponding statements of the account-books of those whose transactions appear there.

The accountant-general acts as a piece of machinery would act. He is a recorder of figures, a registrar of balances. If there are no balances to enter he does not even make a registration, and is then only a legal witness of transactional operations. No more is asked of him in order to arrive at the suppression, pure and simple of the monetary system.

But from the day in which the comptabilist system becomes legal to the exclusion of the monetary system, from the moment in which each individual has his personal account introduced into the registers of the accountant-general, his transactional life is henceforth, and for ever, represented on the one side by the mortgages and guarantees that he furnishes in order to obtain comptabilist unities, on the other hand by the balances of his account books that the accountant enters successively and indefinitely to his account. If the whole fortune of each person were treated in such a manner, and it is this we foresee must be the legal situation in the definitely social state (having for sole tax the succession duty, etc., etc.), it is plain that the true function of the accountant-general would be that of recorder[Pg 17] of the state, of the shifting social position of each person, the determiner of the diagram of his active, relatively effective life. Each individual would thus have the stereotype of his effective social life cast; each social being would have his effective life formulated, if one may so speak, by relation, always by relations, nothing but by relations—to that of all the rest, but in figures, and yet again, in nothing but figures. And herein is seen clearly the fundamental error or profound confusion of those who believe there can be any other thing in the social problem which occupies us than what has just been stated; of those who imagine that capital or fortune must be able at every moment, and not eventually, in the sole end of utilising the metal for itself, to be represented by its equivalent in gold or silver; of those who persuade themselves that the words capital and fortune represent anything else than relative social power of action or enjoyment which it is sufficient to record, to make public, purely, simply and legally, as we propose, in order that it may be absolutely guaranteed to each person.

Ernest SOLVAY.

[A] Annals of the Institute. No 1. June, 1894.

[B] If it is not admitted that the term dh/o exactly represents the account of the conditions of the supply and the demand, it could be represented in a more general way by a function F (dho) of the elements d, h, o, which are the only ones which ever can, according to our view, intervene in the fixing, for even admitting that things could be regulated to the last point, socialized if you will, these two elements of supply and demand would at least remain always existing and dominant.

[C] It is by design that we employ the expression transactional value in order to differentiate it from a value such as would result from a theory of the measure of value based on work stored up in transactional merchandise, a theory with which we have not here to occupy ourselves.

[D] Annales de l'Institut, 1896. Nos 1 and 4.

[E] Annales de l'Institut, 1896. No 5.

[F] We think we ought here to recall (see: Comptabilism et Proportionnalisme social) that every-one who makes transactions carries about with him not only his account book, but also a marker or stamp bearing representative figures or signs, identifying his personality and by aid of which he inscribes or obliterates the figures significant of the transactions in the account book of his correspondent.

It is needless to add, that instead of marking,—an operation we have always put forward the better to show that all account-keeping can be done by simple inscription or the registration of figures and without any «exchange» whatsoever, not even of bits of paper—a system could be adopted, for example, consisting of having on the credit and debit sides of the account-books, leaves of stamps more or less analogous to postage stamps, credit-stamps which the buyer would detach from his account-book, and which would be fastened into that of the seller, then the seller would detach from his account-book corresponding debit stamps to be fastened to the debit side of that of the buyer. These stamps would carry naturally besides their signification the same figures or representative signs of the personality of the maker of the transaction as the marker they would be destined to replace.

The comptabilistic system making use of such stamps rather than of marks would be applied to defered payments as well as to current payments, it could be thus used in every case.

The principle of the account-book consists naturally in the book forming a real account with debit and credit—like all accounts in ordinary book keeping,—in which is inscribed in a way which would be regarded as valid, having legal force the sums corresponding to the transactions effected either by being written out at full length, with the signature, or by marking in figures, and indicating at the same time the personality of the party making the transaction, or by means of stamps as we have just seen, or finally by some other way.

Directly we leave the principle above mentioned to look at some intermediary form of its application, a host of combinations offer themselves. The use of stamps for example would permit doing away with the debit side in the account books. The buyer in this case detaches, from his account-book, which becomes now only a credit account book, the stamps corresponding to the extent of the transaction, and he sticks them in the account book of the seller, which is also only a credit one: the credit of the seller increases, that of the buyer diminishes, that is all. If the buyer does not stick his stamps in the account-book of the seller, these stamps can circulate, they would be analogous to bank notes which have been endorsed by writing upon them the name of the first party holding them.

By Ernest SOLVAY

In the last number of these Annals[G], I explained in a manner which I consider definitive, the theoretical conception of comptabilism.

To this point of view it seems to me necessary to add a few words in order to throw light on certain points which the first article did not sufficiently bring out.

We have seen what is the use of money and to whom it is of use, we have considered if it was indispensable. Gold and silver are not a «real commodity» except when they take the form of useful objects, utensils, works of art, etc., the possession of which produces enjoyment. Turned into coin, they lose this character, they become an instrument, an instrument recognised so far as indispensable for obtaining a real commodity, be this commodity material or moral, by an operation which I have designated under the general term of «transaction». Money is not then a commodity in the true sense of the word; on the contrary it is generally obtained by the surrender of a commodity.

It is solely in order to accomplish the «operation» of transaction that money is needed, because this is the method, the means, the instrument which custom has consecrated; and if another practicable method, means or instrument were found [Pg 20]in order to accomplish this operation money would no longer be indispensable. Now, this is what comptabilism does.

It is essential to note here that the comptabilistic unities, francs, marks, pounds, etc., would be derived from securities, and not, as with money by the surrender of commodities, that in consequence these unities would no longer have a value by themselves, but simply by the things which they represented.

But apart from that, they could be with held or parted with, they could be borrowed or lent, with or without interest, directly from man to man, or by the medium of banking houses, exactly as in the case of money.

And in fact, if the force of habit required, nothing would prevent their being called money of account or comptabilistic money, since apart from what has just been said as to the way of obtaining them and their nature, nothing would be altered in the current methods, everything would remain as to day both in the organisation of business and of society. And all that might have been said, written or thought until now in an opposite sense to the fore going considerations should be held as contrary to the reality of the facts resulting from comptabilism.

The conception of the comptabilistic system is one quite other than that of the monetary system. There is not the smallest trace of this second conception in the first; it becomes necessary to leave entirely the one to understand the other. In a word the two conceptions mutually exclude each other; the one is based upon exchange, the other upon accounts, and the two systems derived rest thus on two essentially different principles.

The examination of the theoretical side of the comptabilistic system could not be undertaken through the ideas, nor from the point of view derived from the monetary system. It is necessary first of all to accustom oneself to think and speak of business, finances, etc., abstraction being made of every idea of money and to persuade oneself that transactions—and by transactions I understand every operation, whatever it may be, which gives rise at present to the use of money or its[Pg 21] equivalent—when finally analysed, only modify the ratio of fortunes. If these ratios could be continuously recognised and fixed, could be officially registered, money would lose its use. Indeed, money put in circulation by whatsoever an operation is only a means of granting to the one who receives it, the power to acquire subsequently its equivalent, the other who has given the money having diminished by this much this power as far as he is concerned.

Now the comptabilistic system in officially registering this power, acquired on the one hand and diminished on the other, permits the afore mentioned ratios being fixed, and realises entirely the part played by money. Therefore it can entirely be substituted for the monetary system. And let it be said, in its favour, that the power registered in this system cannot itself be lessened by the fact of the fluctuations in price of the metal, as actually now takes place. Moreover, the necessity which exists at this present moment of surrendering commodities to procure the monetary instrument indispensable in transactions, would disappear.

It is evident that it might have been possible theoretically to pass directly from the regime of barter to the application of the comptabilistic system, and if one admits that the conception of this system could have been produced at this far distant epoch, and have been thus used from the commencement,—which in the presence of the laws of evolution of the human mind, could only be a pure hypothesis—it must be immediately granted that the monetary idea could not then have occurred to anyone—and even admitting, which is impossible, that it had occurred all the same to someone, no one would have dreamt of making use of it, so much in the presence of comptabilism would the monetary system have seemed barbarous by its illogical and inconvenient character.

Such are the theoretical considerations which it seems necessary to insist upon.

But if there is a difficulty in comprehending the question from its theoretical side, this difficulty disappears if approached from the practical side.

This is what will be seen on examining the system which M. Hector Denis has gone to study in Austria and which he proposes to realise in Belgium.

All the post-offices in the Austrian Empire are in connection with the Savings Bank, the central establishment of which is in Vienna and which has become during the last few years a thoroughly comptabilistic establishment, in this sense, that,—independent of its primitive aim, it keeps the accounts of over thirty thousand who are affiliated and who annually through this medium do business of which the figures are above a thousand millions of florins.

The Savings Bank exacts from those persons who wish to transact business through its medium, a fixed monetary deposit of 100 florins, without relation therefore to the importance of the transactions which they can effect; it opens for them an account and delivers them, upon request, cheque books which serve to effect the payments which they desire to make. All this is done by the intervention of any post-office of the Empire.

Each time that a cheque is paid by an affiliated person, the Central Office at Vienna is advised by post and returns immediately, also by post, an extract of their account to the two persons concerned. Each affiliated person's account is thus kept to date, and this as much for the Central Bank as for the person affiliated.

Here then are thirty thousand persons who could at a stretch do entirely without money—if their mutual relations were sufficient to permit them to do so for all the necessaries of life, and this result is obtained merely by the fact that an official establishment is willing to undertake to keep the banking account. But it is seen that these thirty thousand persons are but a select few in the mass of the population, since the Savings Bank admits them to carry on transactions merely upon the deposit of 100 florins, thus almost always at the risk and peril of the transactors, as has always been the case so far in regard to cheques. And it is evident that if it were desired to make the system general, it would be necessary to adopt the principle of comptabilism which would mean that[Pg 23] the transactions were guaranteed by the property of the persons affiliated.

Here then, as I said, has the Savings Bank of Vienna become up to a certain point a comptabilistic establishment. I may add that the dangers that might threaten this institution, as far as it actually works, spring from its being not entirely comptabilistic, in so far as it still retains the metallic basis.

The deposits received are not left unproductive, they are placed in funds, public or otherwise.

Let a political crisis occur which should cause a rush of withdrawals of these deposits from the Bank and it would be exposed to the greatest dangers. Solely because the institution is based upon current ideas and not upon the comptabilistic system.

In effect, in this latter system, the individual who is affiliated does not make a deposit of monetary unities having a value in themselves, he gives as a pledge a commodity, and according to the value of this commodity he is permitted to make use of more or less unities.

Here then is the ground on which the institution ought to be based. Under these conditions deposits are not necessary. The affiliated person will give a pledge in exchange for his cheque book. The registers of the Central Savings Bank will declare that he is permitted to carry on transactions with x unities, and his cheques will be accepted, as long as he does not go beyond this figure.

In place of a deposit having a value of its own, there is the simply writing down, the entry of a right, and the dangers of the present system would be avoided.

The entry and the writing down constitute the ideal realization of the comptabilistic system. They lead one to understand that the transactional unities have only a fictitious value, that they serve solely to measure the transactional value of things, that their system is thus dependant on the existence of these things.

Ideally speaking, all the transactions, that is to say the changes in the fortunes of individuals, may be written down, may be entered, for example in bank books.

But concerning the practical side, although the entry remains the ideal conception, it may be that the necessities of human relations require other methods of a more convenient nature. This is a side of the question upon which we hope soon to set forth some solutions, but which can be discussed without the theoretical side of comptabilism being introduced.

Ernest SOLVAY.

[G] Annales de l'Institut des Sciences sociales, of Brussels.

By Hector DENIS

The accumulation and safe keeping of funds, their investment with the triple guarantee of security, productiveness and easy and prompt realization are regarded as the fundamental functions of Savings Banks, and it is in these directions that their development has especially been accomplished.

The comparative studies on these institutions, such as the works of Rostrand and the fine account of Messrs Hamande and Burny testify to the increasing ingenuity of the means of drawing out and gathering up savings, and of the great expansion Savings Banks well conducted can give to divers forms of credit, and will finally be obliged to give them.

But such is the flexibility of this institution that in carrying the spirit of reform into the means of assuring to the depositor the most prompt and convenient disposal of his savings, there ought, in order to apply it to his payments, to be accomplished in the Savings Bank, an evolution equally fecund in a new direction.

A savings bank like that of Vienna having at its command the powerful lever of the postal service, combining in a few years with singular ability, the centralization of the accounts of its[Pg 26] depositors with the post office functions,—at once receptive and distributive, centripetal and centrifugal, cannot fail to appear one of the most ingenious, stable and perfect organs of modern circulation.

There is no need to discover in this functional evolution the realisation of any new principle—undeniable bonds of filiation attach it manifestly to the Bank of Amsterdam, whose system of clearing accounts Adam Smith has so admirably described, and in a still more distant past to the Bank of Venice, which, more perhaps than the Bank of St-George, served as a type to the Bank of Amsterdam; only like the most advanced modern institutions of credit and settling up, it has, over the primitive institutions, the advantage of perfections of means, of rapidity, and of an ever-growing importance in its operations, and of an ever increasing economy of money;—it has as its own peculiar features conditions of special expansion, valuable means of control and specially a capacity of adaptation to a system of credit institutions which can make it one of the instruments of the transformation of the monetary system.

The Austrian Imperial Government in carrying out the reforms which are the subject of this paper does not directly pursue the solution of the monetary problem, but is primarily occupied with the financial interest of the Savings Bank. As its able secretary, M. Tobisch, has explained, the law of May 28th 1882, of which the text is given further on, in organising the Postal Savings Bank, caused no doubt a considerable number of deposits to be made, but their average importance was so feeble and they involved such general expenses, that the cost almost completely absorbed the results of the investments. In order to distribute these general expenses over a greater mass of monies and to realise a larger clear profit, that is to cause more considerable deposits to be made by especially interesting tradesmen and working-men to have recourse to the medium of the Savings Bank, a notice of the Minister of Commerce of Oct. 29 1883, authorised the depositors of over 100 florins to draw cheques on the Central Office at Vienna. Originally the depositor remained the holder of[Pg 27] his account-book, but from Dec. 1 1886, the deposit of all such books at the Central Office in Vienna became obligatory for those who wished to take advantage of the cheque service. The institution of this service had a considerable influence on the progress of the amount of deposits; before the reform in 1883 the total deposits amounted to 8,176,889 florins, a year after in 1884, they reached 56,586,461 florins, of which 46,223,539 was connected with the cheque service.

The natural corollary of the centralisation at Vienna of the accounts of all those who adhered to the cheque-service was the organisation of the service of clearing accounts, for the more the number of its adherents increased, the more frequently it happened that one depositor drew a cheque in favour of another depositor. The cheque, up till then payable in specie, became a clearing cheque realisable by a simple transfer in writing. This complimentary service which is destined to become the principal one, was instituted Sept. 1 1884.

The Austrian institution is only at present an element in the vast modern system of credit and the balancing of accounts and no one is ignorant that the system entirely rests on metallic money, as Stanley Jevons, Francis A. Walker and Macleod have elsewhere clearly shown. Macleod makes the striking comparison of modern circulation to the movement of a peg top which spins round on a very fine metallic point.

The Postal Savings Bank, as it is organised and works, has not yet any kind of purpose of freeing circulation from its metallic basis, but like all other credit institutions, it contributes to this end by economising more and more the use of money; with extraordinary powers of expansion, it enables an ever increasing number of respectable persons, associations or bodies, to effect all their payments without the least risk, almost without loss of time and without having to keep any metallic money in their possession. And if one tries to conceive the future ideal evolution of an instrument so flexible as the Savings Bank, one may expect as I shall attempt to show in subsequent papers, that in combining its circulatory function with its function of investment it will be led into concurrence[Pg 28] with the radical transformation sought by M. Solvay in the definitive elimination of the metallic instrument.

The sources from which the materials of this account have been drawn, are the laws, regulations and instructions of which the translation is appended, the statistics of the cheque and clearing service in the last official report (Zwölfter Rechenschaftsbericht des postsparcassen Amtes) the remarkable studies of M. Tobisch, secretary of the Savings Bank, and finally direct observation. Guided by one of the most enlightened officials of the Savings Bank, Inspector L. Kotschy, I have been able to penetrate into the inner life of this admirable institution. The Vienna Central Postal Bank occupies the old palace of the University; there, distributed in its antique halls, a population of 1,300 employés, among them 150 ladies, working after a skilfully organised plan, pursue silently now for thirteen years, with inflexible method, an experiment of very great interest for science and for the economic life of societies. Bound by invisible threads to more than four thousand secondary organs:—the post offices, which plunge directly into the torrent of the exchanges,—the Central Office records each day with extraordinary precision the minutest changes that the ever increasing number of its adherents accomplish in the social movement of wealth.

All the operations of which it thus fixes the traces arrange themselves into two great classes which recur as the two essential aspects of the rhythmic movement of a central organ of circulation; one joins in the formation of the property of every adherent of the system, in the constitution of his credit at the Central Bank; the other leads to different modes of disposing of his property and to the formation of his debit.

The services of cheques and account-clearing[H] of the Austrian Savings Bank enable on the one hand every person to make, under conditions fixed by law, in any Post Office in the Austrian Empire, payments on account, or to the profit of all [Pg 29]those who participate in the service; on the other and they enable every adherent to assign by means of a payment cheque, a part of his property to anyone, physically and morally, or by means of a clearance cheque to cause the transfer to be made to the account of another participator in the service.

The Austrian terminology bristles with difficulties, the name of cheque verkehr is here given to the first of these services, circulation of payment cheques resulting in the end in the use of metallic money, and to the second service, the name of clearing verkehr, circulation of clearing cheques, which resolves itself, as far as the Savings Bank is concerned, into the transference from one account to another, in the substitution of one creditor for another.

The cheque service may exclusively be adhered to, or the cheque and clearing service.

For affiliation to the cheque service it is necessary to request the Office of the Postal Savings Bank in Vienna to open an account, to send a cheque book and a book of certificates of receipts and deposits, of which we are now about to speak. The cheque book costs 1 florin 50 kreutzers, the certificates of deposit 1 kreutzer a piece.

The Post Office can refuse the request without having to give any reason. If an account is opened to the grantee, he receives cheque books and certificates, but he is bound within a month to effect a deposit of 100 florins as security. Neither the law nor the regulations fix any maximum of deposit. The minimum of 100 florins will remain in the hands of the administration, without the person entitled to it being able to dispose of it as long as he has an account open in the Post Office. The adhesion to the clearing circulation is at once requested by the Post Office, of adherents to the cheque service.

The number of adherents to the cheque service is not identical with that of adherents to the service of clearing. For the thirteen years that these services have been instituted the first has always taken precedence of the second, but the divergence which exists between the two numbers is being reduced and the number of adherents to the clearing service tends to blend and[Pg 30] will finally blend with the adherents to the cheque service.

The geographical distribution of those who have accounts in the two services is of much interest. In 1895, out of 28,363 adherents to the cheque service there were 27,820 in Austria, 353 in Hungary, and 190 abroad,—163 in the German Empire, 5 in England, 1 in France, 3 in Holland, 5 in Italy, 3 in Switzerland, 2 in Belgium—an interesting fact.

The twelfth report: Zwölfter Rechenschaftsbericht des postsparcassen Amtes, insists on the important number of Hungarian commercial firms, affiliated to the Austrian Bank, all of whom have an account open in the Post Office Savings Bank instituted in 1887 at Budapest; it announces the approaching inauguration of a direct and regular service of account-keeping between the two Banks, a service to which the traders in both countries attach great importance. It will mark a new phase in the evolution of the institution; and form as it were the preface to its internationalisation.

It is curious to note that out of 543 residing in Hungary and abroad who have cheque accounts, there are 434 who are affiliated to the Clearing at Vienna, that is 79.9%, a proportion very much larger than is seen in all those in the various Austrian provinces.

The number of those having accounts has successively been:

| In the cheque service | In the clearing service | ||

|---|---|---|---|

| In | 1883 | 167 | |

| » | 1884 | 2,520 | 1,283 |

| » | 1885 | 6,877 | 4,733 |

| » | 1886 | 10,553 | 7,274 |

| » | 1887 | 12,981 | 8,758 |

| » | 1888 | 14,296 | 9,836 |

| » | 1889 | 16,046 | 11,025 |

| » | 1890 | 17,808 | 12,200 |

| » | 1891 | 19,391 | 13,331 |

| » | 1892 | 21,365 | 14,955 |

| » | 1893 | 23,471 | 16,197 |

| » | 1894 | 25,834 | 18,250 |

| » | 1895 | 28,363 | 20,750 |

From the above it is seen that the proportion per cent of the number of adherents to the service of clearing rises gradually in the later years;—after having from 1890 to 1893 been nearly uniformly from 69 to 70%, it rises in 1895 to 73.2%.

The classification of the adherents from the point of view of conditions and profession reveals the elasticity peculiar to such an institution. Advocates, notaries, doctors, even professors appear in great numbers. Manufacturers and traders united represent nevertheless more than half the total number of members; 339 bankers and money-changers, 362 associations for savings and loans, 220 private savings banks, 1,490 associations or corporations,—public establishments of which 185 were communes and administrative bodies,—271 benevolent associations, funds, establishments and foundations, 175 agricultural and forestal associations and 175 religious associations, 266 assurance societies, and 204 journals or periodicals serving as media for the Savings Bank. The administration of the State forests and domains have recourse to the Savings Bank in order to bank the produce of the forestal sales, and the administration of taxes is now experimenting as to its intervention for the getting in of duties. This institution thus presents a marvellous flexibility, invading by degrees the whole domain of exchange and enveloping one by one all the organs of the collective life.

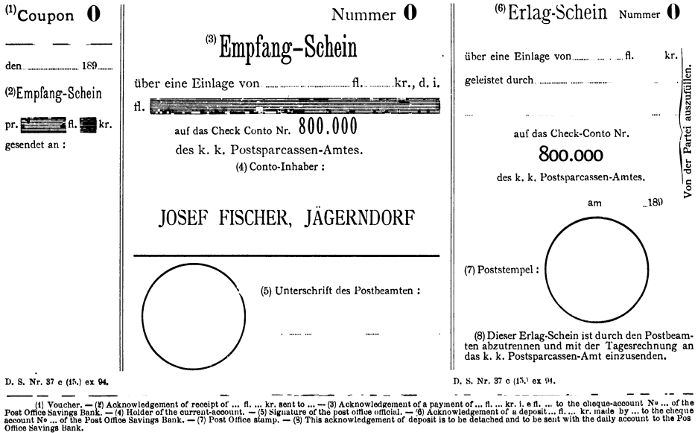

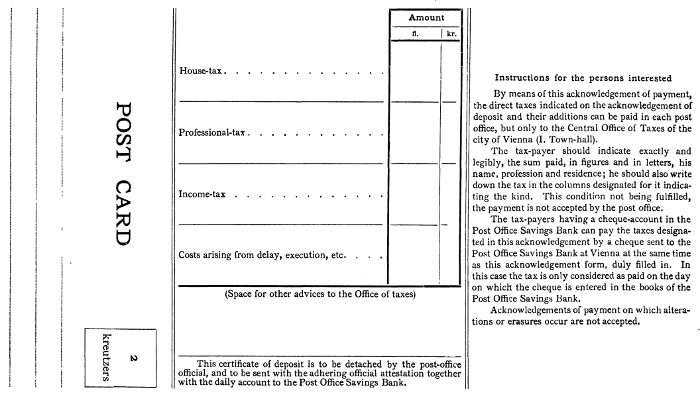

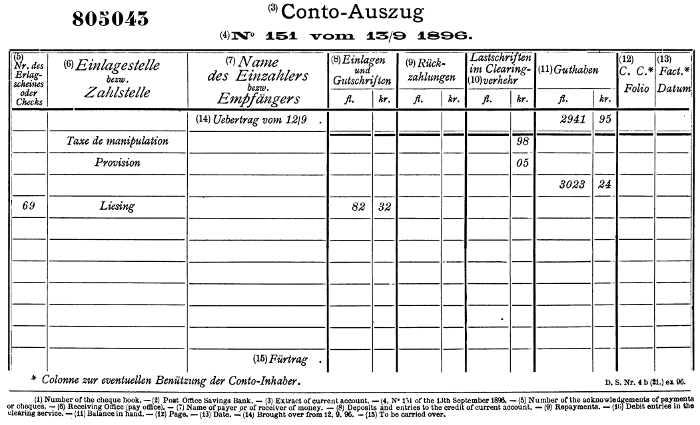

Let us first explain the modes of operating payments to the profit of every member affiliated to the cheque and clearing service. In the first of these modes, the instrument employed is the certificate or attestation of receipt and of deposit (empfang erlag scheine). (Fig. 1.)

Books containing blank certificates are issued by the Central Office at the low price of a kreutzer the piece, to every person adhering to the cheque and clearing services; these are books of 10, 20, 50 and 100 pieces, and to meet the needs of various holders they are drawn up either in German or in some other of the tongues spoken in the Empire. All these certificates bear the number of the account to the operations of which they are destined and carry the name and the address of the account holder.

Each of the certificates presents three parts which are separated one from the other in the course of the operation: the first, the counterfoil, remains attached to the book and in the hands of the holder of the account; of the two others, one, the attestation of the payment, has to be returned by the Post Office receiver to the person who makes the payment; the third the certificate of the deposit has to be transmitted to the Central Office at Vienna, which returns it to the holder of the account. To make a payment it is necessary to fill in the certificate of receipt and the certificate of deposit, and to present them at a Post Office with the sum to be paid into the holder's account. The receiver of the Post Office will bank the sum, and will sign the receipt, imprinting on it the stamp of the office, and will remit it to the person making the payment; he will then detach the certificate of the deposit and will send it to the Central office at Vienna with the daily account of his operations. The central administration will immediately credit the person in whose favour the payment is made, in the account that it has opened for him, and it will then transmit to him the deposit certificate with an extract of his account.

Such is the series of operations which result from empfang erlag schein.

Suppose for example that the holder of an account is a merchant who has furnished supplies to a customer in the provinces to the amount of a hundred florins, net. He fills up a leaf of the account book, bearing a certain number, on which he indicates the amount payable, and which payment is to be placed to his account; he sends this leaf to his customer, keeping the counterfoil with the customer's name written on it: the customer forwards the leaf to the Post Office where he lives with the sum due: the postal receiver separates from the leaf the certificate of receipt (empfang schein), which he signs and returns to the customer, he sends the certificate of deposit to the Central Office at Vienna, where the sum is carried to the account of the merchant. After which the deposit certificate bearing the name of the person making the payment is forwarded to the merchant with an extract from his current account, enabling him thus to exercise strict control.

Figure I.

Deposits can be made by the intermediary of rural postmen to the extent of 500 florins. In this case the receipt and deposit certificates must be remitted to them with the sum; a provisional receipt is given which is replaced at the next round by the official receipt of the district post-office.

It will be interesting to show the importance to which this mode of arranging deposits has now attained.

There is at the Central Office at Vienna a printing office which permanently employs 16 workmen, exclusively engaged in printing cheques and certificates of receipts and deposits. Six million of the latter kind of certificates are now annually printed and the number of them printed since the setting up of this system in 1883 amounts to 107 millions. An office for the verification and control of the printed matter is connected with this workshop. As to the amount of payments made through these certificates to the accounts of holders the 12th Report enables us to give the statistics.

At the opening of the year 1883 the sums paid into the funds of the account holders, by means of the Empfang erlag schein amounted to 322,284 florins.

They rose successively:

| In | 1884 | to | 43,748,349 | florins. |

| » | 1885 | » | 217,109,144 | » |

| » | 1886 | » | 361,466,434 | » |

| » | 1887 | » | 442,138,414 | » |

| » | 1888 | » | 446,874,084 | » |

| » | 1889 | » | 517,734,775 | » |

| » | 1890 | » | 592,089,250 | » |

| » | 1891 | » | 663,221,494 | » |

| » | 1892 | » | 731,325,411 | » |

| » | 1893 | » | 811,318,663 | » |

| » | 1894 | » | 889,793,808 | » |

| » | 1895 | » | 969,479,217 | » |

The annual growth has been during the later years about 70 to 80 millions of florins. It moves at a regular pace.

I have shown by the example above how by aid of the empfang erlag scheine, the trader can by means of his responsible agent, the Savings Bank, receive at once the amounts of his invoices, without the money passing through his own hands. Numerous other applications of the system are before us: commercial travellers can deposit to the account of their employers, the sums they have collected in their rounds; they can even add at the back of the certificate such helpful notes as they think necessary; the commercial firm which employs them being regularly and immediately informed of payments by account extracts and the certificates of deposit being successively forwarded to the firm by the Central Office at Vienna.

Associations of every kind having accounts at the Savings Bank can by the same means gather subscriptions from the members: it is enough to send their members certificates of receipt and deposit; each one makes his payment at the neighbouring post office; the associations receiving, as the merchants, extracts of their accounts.

Assurance societies can in like manner, effect the payment of their insurers' premiums without any formality beyond that of sending to these insurers the empfang erlag scheine. And in like manner subscriptions to journals and all kinds of periodical payments can be received.

Post Office orders issued to the benefit of any person affiliated to the cheque-service can, at his request be placed to the credit of his account. He gives to this end, on forms required by the regulations, an authorisation at his district post office. On its side the Central Office of the Savings Bank puts itself in relation with the post office. Ingenious combinations which are indicated in the instructions reproduced in the appendix to this paper, cause the order to be transmitted to the Money Order Office of the Viennese Post Office, which in paying the amount to the Central Office of the Savings Bank will at the game time inform of this transmission, the person in whose favour the order is made out.

The Post Office Orders only take a very secondary position in the accounts of the cheque and clearing service.

| In | 1884 | their amount rose to | 851,514 | florins |

| » | 1885 | to | 6,399,576 | » |

| » | 1886 | » | 14,197,234 | » |

| » | 1887 | » | 17,702,424 | » |

| » | 1888 | » | 17,853,284 | » |

| » | 1889 | » | 18,967,659 | » |

| » | 1890 | » | 22,349,594 | » |

| » | 1891 | » | 25,614,771 | » |

| » | 1892 | » | 26,271,893 | » |

| » | 1893 | » | 27,230,128 | » |

| » | 1894 | » | 28,252,117 | » |

| » | 1895 | » | 29,241,933 | » |

It is stated that the progressive movement is at once slower and more regular since 1891, than it was previously.

The Postal Savings Bank receives in like manner for the benefit of holders of cheque-books, dividend warrants due from the Austrian public funds. It records the amount of them to the credit of the holder's account and receives a fee of 1 kreutzer a piece.

It is the least important of the agencies which feed the credit of the adherents of the system.

| In | 1884 | the amount received was | 3,310 | florins |

| » | 1885 | 44,056 | » | |

| » | 1886 | 114,684 | » | |

| » | 1887 | 134,588 | » | |

| » | 1888 | 147,833 | » | |

| » | 1889 | 131,944 | » | |

| » | 1890 | 148,104 | » | |

| » | 1891 | 167,199 | » | |

| » | 1892 | 165,139 | » | |

| » | 1893 | 176,524 | » | |

| » | 1894 | 223,757 | » | |

| » | 1895 | 254,497 | » |

The amount of claims to debts and bills rendered payable at the post office can in like manner be placed to the credit of the adherent to the cheque and clearing service in favour of whom these bills have been drawn.

The importance of this agency is more considerable, but its progressive development is said to move at an irregular rate.

Introduced in 1886, it was absolutely insignificant during the first two years.

| 1886 | 17,916 | florins |

| 1887 | 23,370 | » |

| 1888 | 1,013,478 | » |

| 1889 | 1,072,812 | » |

| 1890 | 1,511,822 | » |

| 1891 | 2,303,012 | » |

| 1892 | 2,740,125 | » |

| 1893 | 2,623,893 | » |

| 1894 | 3,001,165 | » |

| 1895 | 4,301,265 | » |

When the bearer of a cheque book is at the same time an adherent to the clearing circulation, the amount of the cheques issued in his favour is carried to the credit of his account by the Postal Savings Bank, unless on these cheques is expressly noted: Outside the clearing circulation.

The amount of this service, after that of the empfang erlag scheine, is the most important element in the formation of the accounts' credit. It has nearly quintupled in the last ten years, moving forward, since 1886, at a steady rate, a proof, as the whole of the facts otherwise witness, of the progressive penetration of the system into the national economy.

At the opening of the institution of clearing verkehr, in the second fortnight in 1884, the amount of the sums carried to the clearing account was:

| 1884 | 1,620,102 | florins |

| 1885 | 40,271,880 | » |

| 1886 | 102,185,786 | » |

| 1887 | 150,479,085 | » |

| 1888 | 177,846,958 | » |

| 1889 | 216,683,156 | » |

| 1890 | 264,262,296 | » |

| 1891 | 310,141,924 | » |

| 1892 | 360,498,168 | » |

| 1893 | 414,342,892 | » |

| 1894 | 445,378,270 | » |

| 1895 | 482,031,950 | » |

The last and assuredly the most ingenious of the application of the system is being made at this very time in the payment of taxes.

The certificate of the payment of taxes (steuer Einzahlungs-schein) is nothing but a special form of empfang erlag schein; the Savings Bank proceeds experimentally by the trial of this mode of collecting the taxes in the province of Lower Austria.

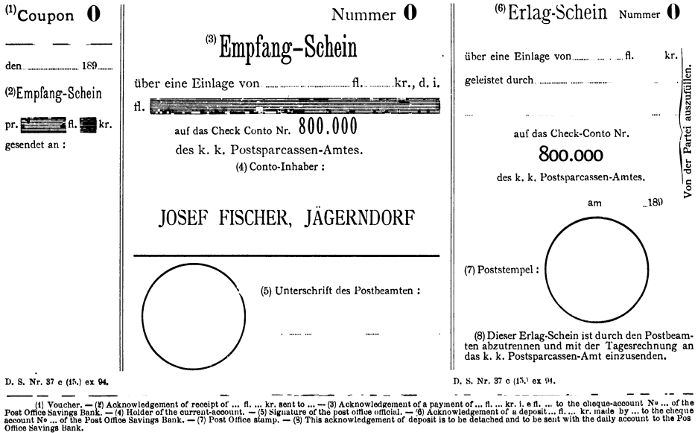

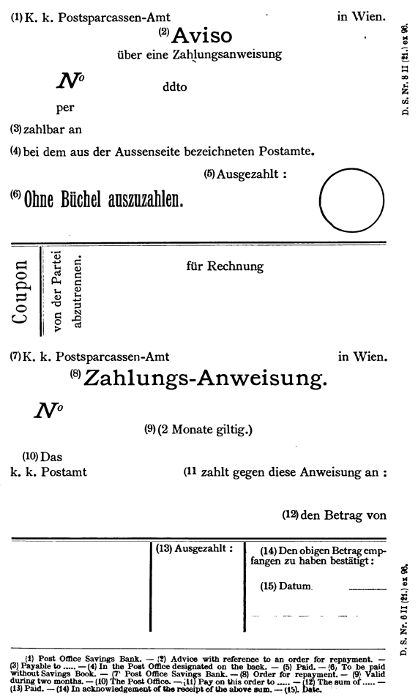

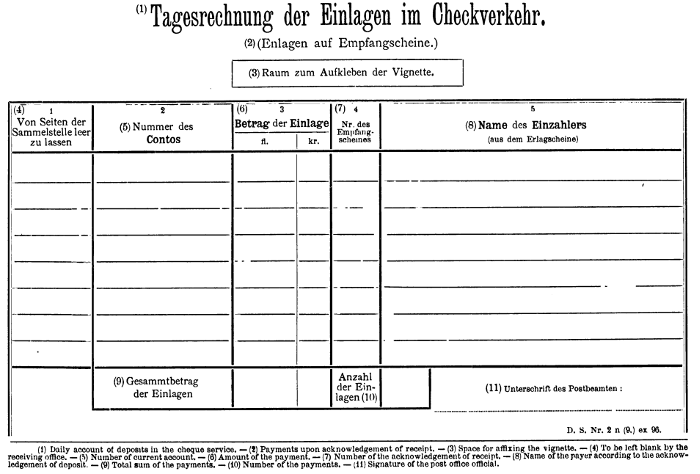

The document, which costs 5 kreutzers, is divided into three parts: the Empfang schein, the Erlag schein, the Treasury acknowledgement: Amtliche bestätigung (confirmation and official attestation). (Fig. II.)

The tax payer pays at the Post Office the amount of his tax which must be paid to the account of the central administration of taxes at Vienna; the document bears the account number of this Receipt Office of Taxation. The attestation of this payment of the tax-payer is signed by the postal employé and bears the stamp of his post office.

The remainder of the document is detached from the tax receipt and presents at first the erlag schein; it is the authentication of the deposit paid to the cashier of the administration of finances and which is sent by an employé of the Central Post Office at Vienna. It bears the name, the profession, the address of the tax-payer, the amount of the payment made by him, and shows what is the nature of the taxes received and the number of the account at the ministry of finances.

The other part of the document is the attestation by the ministry of finances itself of the payment made to its account; this amtliche bestätigung will be detached and sent to the tax-payer: he will thus possess in the end a double authentication. It may be easily imagined how a tax-payer who is an adherent of the clearing service can pay his tax by a simple transfer of accounts, the ministry of finances having itself an account open at the Savings Bank.

If the various modes which concur to the formation of the property of the account holders in the Central Office at Vienna are considered as a whole the total amount of deposits has successively been:

| In | 1883 | 322,284 | florins |

| » | 1884 | 46,223,529 | » |

| » | 1885 | 263,853,687 | » |

| » | 1886 | 478,190,612 | » |

| » | 1887 | 610,477,881 | » |

| » | 1888 | 643,735,637 | » |

| » | 1889 | 754,590,345 | » |

| » | 1890 | 880,361,067 | » |

| » | 1891 | 1,001,448,400 | » |

| » | 1892 | 1,121,000,736 | » |

| » | 1893 | 1,255,692,098 | » |

| » | 1894 | 1,366,649,116 | » |

| » | 1895 | 1,485,308,862 | » |

In fixing the proportional relations per cent of all the statistical data here brought together we see that the factors which concur to form the credit of the double service of cheques and of clearing, the payments made by way of empfang erlag schein represent in 1895, 65%, and the transfers by writing about 35%, while the total amount of the banking of post office orders, of interest in the public funds and of bills does not come to more than 3% of the whole.

Figure II.

The second class of operations of the cheque and clearing service of the Austrian Postal Savings Bank embraces the different modes of disposing of the property of the depositors who share in the service. The cheque is in a general way the instrument to which they recur under its two fundamental forms of cheques of payment and cheques of clearing, according as the amount is to be paid in cash or to be transferred to the account of another participant in the clearing service. The cheque books remitted to holders serve the double purpose; it has not been found necessary to print distinct documents, nor even to give to these two classes of cheques different colours.

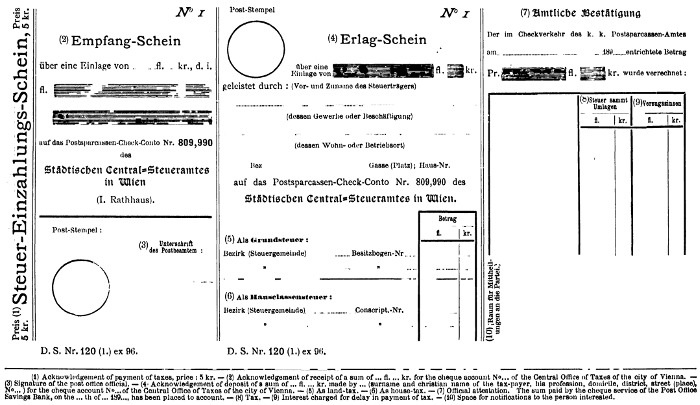

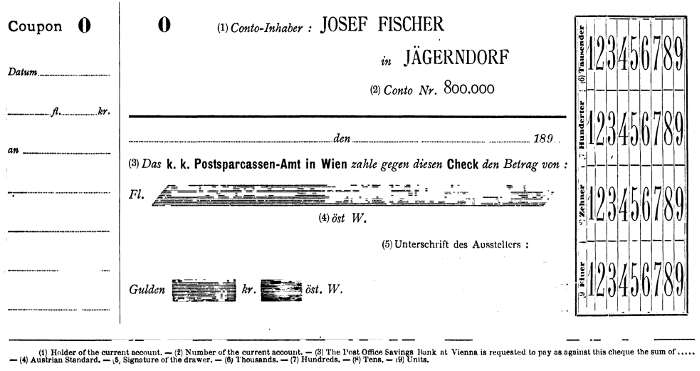

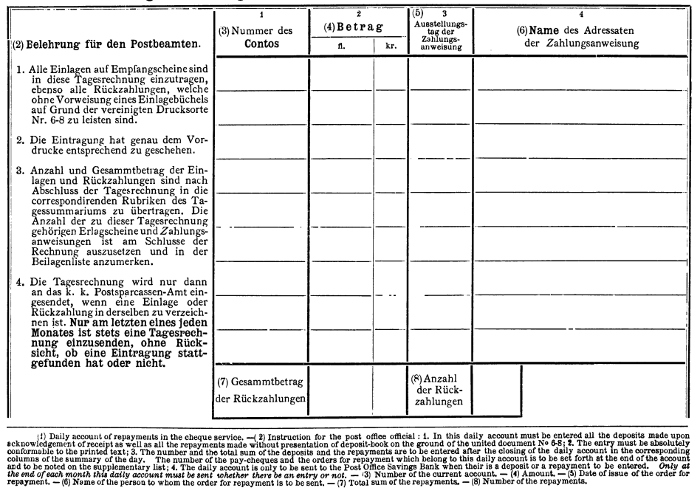

Cheque books containing fifty pieces are remitted to participants by the Central Office at the charge of 1 florin 50 kreutzers; this sum means 50 kreutzers, expense of paper and printing and 1 florin stamp duty. They are printed on the premises of the Central Office as are the attestations of receipts and deposits. About 2,500,000 of them are now annually reproduced and more than 23,000,000 of cheques have been issued since the official presses were first set up at Vienna. They are prepared either in German, or in any other language spoken in the Empire. Before sending them to the holders of an account the Office prints on each of these vouchers the number of the account for which they are to be used, as well as the name and address of the holder. (Fig. III.)

Expressed in ordinary terms, the cheque states, that the Savings Bank will pay, on the voucher being forwarded, the sum of which the amount in florins has been written out in full. It bears the signature of the person drawing it. To avoid frauds in the statement of the sums to be paid, the Savings Bank has adopted moreover an arrangement so ingenious and sure that up to the present time no fraud has been noted.

The cheque bears to the right four series of figures going from 1 to 9. The first set corresponds to thousands, the second to hundreds, the third to tens, the fourth to units; the four series united together can express the sum of 9,999 florins, beyond which no cheque can be drawn, so that if this part of the document is left intact, the amount of the cheque will be 9,999 florins, provided always that the written statement agrees with the series of figures. If a lower figure is stated, then the number of the thousands, hundreds, tens exceeding[Pg 40] the amount desired must be cut off with a pair of scissors. Suppose for example the cheque is to be for 782 florins; the column of the thousands is to be cut off, figures 8 and 9 in the columns of the hundreds, the last figure in that of the tens and the last seven in the column of units. It is evident that by this ingenious method of control, it will never be possible to raise the amount of the cheque; it will be of no use to alter the written statement of the amount in order to augment it, for it will never be possible to make a corresponding alteration in the arrangement of the figures to the right; by this process of cutting off, the cheque can only be reduced in value but never augmented. And if the agreement between the written figures and the combination of the figures resulting from this way of cutting them out is not perfectly exact, the Central Office at Vienna rejects the voucher as possibly fraudulent, at any rate erroneous.

The cheque (of payment) can be payable to bearer at the Postal Savings Bank at Vienna. In this case it is delivered to the person who ought to receive the amount without the drawer having to transmit it to him. This party can either bank it himself immediately at the Post Office Bank at Vienna, or put it in circulation: this circulation is authorised for fourteen days, but the voucher cannot carry any endorsement. The cheque will be paid by the Office up to the time that the credit account of the drawer is sufficient to meet it.

If the cheque has been delivered to a person affiliated to the postal-service of cheques and clearing, he can have the amount put to his credit instead of receiving it in cash.

The customer of the Postal Savings Bank has the right to cause the amount of the cheque to be paid into the hands of a particular person in any one of the Post Offices; in this case he writes on the back of the cheque the address of the person for whom he intends it.[Pg 41]

Figure III.

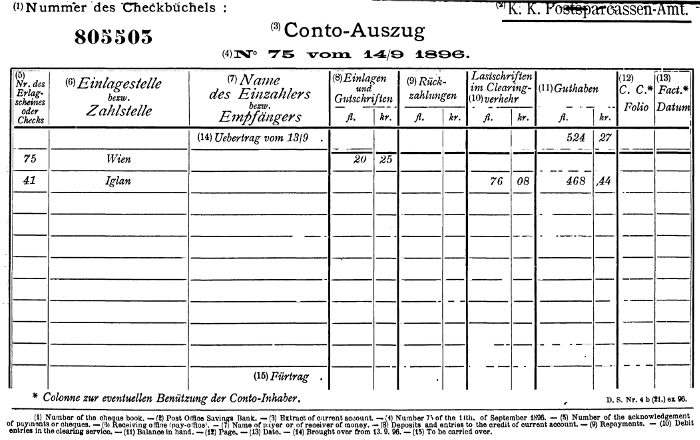

This cheque will be sent by him to the Central Office at Vienna. There are special envelopes for the transmission of these advices which are sold by the Office to the possessors of cheque books. The Central Office will immediately transmit to the person designated an assignment of payment and the cheque will be paid to him on his returning this assignment, signed by him as a receipt. He will detach from it, in order to preserve it, a portion on which is noted the amount of the sum he has received, who the holder of the account is, the said portion bearing also the stamp of the Postal Office at Vienna.

A notice to the post office where it is payable will have been sent at the same time, giving authority to pay the cheque. (Fig. IV.)

Everyday 4,000 to 5,000 of these authorisations to pay cheques are issued. Ladies write out these authorisations by means of type-writing machines: their fingers work the machine with astounding rapidity. According to the data given me each of them prints every day 400 to 500 assignments of payment to the persons designated and authorisations to the post-offices to pay; and the hours of work averaging seven, they write about one a minute.

The cheque can be drawn in favour of a person living in Hungary or a foreign country. It is enough that on the back is noted:—«for the issue of a post office order in favour of N ...», and that it is signed. The Central Office at Vienna will send immediately a post office order of corresponding import. The telegraphic order can even be used.

Statistics distinguish these three categories of cheques and enable us to follow their movement.

Payments effected