The Project Gutenberg EBook of Encyclopaedia Britannica, 11th Edition,

Volume 9, Slice 4, by Various

This eBook is for the use of anyone anywhere at no cost and with

almost no restrictions whatsoever. You may copy it, give it away or

re-use it under the terms of the Project Gutenberg License included

with this eBook or online at www.gutenberg.org

Title: Encyclopaedia Britannica, 11th Edition, Volume 9, Slice 4

"England" to "English Finance"

Author: Various

Release Date: June 21, 2010 [EBook #32940]

Language: English

Character set encoding: ISO-8859-1

*** START OF THIS PROJECT GUTENBERG EBOOK ENCYC. BRITANNICA, VOL 9 SL 4 ***

Produced by Marius Masi, Don Kretz and the Online

Distributed Proofreading Team at https://www.pgdp.net

| Transcriber's note: |

One typographical error has been corrected. It

appears in the text like this, and the

explanation will appear when the mouse pointer is moved over the marked

passage. Links to other EB articles: Links to articles residing in other EB volumes will be made available when the respective volumes are introduced online. |

Articles in This Slice

| ENGLAND | ENGLEWOOD |

| ENGLAND, THE CHURCH OF | ENGLISH CHANNEL |

| ENGLEFIELD, SIR FRANCIS | ENGLISH FINANCE |

| ENGLEHEART, GEORGE |

ENGLAND. Geographical usage confines to the southern part of the island of Great Britain the name commonly given to the great insular power of western Europe.1 In this restricted sense the present article deals with England, the predominant partner in the United Kingdom of Great Britain and Ireland, both as containing the seat of government and in respect of extent, population and wealth.

1. Topography.

England extends from the mouth of the Tweed in 55° 46′ N. to Lizard Point in 49° 57′ 30″ N., in a roughly triangular form. The base of the triangle runs from the South Foreland to Land’s End W. by S., a distance of 316 m. in a straight line, but 545 m. following the larger curves of the coast. The east coast runs N.N.W. from the South Foreland to Berwick, a distance of 348 m., or, following the coast, 640 m. The west coast runs N.N.E. from Land’s End to the head of Solway Firth, a distance of 354 m., or following the much-indented coast, 1225 m. The total length of the coast-line may be put down as 2350 m.,2 out of which 515 m. belong to the western principality of Wales.3 The most easterly point is at Lowestoft, 1° 46′ E., the most westerly is Land’s End, in 5° 43′ W. The coasts are nowhere washed directly by the ocean, except in the extreme south-west; the south coast faces the English Channel, which is bounded on the southern side by the coast of France, the two shores converging from 100 m. apart at the Lizard to 21 at Dover. The east coast faces the shallow North Sea, which widens from the point where it joins the Channel to 375 m. off the mouth of the Tweed, the opposite shores being occupied in succession by France, Belgium, Holland, Germany and Denmark. The west coast faces the Irish Sea, with a width varying from 45 to 130 m.

| Counties. | Area Statute Acres. | Population. 1901. |

| Bedfordshire | 298,494 | 171,240 |

| Berkshire | 462,208 | 256,509 |

| Buckinghamshire | 475,682 | 195,764 |

| Cambridgeshire | 549,723 | 190,682 |

| Cheshire | 657,783 | 815,099 |

| Cornwall | 868,220 | 322,334 |

| Cumberland | 973,086 | 266,933 |

| Derbyshire | 658,885 | 620,322 |

| Devonshire | 1,667,154 | 661,314 |

| Dorsetshire | 632,270 | 202,936 |

| Durham | 649,352 | 1,187,361 |

| Essex | 986,975 | 1,085,771 |

| Gloucestershire | 795,709 | 634,729 |

| Hampshire | 1,039,031 | 797,634 |

| Herefordshire | 537,363 | 114,380 |

| Hertfordshire | 406,157 | 250,152 |

| Huntingdonshire | 234,218 | 57,771 |

| Kent | 995,014 | 1,348,841 |

| Lancashire | 1,203,365 | 4,406,409 |

| Leicestershire | 527,123 | 434,019 |

| Lincolnshire | 1,693,550 | 498,847 |

| Middlesex | 181,320 | 3,585,323 |

| Monmouthshire | 341,688 | 292,317 |

| Norfolk | 1,308,439 | 460,120 |

| Northamptonshire | 641,992 | 338,088 |

| Northumberland | 1,291,530 | 603,498 |

| Nottinghamshire | 539,756 | 514,578 |

| Oxfordshire | 483,626 | 181,120 |

| Rutland | 97,273 | 19,709 |

| Shropshire | 859,516 | 239,324 |

| Somersetshire | 1,043,409 | 508,256 |

| Staffordshire | 749,602 | 1,234,506 |

| Suffolk | 952,710 | 384,293 |

| Surrey | 485,122 | 2,012,744 |

| Sussex | 933,887 | 605,202 |

| Warwickshire | 577,462 | 897,835 |

| Westmorland | 503,160 | 64,303 |

| Wiltshire | 879,943 | 273,869 |

| Worcestershire | 480,560 | 488,338 |

| Yorkshire | 3,882,328 | 3,584,762 |

| Total | 32,544,685 | 30,807,232 |

The area of England and Wales is 37,327,479 acres or 58,324 sq. m. (England, 50,851 sq. m.), and the population on this area in 1901 was 32,527,843 (England, 30,807,232). The principal territorial divisions of England, as of Wales, Scotland and Ireland, are the counties, of which England comprises 40. Their boundaries are not as a rule determined by the physical features of the land; but localities are habitually defined by the use of their names. A list of the English counties (excluding Wales) is given in the table above.4

Hills.—As an introduction to the discussion of the natural regions into which England is divided (Section II.), and for the sake of comparison of altitudes, size of rivers and similar details, the salient geographical features may be briefly summarized. The short land-frontier of England with Scotland (its length is only 100 m.) is in great measure a physical boundary, as considerable lengths of it are formed on the east side by the river Tweed, and on the west by Kershope Burn, Liddel Water, and the river Sark; while for the rest it follows pretty closely the summit of the Cheviot Hills, whose highest point is the Cheviot (2676 ft.). A narrow but well-marked pass or depression, known as the Tyne Gap, is taken to separate the Cheviot system from the Pennine Chain, which is properly to be described as a wide tract of hill-country, extending through two degrees of latitude, on an axis from N. by W. to S. by E. The highest point is Cross Fell (2930 ft.). On the north-west side of the Pennine system, marked off from it by the upper valleys of the rivers Eden and Lune, lies the circular hill-tract whose narrow valleys, radiating from its centre somewhat like wheel-spokes, contain the beautiful lakes which give it the celebrated name of the Lake District. In this tract is found the highest land in England, Scafell Pike reaching 3210 ft. East of the Pennines, isolated on three sides by lowlands and on the fourth side by the North Sea, lie the highmoors of the North Riding of Yorkshire, with the Cleveland Hills, and, to the south, the Yorkshire Wolds of the East Riding. Neither of these systems has any great elevation; the moors, towards their north-western edge, reaching an extreme of 1489 ft. in Urra Moor. The tableland called the Peak of Derbyshire, in the south of the Pennine system, is 2088 ft. in extreme height, but south of this system an elevation of 2000 ft. is not found anywhere in England save at a few points on the south Welsh border and in Dartmoor, in the south-west. Wales, on the other hand, projecting into the western sea between Liverpool Bay and the estuary of the Dee on the north, and the Bristol Channel on the south, is practically all mountainous, and has in Snowdon, in the north-west, a higher summit than any in England—3560 ft. But the midlands, the west, and the south of England, in spite of an absence of great elevation, contain no plains of such extent as might make for monotony. The land, generally undulating, is further diversified with hills arranged in groups or ranges, a common characteristic of which is a bold face on the one hand and a long gentle slope, with narrow valleys deeply penetrating, on the other. Southward from the Pennines there may be mentioned, in the midlands, the small elevated tract of Charnwood Forest (Bardon Hill, 912 ft.) in Leicestershire, and Cannock Chase (775 ft.) and the Clent Hills (928 ft.), respectively north and south of the great manufacturing district of Birmingham and Wolverhampton. Of the western counties, the southern half of Shropshire, Herefordshire and Monmouthshire are generally hilly. Among the Shropshire Hills may be mentioned the isolated Wrekin (1335 ft.), Long Mynd (1674 ft.) and the Clee Hills (Brown Clee, 1805 ft.). The 409 long ridge of the Black Mountain reaches an extreme height of 2310 ft. on the Welsh border of Herefordshire. The Malvern Hills on the other side of the county, which, owing to their almost isolated position among lowlands, appear a far more prominent feature, reach only 1395 ft. In western Monmouthshire, again belonging to the south Welsh system, there are such heights as Sugar Loaf (1955 ft.) and Coity (1905 ft.).

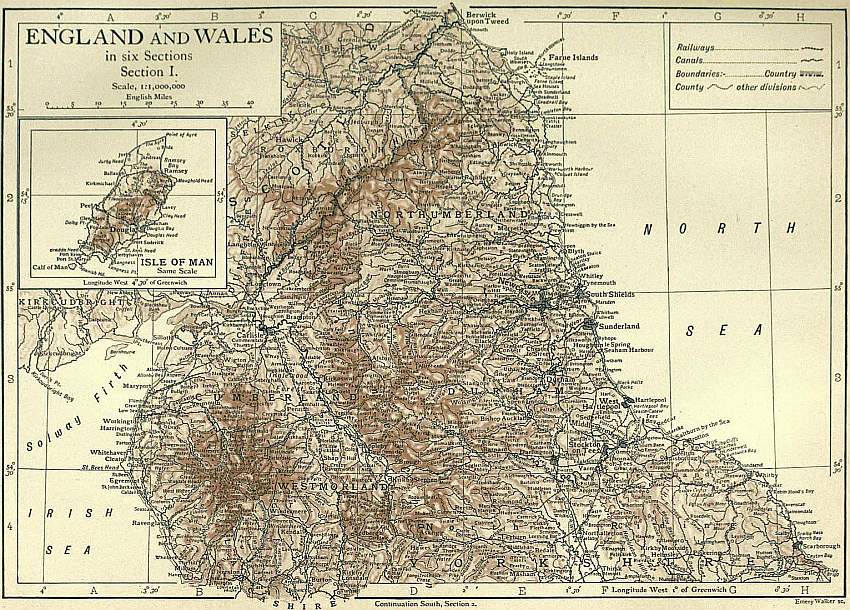

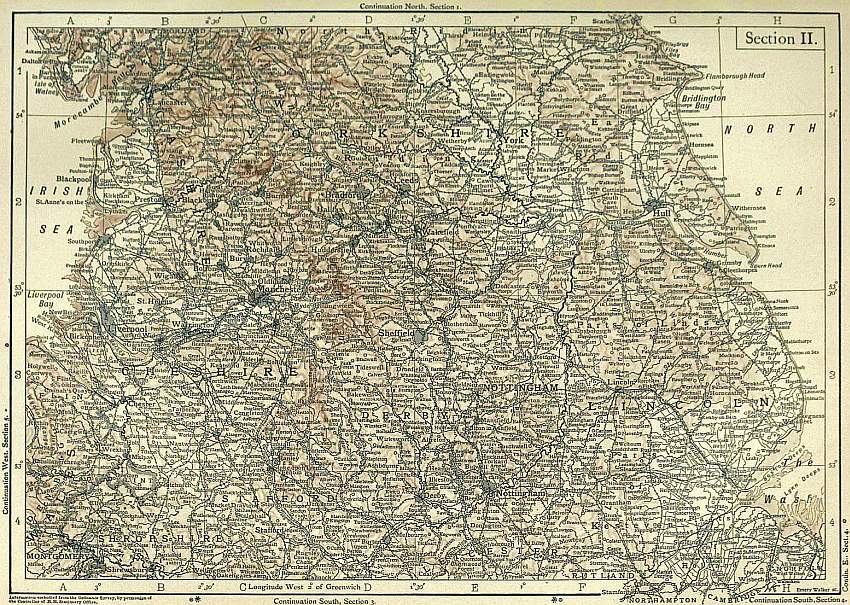

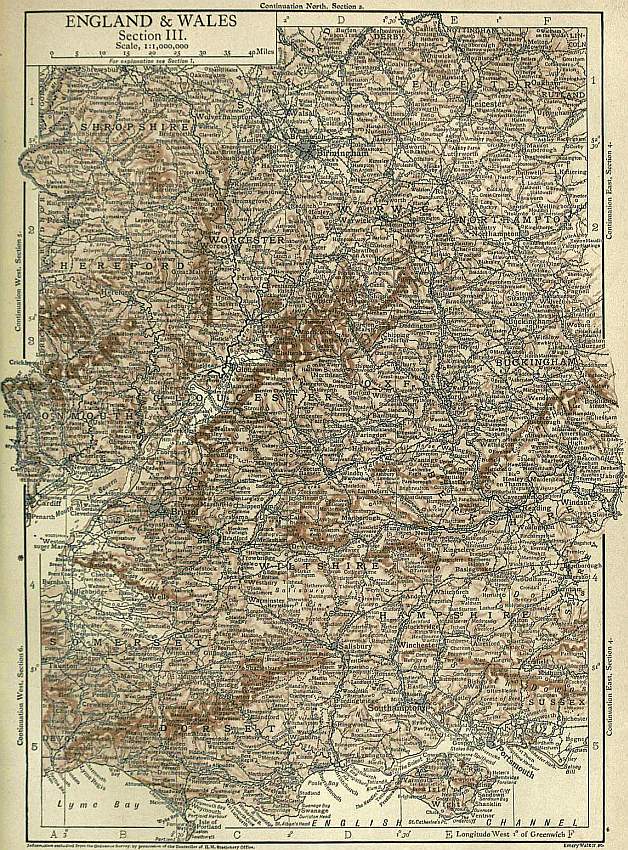

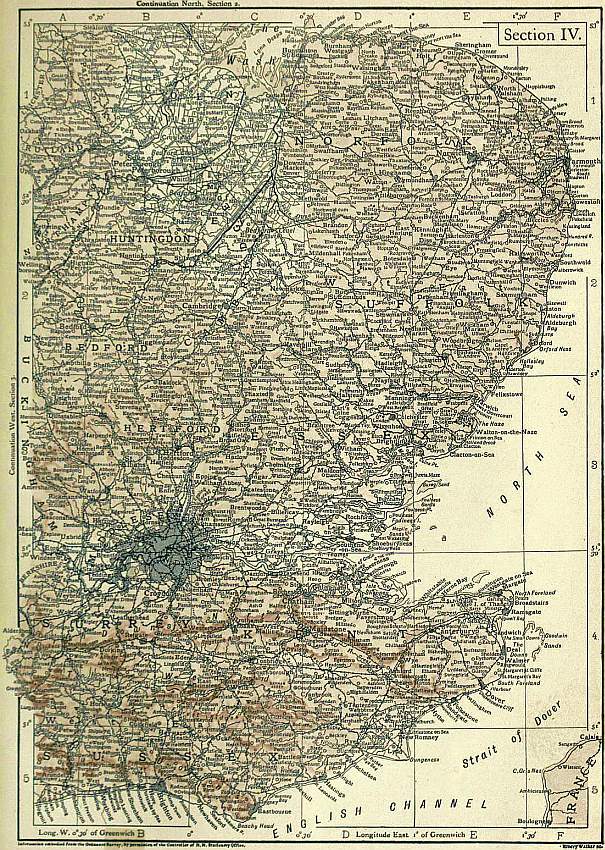

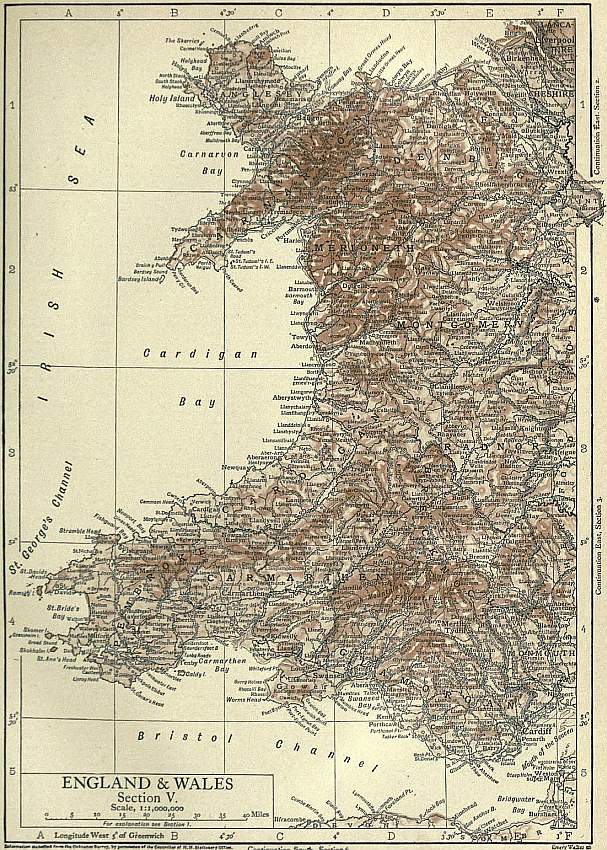

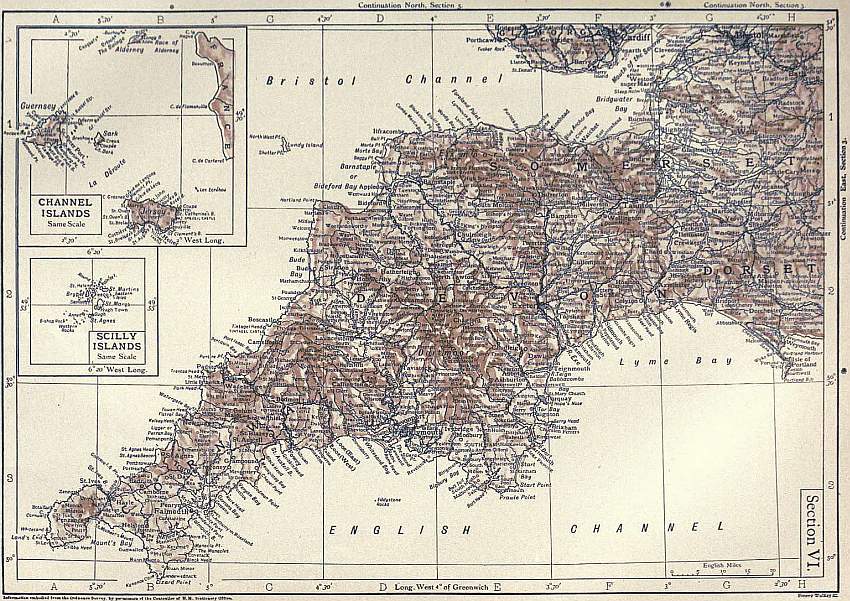

(Click to enlarge top section.)

(Click to enlarge bottom section.)

In the south midlands of England there are two main ranges of hills, with axes roughly parallel. The western range is the Cotteswold Hills of Gloucestershire and the counties adjacent on the east running S.W. and N.E. Its highest point is Cleeve Cloud (1134 ft.). The uplands of Northamptonshire continue this range north-eastward, decreasing in elevation. The eastern range, beginning in Wiltshire, runs E.N.E. as the White Horse Hills (856 ft. at the highest point), and after the interruption caused by the gap or narrow valley by which the river Thames penetrates the hills near Goring, continues N.E. as the Chiltern Hills (850 ft.). The East Anglian ridge continues the line E.N.E., gradually decreasing in altitude. In the south-east of England, the North and South Downs are both well-defined ranges, but are characterized by a number of breaches through which rivers penetrate, on the one hand to the Thames or the North Sea and on the other to the English Channel. Leith Hill in the North Downs reaches 965 ft., and Butser Hill in the South Downs 889 ft.; Blackdown and Hindhead, two almost isolated masses of high ground lying between the two ranges of the Downs towards their western extremity, are respectively 918 and 895 ft. in height. In the north of Hampshire along its boundary with Surrey and Berkshire, in the southern half of Wiltshire (where rises the upland of Salisbury Plain), in Dorsetshire, and the south of Somersetshire, the hills may be said to run in a series of connected groups. They cannot be defined as a single range, nor are they named, as a rule, according to the groups into which they fall, but the general title of the Western Downs is applied to them. One point only in all these groups exceeds 1000 ft. in altitude, namely, Inkpen Beacon (1011 ft.) in the extreme south-west of Berkshire, but heights above 900 ft. are not infrequent. In the northern part of Somersetshire, two ranges, short but well defined, lie respectively east and west of a low plain which slopes to the Bristol Channel. These are the Mendips (Black Down, 1068 ft.) and the Quantocks (Will’s Neck, 1261 ft.). The Blackdown Hills, in south-western Somersetshire and eastern Devonshire, reach 1035 ft. in Staple Hill in the first-named county. In western Somersetshire and north Devonshire the elevated mass of Exmoor reaches 1707 ft. in Dunkery Beacon; and in south Devonshire the highest land in southern England is found in the similar mass of Dartmoor (High Willhays, 2039 ft.). The westward prolongation of the great south-western promontory of England, occupied by the county of Cornwall, continues as a rugged ridge broken by a succession of depressions, and exceeds a height of 800 ft., nearly as far as the point where it falls to the ocean in the cliffs of Land’s End.

Lowlands.—The localities of the more extensive lowlands of England may now be indicated in their relation to the principal hill-systems, and in this connexion the names of some of the more important rivers will occur. In the extreme north-west is the so-called Solway Plain, of no great extent, but clearly defined between the northern foothills of the Lake District and the shore of Solway Firth. In Lancashire a flat coastal strip occurs between the western front of the Pennine Chain and the Irish Sea, and, widening southward, extends into Cheshire and comprises the lower valleys of the Mersey and the Dee. In the preceding review of the English hill-systems it may have been observed that eastern England hardly enters into consideration. The reason now becomes clear. From Yorkshire to the flat indented sea-coast north of the Thames estuary, east of the Pennines and the slight hills indicated as the Northampton uplands, and in part demarcated southward by the East Anglian ridge in Huntingdonshire, Cambridgeshire and Suffolk, the land, although divided between a succession of river-systems, varies so little in level as to be capable of consideration as a single plain. Its character, however, varies in different parts. The Fens, the flat open levels in the lower basins of the Witham, Welland, Nene and Great Ouse, only kept from their former marshy conditions by an extensive system of artificial drainage, and the similar levels round the head of the Humber estuary, differ completely in appearance from the higher and firmer parts of the plain. The coast-land north of the mouth of the Thames is a low plain; and on the south coast somewhat similar tracts are found in Romney Marsh, and about the shallow inlets (Portsmouth Harbour and others) which open from Spithead. The vales of Kent and Sussex are rich undulating lowlands within the area of the Weald, separated by the Forest Ridges, and enclosed by the North and South Downs. In the south-west there is a fairly extensive lowland in south Devonshire watered by the Exe in its lower course. But the most remarkable plain is that in Somersetshire, enclosed by the Mendips, the Western Downs, Blackdown Hills and the Quantocks and entered by the Parrett and other streams. The midlands, owing to the comparatively slight elevation of the land, are capable of geographical consideration as a plain. But it is not a plain in the sense of that of East Anglia. There is no quite level tract of great extent, excepting perhaps the fertile and beautiful district watered by the lower Severn and its tributary the Upper or Warwickshire Avon, overlooked by the Cotteswolds on the one hand and the Malvern and other hills on the other.

Coast.—The coast-line of England is deeply indented by a succession of large inlets, particularly on the east and west. Thus, from north to south there are, on the east coast, the mouths of the Tyne and the Tees, the Humber estuary, the Wash (which receives the waters of the Witham, Welland, Nene and Great Ouse), the Orwell-Stour, Blackwater and Thames-Medway estuaries. On the west there are Solway Firth, Morecambe Bay, the estuaries of the Mersey and Dee, Cardigan Bay of the Welsh coast, and the Bristol Channel and Severn estuary. In this way the land is so deeply penetrated by the water that no part is more than 75 m. from the sea. Thus Buckingham appears to be the most inland town in England, being 75 m. from the estuaries of the Severn, Thames and Wash; Coleshill, near Birmingham, is also almost exactly 75 m. from the Mersey, Severn and Wash.

The east and south coasts show considerable stretches of uniform uninflected coast-line, and except for the Farne Islands and Holy Island in the extreme north, the flat islands formed by ramifications of the estuaries on the Essex and north Kent coasts, and the Isle of Wight in the south, they are without islands. The west coast, on the other hand, including both shores of the great south-western promontory, is minutely fretted into capes and bays, headlands and inlets of every size, and an island-group lies off each of the more prominent headlands from Land’s End northward. The formation of the coast varies from low, shifting banks of shingle or sand to majestic cliffs, and its character in different localities has been foreshadowed in the previous consideration of the hill-systems and lowlands. Thus in the north-east the coast is generally of no great elevation, but the foothills of the Cheviot and Pennine systems approach it closely. On the Yorkshire coast the Cleveland Hills and the high moors are cut off on the seaward side in magnificent cliffs, which reach the greatest elevation of sea-cliffs on the English coast (666 ft.). The Yorkshire Wolds similarly terminate seaward in the noble promontory of Flamborough Head. From this point as far south as the North Foreland of Kent the coast, like the land, is almost wholly low, though there are slight cliffs at some points, as along the coasts of Norfolk and Suffolk, on which the sea constantly encroaches. On the south coast a succession of cliffs and low shores may be correlated with the main physical features of the land. Thus in succession there are the famous white cliffs about Dover, terminating the North Downs, the low coast of Romney Marsh, projecting seaward in Dungeness, the cliffs above Hastings, terminating an offshoot of the Forest Ridges, the low shore between Hastings and Eastbourne, to which succeeds the lofty Beachy Head, terminating the South Downs. A flat coast follows as far as Selsey Bill and Spithead, but the south coast 410 of the Isle of Wight shows a succession of splendid cliffs. The shallow inlet of Poole Bay is followed by the eminence of St Alban’s Head, and thereafter, right round the south-western promontory of England, the cliff-bound coast, with its bays and inlets closely beset with hills, predominates over the low shore-line, exhibits a remarkable series of different forms, and provides the finest scenery of its kind in England. The shores of the Severn estuary are low, but the Welsh coast, sharing the general character of the land, is more or less elevated throughout, though none of the higher mountain-masses directly approaches the sea. Low shores correspond to the plains of Cheshire, Lancashire and the Solway, while the intervening coast is of no great elevation, as only the foothills of the Lake District approach it with a gradual slope.

| Rivers. | Length Miles. | Drainage Area sq. m. |

| 1. North-east— | ||

| Tweed5 | 97 | 1870 |

| Tyne | 80 | 1130 |

| Wear | 60 | 458 |

| Tees | 85 | 708 |

| 2. East— | ||

| Humber system6 | · · | 9293 |

| Witham | 80 | 1079 |

| Welland | 70 | 760 |

| Nene | 90 | 1077 |

| Ouse (Great) | 160 | 2607 |

| Yare | 60 | 880 |

| Stour (Suffolk-Essex) | 60 | 407 |

| Thames7 | 209 | 5924 |

| 3. South— | ||

| Stour (Kent) | 40 | 370 |

| Rother | 32 | 312 |

| Arun | 43 | 370 |

| Avon (Hampshire) | 60 | 1132 |

| Exe | 55 | 584 |

| Tamar | 58 | 384 |

| 4. Bristol Channel (south-west)— | ||

| Torridge | 45 | 336 |

| Taw | 48 | 455 |

| Parrett | 37 | 562 |

| Severn8 9 | 210 | 6850 |

| Usk9 | 70 | 540 |

| 5. North-west— | ||

| (a) Cheshire-Lancashire— | ||

| Dee9 | 70 | 813 |

| Mersey10 | 70 | 1596 |

| Ribble | 65 | 585 |

| (b) Solway— | ||

| Eden | 70 | 1300 |

A great extent of the English coast is constantly undergoing visible alteration, the sea in some instances receding from the land, and in others gaining upon it. The whole of Romney Marsh, in Kent and Sussex, formerly constituted an arm of the sea, where vessels rode in deep water, carrying produce to ports no longer in existence. Lydd and Romney, though maritime still in name, retaining some of the ancient privileges of the Cinque Ports, have become, through changes in the coast-line, small inland towns; and the same has been the fate of Rye, Winchelsea, and other places in that district. Again, the Isle of Thanet, in the north-eastern corner of Kent, has practically ceased to be an island. The wide estuary of the sea separating it from the mainland, through which ships sailed from the English Channel into the Thames, using it as the shortest route from the south to London, has entirely disappeared, leaving only a flat lowland traversed by branches of the river Stour to mark its former existence. The sea is encroaching over a considerable extent of coast-line on the North Sea as well as on the English Channel. Ravenspur, once an important town of Yorkshire, where Bolingbroke, afterwards Henry IV., landed in 1399, is now submerged; and Dunwich and other ancient ports in East Anglia have met with the same fate. The process of destruction, slow in some places, is so rapid in others that it can be traced even from month to month—the incessant work of the waves washing away the soft strata at the base of the cliffs and leaving the summits unsupported. Many cliffs of the east coast, from the Humber to the mouth of the Thames, are suffering from this destructive action, and instances also occur on the south coast. A royal commission on Coast Erosion was appointed to inquire into this question in 1906 (see Report, 1907 sqq.).

Except along the centre of the Irish Sea, at one point off the Tweed and one between Devon and Normandy, the depth of water between England and the nearest land nowhere exceeds 50 fathoms.

Rivers.—The variations in length of the general slope of the land towards successive natural divisions of the coast may be illustrated by a comparative table of the mileage and drainage areas of the principal English rivers. The mileage does not take account of the lesser sinuosities of rivers.

With the exception of those in the Lake District (q.v.) the lakes of England are few and insignificant. A number of small meres occur in a defined area in Cheshire.

II. Physical Geography

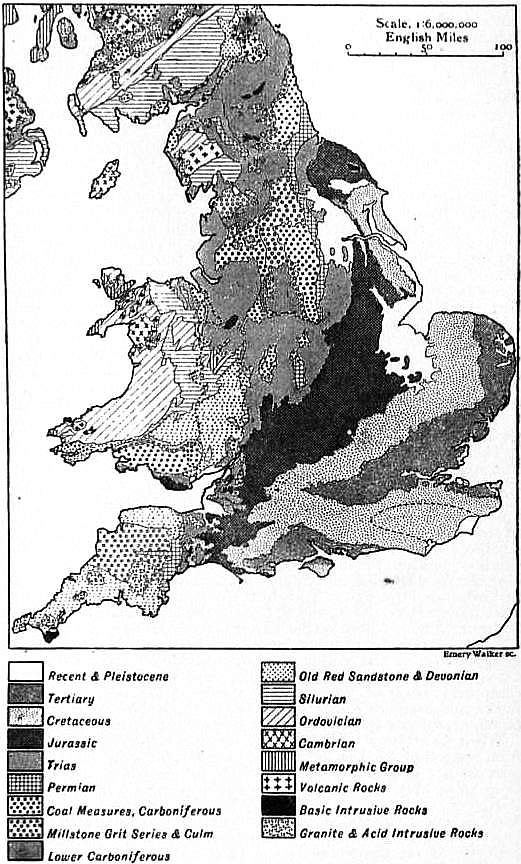

The object of this section is to give a physical description of England and Wales according to natural regions, which usually follow the geology of the country very closely; although the relationship of configuration and geology is not so simple or so clearly marked as in Scotland.

The land is highest in the west and north, where the rocks also are oldest, most disturbed, and hardest, and the land surface gradually sinks towards the east and south, where the rocks become successively less disturbed, more recent, and softer. The study of the scenery of England and Wales as a whole, or the study of orographical and geological maps of the country, allows a broad distinction to be drawn between the types of land-forms in the west and in the east. This distinction is essential, and applies to all the conditions of which geography takes account. The contrasted districts are separated by an intermediate area, which softens the transition between them, and may be described separately.

The Western Division is composed entirely of Archaean and Palaeozoic rocks, embracing the whole range from pre-Cambrian up to Carboniferous. The outcrops of these rocks succeed each other in order of age in roughly concentric belts, with the Archaean mass of the island of Anglesey as a centre, but the arrangement in detail is much disturbed and often very irregular. Contemporary igneous outbursts are extremely common in some of the ancient formations, and add, by their resistance to atmospheric erosion, to the extreme ruggedness of the scenery. The hills and uplands of ancient rocks do not form regular ranges, but rise like islands in four distinct groups from a plain of New Red Sandstone (Permian and Triassic), which separates them from each other and from the newer rocks of the Eastern Division. Each of the uplands is a centre for the dispersal of streams; but with only one prominent exception (the Humber) these reach the sea without crossing into the Eastern Division of the country.

The Eastern Division, lying to the east of the zone of New Red Sandstone, may be defined on the west by a slightly curved line drawn from the estuary of the Tees through Leicester and Stratford-on-Avon to the estuary of the Severn, and thence through Glastonbury to Sidmouth. It is built up of nearly uniform sheets of Mesozoic rock, the various beds of the Jurassic lying above the New Red Sandstone (Triassic), and dipping south-eastward under the successive beds of the Cretaceous system. In exactly the same way the whole of the south-east of the island appears to have been covered uniformly with gently 411 dipping beds of Tertiary sands and clays, beneath which the Cretaceous strata dipped. At some period subsequent to this deposition there was a movement of elevation, which appears to have thrown the whole mass of rocks into a fold along an anticlinal axis running west and east, which was flanked to north and south by synclinal hollows. In these hollows the Tertiary rocks were protected from erosion, and remain to form the London and the Hampshire Basins respectively, while on the anticlinal axis the whole of the Tertiary and the upper Cretaceous strata have been dissected away, and a complex and beautiful configuration has been impressed on the district of the Weald. The general character of the landscape in the Eastern Division is a succession of steep escarpments formed by the edges of the outcropping beds of harder rock, and long gentle slopes or plains on the dip-slopes, or on the softer layers; clay and hard rock alternating throughout the series.

The contrast between the lower grounds of the Western and the Eastern Divisions is masked in many places by the general covering of the surface with glacial drift, which is usually a stiff clay composed on the whole of the detritus of the rocks upon which it rests, though containing fragments of rocks which have been transported from a considerable distance. This boulder clay covers almost all the low ground north of the Thames Basin, its southern margin fading away into washed sands and gravels.

The history of the origin of the land-forms of England, as far as they have been deduced from geological studies, is exceedingly complicated. The fact that every known geological formation (except the Miocene) is represented, proves of itself how long the history has been, and how multifarious the changes. It must suffice to say that the separation of Ireland from England was a comparatively recent episode, while the severance of the land-connexion between England and the continent by the formation of the Strait of Dover is still more recent and probably occurred with the human period.

Natural Divisions.—The four prominent groups of high land rising from the plain of the Red Rocks are: (1) the Lake District, bounded by the Solway Firth, Morecambe Bay and the valleys of the Eden and the Lune; (2) the Pennine Region, The western division. which stretches from the Scottish border to the centre of England, running south; (3) Wales, occupying the peninsula between the Mersey and the Bristol Channel, and extending beyond the political boundaries of the principality to include Shropshire and Hereford; and (4) the peninsula of Cornwall and Devon. They are all similar in the great features of their land-forms, which have been impressed upon them by the prolonged action of atmospheric denudation rather than by the original order and arrangement of the rocks; but each group has its own geological character, which has imparted something of a distinctive individuality to the scenery. Taken as a whole, the Western Division depends for its prosperity on mineral products and manufactures rather than on farming; and the staple of the farmers is live-stock rather than agriculture. The people of the more rugged and remoter groups of this division are by race survivors of the early Celtic stock, which, being driven by successive invaders from the open and fertile country of the Eastern Division, found refuges in the less inviting but more easily defended lands of the west. Even where, as in the Pennine region and the Lake District, the people have been completely assimilated with the Teutonic stock, they retain a typical character, marked by independence of opinion approaching stubbornness, and by great determination and enterprise.

Lake District.—The Lake District occupies the counties of Cumberland, Westmorland and North Lancashire. It forms a roughly circular highland area, the drainage lines of which radiate outward from the centre in a series of narrow valleys, the upper parts of which cut deeply into the mountains, and the lower widen into the surrounding plain. Sheets of standing water are still numerous, and formerly almost every valley contained a single long narrow lake-basin; but some of these have been subdivided, drained or filled up by natural processes. The existing lakes include Windermere and Coniston, draining south; Wastwater, draining south-west, Ennerdale water, Buttermere and Crummock water (the two latter, originally one lake, are now divided by a lateral delta), draining north-west; Derwent water and Bassenthwaite water (which were probably originally one lake), and Thirlmere, draining north; Ullswater and Haweswater, draining north-east. There are, besides, numerous mountain tarns of small size, most of them in hollows barred by the glacial drift which covers a great part of the district. The central and most picturesque part of the district is formed of great masses of volcanic ashes and tuffs, with intrusions of basalts and granite, all of Ordovician (Lower Silurian) age. Scafell and Scafell Pike (3162 and 3210 ft.), at the head of Wastwater, and Helvellyn (3118), at the head of Ullswater, are the loftiest amongst many summits the grandeur of whose outlines is not to be estimated by their moderate height. Sedimentary rocks of the same age form a belt to the north, and include Skiddaw (3054 ft.); while to the south a belt of Silurian rocks, thickly covered with boulder clay, forms the finely wooded valleys of Coniston and Windermere. Round these central masses of early Palaeozoic rocks there is a broken ring of Carboniferous Limestone, and several patches of Coal Measures, while the New Red Sandstone appears as a boundary belt outside the greater part of the district. Where the Coal Measures reach the sea at Whitehaven, there are coal-mines, and the hematite of the Carboniferous Limestones has given rise to the active ironworks of Barrow-in-Furness, now the largest town in the district. Except in the towns of the outer border, the Lake District is very thinly peopled; and from the economic point of view, the remarkable beauty of its scenery, attracting numerous residents and tourists, is the most valuable of its resources. The very heavy rainfall of the district, which is the wettest in England, has led to the utilization of Thirlmere as a reservoir for the water supply of Manchester, over 80 m. distant.

Pennine Region.—The Pennine Region, the centre of which forms the so-called Pennine Chain, occupies the country from the Eden valley to the North Sea in the north, and from the lower Tees, Yorkshire Ouse and Trent, nearly to the Irish Sea, in the south. It includes the whole of Northumberland and Durham, the West Riding of Yorkshire, most of Lancashire and Derbyshire, the north of Staffordshire and the west of Nottinghamshire. The region is entirely composed of Carboniferous rocks, the system which transcends all others in the value of its economic minerals. The coal and iron have made parts of the region the busiest manufacturing districts, and the centres of densest population, in the country, or even in the world. The whole region may be looked upon as formed by an arch or anticline of Carboniferous strata, the axis of which runs north and south; the centre has been worn away by erosion, so that the Coal Measures have been removed, and the underlying Millstone Grit and Carboniferous Limestone exposed to the influences which form scenery. On both sides of the arch, east and west, the Coal Measures remain intact, forming outcrops which disappear towards the sea under the more recent strata of Permian or Triassic age. The northern part of the western side of the anticline is broken off by a great fault in the valley of the Eden, and the scarp thus formed is rendered more abrupt by the presence of a sheet of intrusive basalt. Seen from the valley, this straight line of lofty heights, culminating in Crossfell, presents the nearest approach in England to the appearance of a mountain range. In the north the Pennine region is joined to the Southern Uplands of Scotland by the Cheviot Hills, a mass of granite and Old Red Sandstone; and the northern part is largely traversed by dykes of contemporary volcanic or intrusive rock. The most striking of these dykes is the Great Whin Sill, which crosses the country from a short distance south of Durham almost to the source of the Tees, near Crossfell. The elevated land is divided into three masses by depressions, which furnish ready means of communication between east and west. The South Tyne and Irthing valleys cut off the Cheviots on the north from the Crossfell section, which is also marked off on the south by the valleys of the Aire and Ribble from the Kinder Scout or Peak section. The numerous streams of the region carry off the rainfall down long valleys or dales to the east and the south, and by shorter and steeper valleys to the west. The dales are separated from each other by high uplands, which for the most part are heathery moorland or, at best, hill pastures. The agriculture of the region is confined to the bottoms of the dales, and is of small importance. Crossfell and the neighbouring hills are formed from masses of Carboniferous Limestone, which received its popular name of Mountain Limestone from this fact. Farther south, such summits as High Seat, Whernside, Bow Fell, Penyghent and many others, all over 2000 ft. in height, are capped by portions of the grits and sandstones, which rest upon the limestone. The belt of Millstone Grit south of the Aire, lying between the great coal-fields of the West Riding and Lancashire, has a lower elevation, and forms grassy uplands and dales; but farther south, the finest scenery of the whole region occurs in the limestones of Derbyshire, in which the range terminates. The rugged beauty of the south-running valleys, and especially of Dovedale, is enhanced by the rich woods which still clothe the slopes. There are remarkable features underground as well as on the surface, the caverns and subterranean streams of Yorkshire and Derbyshire being amongst the deepest that have yet been explored. Compared with the rugged and picturesque scenery of the Lower Carboniferous rocks, that of the Coal Measures is, as a rule, featureless and monotonous. The coal-fields on the eastern side, from the Tyne nearly to the Trent, are sharply marked off on the east by the outcrop of Permian dolomite or Magnesian limestone, which forms a low terrace dipping towards the east under more recent rocks, and in many places giving rise to an escarpment facing westward towards the gentle slope of the Pennine dales. To the west and south the Coal Measures dip gently under the New Red Sandstone, to reappear at several points through the Triassic plain. The clear water of the upland becks and the plentiful supply of water-power led to the founding of small paper-mills in remote valleys before the days of steam, and some of these primitive establishments still 412 exist. The prosperity and great population of the Pennine region date from the discovery that pit-coal could smelt iron as well as charcoal; and this source of power once discovered, the people bred in the dales developed a remarkable genius for mechanical invention and commercial enterprise, which revolutionized the economic life of the world and changed England from an agricultural to an industrial country. The staple industry of the district in ancient times was sheep-rearing, and the villages in nearly all the dales carried on a small manufacture of woollen cloth. The introduction of cotton caused the woollen manufactures on the western side to be superseded by the working up of the imported raw material; but woollen manufactures, themselves carried on now almost entirely with imported raw material, have continued to employ the energies of the inhabitants of the east. Some quiet market-towns, such as Skipton and Keighley, remain, but most of them have developed by manufactures into great centres of population, lying, as a rule, at the junction of thickly peopled valleys, and separated from one another by the empty uplands. Such are Leeds, Bradford, Sheffield, Huddersfield and Halifax on the great and densely peopled West Riding coal-field, which lies on the eastern slope of the Pennines. The iron ores of the Coal Measures have given rise to great manufactures of steel, from cutlery to machinery and armour-plates. High on the barren crest of the Pennines, where the rocks yield no mineral wealth, except it be medicinal waters, Harrogate, Buxton and Matlock are types of health resorts, prosperous from their pure air and fine scenery. Across the moors, on the western side of the anticline, the vast and dense population of the Lancashire coal-field is crowded in the manufacturing towns surrounding the great commercial centre, Manchester, which itself stands on the edge of the Triassic plain. Ashton, Oldham, Rochdale, Bury, Bolton and Wigan form a nearly confluent semicircle of great towns, their prosperity founded on the underlying coal and iron, maintained by imported cotton. The Lancashire coal-field, and the portion of the bounding plain between it and the seaport of Liverpool, contain a population greater than that borne by any equal area in the country, the county of London and its surroundings not excepted. In the south-west of the Pennine region the coal-field of North Staffordshire supports the group of small but active towns known collectively from the staple of their trade as “The Potteries.” On the north-east the great coal-field of Northumberland and Durham, traversed midway by the Tyne, supports the manufactures of Newcastle and its satellite towns, and leaves a great surplus for export from the Tyne ports.

Wales.—The low island of Anglesey, which is built up of the fundamental Archaean rocks, is important as a link in the main line of communication with Ireland, because it is separated from the mainland by a channel narrow enough to be bridged, and lies not far out of the straight line joining London and Dublin. The mainland of Wales rises into three main highlands, the mountain groups of North, Mid and South Wales, connected together by land over 1000 ft. in elevation in most places, but separated by valleys affording easy highways. The streams of the southern and western slopes are short and many, flowing directly to the Bristol Channel and the Irish Sea; but the no less numerous streams of the eastern slopes gather themselves into three river systems, and reach the sea as the Dee, the Severn and the Wye. The mountain group of North Wales is the largest and loftiest; its scenery resembles that of the Scottish Highlands because of the juxtaposition of ancient Palaeozoic rocks—Cambrian and Ordovician, often altered into slate—and contemporaneous volcanic outbursts and igneous intrusions. Here rises the peak of Snowdon (3560 ft.), the culminating point of South Britain, and near it half a dozen summits exceed 3000 ft., while Cader Idris, farther south, though slightly lower, presents a singularly imposing outline. The mild winter climate has fringed the coast with seaside resorts, the rugged heights attract tourists in summer, and the vast masses of slate have given rise to the largest slate quarries in the world. The heavy rainfall of the upper valleys unfits them for agriculture, and the farms are poor. There are several lakes: that of Bala being the largest, except the old lake of Vyrnwy, reconstituted artificially to store the rainfall for the water-supply of Liverpool, 68 m. distant. The Vyrnwy is tributary to the Severn; but north of it the streams gather into the Dee, and flow eventually northward. Mid Wales is built up, for the most part, of Silurian or Ordovician rocks, practically free from igneous intrusions except in the south-west. There the resistance of a series of igneous dykes gives prominence to the Pembroke peninsula, in which the fine fjord-like harbour of Milford Haven lies far out towards the Atlantic. The coast north of Pembroke and Merioneth has been worked into the grand sweep of Cardigan Bay, its surface carved into gently rounded hills, green with rich grass, which sweep downward into wide rounded valleys. Plinlimmon (2468 ft.) is the highest of the hills, and forms a sort of hydrographic centre for the group, as from its eastern base the Severn and the Wye take their rise—the former describing a wide curve to east and south, the latter forming a chord to the arc in its southward course. Mid Wales is mainly a pastoral country, and very thinly peopled. A group of artificial lakes, one of them exceeded in area only by Windermere, has been formed in the valley of the Elan, a tributary of the Wye, for the supply of water to Birmingham. The group of heights of South Wales, running on the whole from west to east, marks the outcrops of the Old Red Sandstone and Carboniferous strata which lie within a vast syncline of the Silurian rocks. The Brecon Beacons of Old Red Sandstone are the highest (2907 ft.), but the Black Mountain bears a number of picturesque summits carved out of Millstone Grit and Carboniferous Limestone, which rise frequently over 2000 ft. Throughout Hereford, and in part of Monmouthshire, the Old Red Sandstone sinks to a great undulating plain, traversed by the exquisite windings of the Wye, and forming some of the richest pasture and fruit lands of England. This plain formed an easy passage from south to north, and since the time of the Romans was a strategical line of the greatest importance, a fact which has left its traces on the present distribution of towns. Around the western and northern edge of the Old Red Sandstone plain the underlying Silurian rocks (and even the Cambrian and Archaean in places) have been bent up so that their edges form hills of singular abruptness and beauty. Of these are the Malvern Hills, east of Hereford, and in particular the hills of Shropshire. Wenlock Edge, running from south-west to north-east, is an escarpment of Silurian limestone, while the broad upland of Long Mynd, nearly parallel to it on the north, is a mass of Archaean rock. The Wrekin, the Caradoc and Cardington Hills are isolated outbursts of pre-Cambrian volcanic rocks. The outer rim of the Welsh area contains a broken series of coal-fields, where patches of Carboniferous strata come to the surface on the edge of the New Red Sandstone plain. Such are the coal-fields of Flint in the north, the Forest of Wyre and the Forest of Dean, close to the Severn, on the east. The great coal-field on the south is a perfect example of a synclinal basin, the Millstone Grit and Carboniferous Limestone which underlie the Coal Measures appearing all round the margin. This coal-field occupies practically the whole of Glamorgan and part of Monmouth, and its surface slopes from the Black Mountain and Brecon Beacons to the sea as a gently inclined plateau, scored by deep valleys draining south. Each chief valley has a railway connecting a string of mining villages, and converging seaward to the busy ports of Newport, Cardiff and Barry (a town created on a sandy island by the excavation of a great dock to form an outlet for the mines). In the north of the field, where the limestone crops out and supplies the necessary flux, Merthyr Tydfil has become great through iron-smelting; and in the west Swansea is the chief centre in the world for copper and tin smelting. The unity and ruggedness of the highlands of Wales have proved sufficient to isolate the people from those of the rest of South Britain, and to preserve a purely Celtic race, still very largely of Celtic speech.

Cornwall and Devon.—The peninsula of Cornwall and Devon may be looked upon as formed from a synclinal trough of Devonian rocks, which appear as plateaus on the north and south, while the centre is occupied by Lower Carboniferous strata at a lower level. The northern coast, bordering the Bristol Channel, is steep, with picturesque cliffs and deep bays or short valleys running into the high land, each occupied by a little seaside town or village. The plateau culminates in the barren heathy upland of Exmoor, which slopes gently southward from a general elevation of 1600 ft., and is almost without inhabitants. The Carboniferous rocks of the centre form a soil which produces rich pasture under the heavy rainfall and remarkably mild and equable temperature, forming a great cattle-raising district. The Devonian strata on the south do not form such lofty elevations as those on the north, and are in consequence, like the plain of Hereford, very fertile and peculiarly adapted for fruit-growing and cider-making. The remarkable features of the scenery of South Devon and Cornwall are due to a narrow band of Archaean rock which appears in the south of the peninsulas terminating in Lizard Head and Start Point, and to huge masses of granite and other eruptive rocks which form a series of great bosses and dykes. The largest granite boss gives relief to the wild upland of Dartmoor, culminating in High Willhays and Yes Tor. The clay resulting from the weathering of the Dartmoor granite has formed marshes and peat bogs, and the desolation of the district has been emphasized by the establishment in its midst of a great convict prison, and in its northern portion of a range for artillery practice. The Tamar flows from north to south on the Devonian plain, which lies between Dartmoor on the east and the similar granitic boss of Bodmin Moor (where Brown Willy rises to 1345 ft.) on the west. There are several smaller granite bosses, of which the mass of Land’s End is the most important. Most of the Lizard peninsula, the only part of England stretching south of 50° N., is a mass of serpentine. The great variety of the rocks which meet the sea along the south of Cornwall and Devon has led to the formation of a singularly picturesque coast—the headlands being carved from the hardest igneous rocks, the bays cut back in the softer Devonian strata. The fjord-like inlets of Falmouth, Plymouth and Dartmouth are splendid natural harbours, which would have developed great commercial ports but for their remoteness from the centres of commerce and manufactures. China clay from the decomposing granites; tin and copper ore, once abounding at the contacts between the granite and the rocks it pierced, were the former staples of wealth, and the mining largely accounts for the exceptional density of population in Cornwall. Fishing has always been important, the numerous good harbours giving security to fishing-boats; and the fact that this coast is the mildest and almost the sunniest, though by no means the driest, part of Great Britain has led to the establishment of many health 413 resorts, of which Torquay is the chief. The old Cornish language of the Celtic stock became extinct only in the 18th century, and the Cornish character remains as a heritage of the time when the land had leisure to mould the life and the habits of the man. Projecting farthest of all England into the Atlantic, it is not surprising that the West country has supplied a large proportion of the great naval commanders in British history, and of the crews of the navy.

Between the separate uplands there extends a plain of Permian and Triassic rocks, which may conveniently be considered as an intermediate zone between the two main divisions. To the eye it forms an almost continuous plain with The midland plain. the belt of Lias clays, which is the outer border of the Eastern Division; for although a low escarpment marks the line of junction, and seems to influence the direction of the main rivers, there is only one plain so far as regards free movement over its surface and the construction of canals, roads and railways. The plain usually forms a distinct border along the landward margins of the uplands of more ancient rock, though to the east of the Cornwall-Devon peninsula it is not very clear, and its continuity in other places is broken by inliers of the more ancient rocks, which everywhere underlie it. One such outcrop of Carboniferous Limestone in the south forms the Mendip Hills; another of the Coal Measures increases the importance of Bristol, where it stands at the head of navigation on the southern Avon. In the north-west a tongue of the Red rocks forms the Eden valley, separating the Lake District from the Pennine Chain, with Carlisle as its central town. Farther south, these rocks form the low coastal belt of Lancashire, edged with the longest stretches of blown sand in England, and dotted here and there with pleasure towns, like Blackpool and Southport. The plain sweeps round south of the Lancashire coal-field, forms the valley of the Mersey from Stockport to the sea, and farther south in Cheshire the salt-bearing beds of the Keuper marls give rise to a characteristic industry. The plain extends through Staffordshire and Worcester, forming the lower valley of the Severn. The greater part of Manchester, all Liverpool and Birkenhead, and innumerable busy towns of medium size, which in other parts of England would rank as great centres of population, stand on this soil. Its flat surface and low level facilitate the construction of railways and canals, which form a closer network over it than in other parts of the country. The great junction of Crewe, where railways from south-east, south-west, east, west and north converge, is thus explained. South of the Pennines, the Red rocks extend eastward in a great sweep through the south of Derbyshire, Warwick, the west of Leicestershire, and the east of Nottingham, their margin being approximately marked by the Avon, flowing south-west, and the Soar and Trent, flowing north-east. South and east of these streams the very similar country is on the Lias clay. Several small coal-fields rise through the Red rocks—the largest, between Stafford and Birmingham, forms the famous “Black Country,” with Wolverhampton and Dudley as centres, where the manufacture of iron has preserved a historic continuity, for the great Forest of Arden supplied charcoal until the new fuel from the pits took its place. This coal-field, ministering to the multifarious metal manufactures of Birmingham, constitutes the centre of the Midlands. Smaller patches of the Coal Measures appear near Tamworth and Burton, while deep shafts have been sunk in many places through the overlying Triassic strata to the coal below, thus extending the mining and manufacturing area beyond the actual outcrop of the Coal Measures. A few small outcrops occur where still more ancient strata have been raised to the surface, as, for instance, in Charnwood Forest, where the Archaean rocks, with intrusions of granite, create a patch of highland scenery in the very heart of the English plain; and in the Lickey Hills, near Birmingham, where the prominent features are due to volcanic rocks of very ancient date. The “Waterstones,” or Lower Keuper Sandstones,—forming gentle elevations above the softer marls, and usually charged with an abundant supply of water, which can be reached by wells,—form the site of many towns, such as Birmingham, Warwick and Lichfield, and of very numerous villages. The plain as a whole is fertile and undulating, rich in woods and richer in pasture: the very heart of rural England. Cattle-grazing is the chief farm industry in the west, sheep and horse-rearing in the east; the prevalence of the prefix “Market” in the names of the rural towns is noticeable in this respect. The manufacture of woollen and leather goods is a natural result of the raising of live stock; Leicester, Coventry and Nottingham are manufacturing towns of the region. The historic castles, the sites of ancient battles, and the innumerable mansions of the wealthy, combine to give to central England a certain aesthetic interest which the more purely manufacturing districts of the west and north fail to inspire. The midland plain curves northward between the outcrop of the Dolomite on the west and the Oolitic heights on the east. It sinks lowest where the estuary of the Humber gathers in its main tributaries, and the greater part of the surface is covered with recent alluvial deposits. The Trent runs north in the southern half of this plain, the Ouse runs south through the northern half, which is known as the Vale of York, lying low between the Pennine heights on the west and the Yorkshire moors on the east. Where the plain reaches the sea, the soft rocks are cut back into the estuary of the Tees, and there Middlesbrough stands at the base of the Moors. The quiet beauty of the rural country in the south, where the barren Bunter pebble-beds have never invited agriculture, and where considerable vestiges of the old woodland still remain in and near Sherwood Forest, has attracted so many seats of the landed aristocracy as to earn for that part the familiar name of “the Dukeries.” The central position of York in the north made it the capital of Roman Britain in ancient times, and an important railway junction in our own.

Five natural regions may be distinguished in the Eastern Division of England, by no means so sharply marked off as those of the west, but nevertheless quite clearly characterized. The first is the Jurassic Belt, sweeping along the border of the The eastern division. Triassic plain from the south coast at the mouth of the Exe to the east coast at the mouth of the Tees. This is closely followed on the south-east by the Chalk country, occupying the whole of the rest of England except where the Tertiary Basins of London and Hampshire cover it, where the depression of the Fenland carries it out of sight, and where the lower rocks of the Weald break through it. Thus the Chalk appears to run in four diverging fingers from the centre or palm on Salisbury Plain, other formations lying wedge-like between them. Various lines of reasoning unite in proving that the Mesozoic rocks of the south rest upon a mass of Palaeozoic rocks, which lies at no very great depth beneath the surface of the anticlinal axis running from the Bristol Channel to the Strait of Dover. The theoretical conclusion has been confirmed by the discovery of Coal Measures, with workable coal seams, at Dover at a depth of 2000 ft. below the surface.

The Eastern Division is built up of parallel strata, the edges of the harder rocks forming escarpments, the sheets of clay forming plains; and on this account similar features are repeated in each of the successive geological formations. The rivers exhibit a remarkably close relation to the geological structure, and thus contrast with the rivers of the Western Division. There are two main classes of river-course—those flowing down the dip-slopes at right angles to the strike, and cutting through opposed escarpments by deep valleys, and those following the line of strike along a bed of easily eroded rock. A third class of streams, tributary to the second, flows down the steep face of the escarpments. By the study of the adjustment of these rivers to their valleys, and of the relation of the valleys to the general structure, Professor W. M. Davis has elaborated a theory of river classification, and a scheme of the origin of surface-features which is attractive in its simplicity. The Thames is the one great river of the division, rising on the Jurassic Belt, crossing the Chalk country, and finishing its course in the Tertiary London Basin, towards which, in its prevailing west-to-east direction, it draws its tributaries from north and south. The other rivers are shorter, and flow either to the North Sea on the east, or to the English Channel on the south. With the exception of the Humber, they all rise and pursue their whole course within the limits of the Eastern Division itself.

The Eastern Division is the richest part of England agriculturally, it is the part most accessible to trade with the Continent, and that least adapted for providing refuges for small bodies of men in conflict with powerful invaders. Hence the latest of the conquerors, the Saxon and other Germanic tribes, obtained an easy mastery, and spread over the whole country, holding their own against marauding Northmen, except on the northern part of the east coast; and even after the political conquest by the Normans, continuing to form the great mass of the population, though influenced not a little by the fresh blood and new ideas they had assimilated. The present population is so distributed as to show remarkable dependence on the physical features. The chalk and limestone plateaus are usually almost without inhabitants, and the villages of these districts occur grouped together in long strings, either in drift-floored valleys in the calcareous plateaus, or along the exposure of some favoured stratum at their base. In almost every case the plain along the foot of an escarpment bears a line of villages and small towns, and on a good map of density of population the lines of the geological map may be readily discerned.

The Jurassic Belt.—The Jurassic belt is occupied by the counties of Gloucester, Oxford, Buckingham, Bedford, Northampton, Huntingdon, Rutland, Lincoln and the North Riding of Yorkshire. The rocks of the belt may be divided into two main groups: the Lias beds, which come next to the Triassic plain, and the Oolitic beds. Each group is made up of an alternation of soft marls or clays and hard limestones or sandstones. The low escarpments of the harder beds of the Lias are the real, though often scarcely perceptible, boundary between the Triassic plain and the Jurassic belt. They run along the right bank of the Trent in its northward course to the Humber, and similarly direct the course of the Avon southward to the Severn. The great feature of the region is the long line of the Oolitic escarpment, formed in different places by the edges of different beds of rock. The escarpment runs north from Portland Island on the English Channel, curves north-eastward as the Cotteswold Hills, rising abruptly from the Severn plain to heights of over 1000 ft.; it sinks to insignificance in the Midland counties, is again clearly marked in Lincolnshire, and rises in the North Yorkshire moors to its maximum height of over 1500 ft. Steep towards the west, where it overlooks the low Lias plain as the Oolitic escarpment, the land falls very gently in slopes of Oxford Clay towards the Cretaceous escarpments on the south and east. Throughout its whole extent it yields valuable building-stone, and in the Yorkshire 414 moors the great abundance of iron ore has created the prosperity of Middlesbrough, on the plain below. The Lias plain is rich grazing country, the Oxford Clay forms valuable agricultural land, yielding heavy crops of wheat. The towns of the belt are comparatively small, not one attains a population of 75,000, and the favourite site is on the Lias plain below the great escarpment. They are for the most part typical rural market-towns, the manufactures, where such exist, being usually of agricultural machinery, or woollen and leather goods. Bath, Gloucester, Oxford, Northampton, Bedford, Rugby, Lincoln and Scarborough are amongst the chief. North of the gap in the low escarpment in which the town of Lincoln centres, a close fringe of villages borders the escarpment on the west; and throughout the belt the alternations of clay and hard rock are reflected in the grouping of population.

The Chalk Country.—The dominating surface-feature formed by the Cretaceous rocks is the Chalk escarpment, the northern edge of the great sheet of chalk that once spread continuously over the whole south-east. It appears as a series of rounded hills of no great elevation, running in a curve from the mouth of the Axe to Flamborough Head, roughly parallel with the Oolitic escarpment. Successive portions of this line of heights are known as the Western Downs, the White Horse Hills, the Chiltern Hills, the East Anglian Ridge, the Lincolnshire Wolds and the Yorkshire Wolds. The rivers from the gentle southern slopes of the Oolitic heights pass by deep valleys through the Chalk escarpments, and flow on to the Tertiary plains within. The typical scenery of the Chalk country is unrelieved by small streams of running water; the hills rise into rounded downs, often capped with fine clumps of beech, and usually covered with thin turf, affording pasture for sheep. The chalk, when exposed on the surface, is an excellent foundation for roads, and the lines of many of the Roman “streets” were probably determined by this fact. The Chalk country extends over part of Dorset, most of Wiltshire, a considerable portion of Hampshire and Oxfordshire, most of Hertfordshire and Cambridgeshire, the west of Norfolk and Suffolk, the east of Lincolnshire, and the East Riding of Yorkshire. From the upland of Salisbury Plain, which corresponds to the axis of the anticline marking the centre of the double fold into which the strata of the south of England have been thrown, the great Chalk escarpment runs north-eastward; fingers of Chalk run eastward one each side of the Weald, forming the North and South Downs, while the southern edge of the Chalk sheet appears from beneath the Tertiary strata at several places on the south coast, and especially in the Isle of Wight. Flamborough Head, the South Foreland, Beachy Head and the Needles are examples of the fine scenery into which chalk weathers where it fronts the sea, and these white cliffs gave to the island its early name of Albion. The Chalk is everywhere very thinly peopled, except where it is thickly covered with boulder clay, and so becomes fertile, or where it is scored by drift-filled valleys, in which the small towns and villages are dotted along the high roads. The thickest covering of drift is found in the Holderness district of Yorkshire, where, from the chalk cliffs of Flamborough Head to the sandspit of Spurn Point, the whole coast is formed of boulder-clay resting on chalk. Of the few towns in the Chalk country, the interest of which is largely historical or scholastic, Salisbury, Winchester, Marlborough and Cambridge are the most distinguished. Reading flourishes from its position on the edge of the London Tertiary Basin, Croydon is a suburb of London, and Hull, though on the Chalk, derives its importance from the Humber estuary, which cuts through the Chalk and the Jurassic belts, to drain the Triassic plain and the Pennine region. The narrow strip of Greensands appearing from beneath the Chalk escarpment on its northern side is crowded with small towns and villages on account of the plentiful water-supply. The distinction between the low grounds of the Jurassic belt and the Chalk country is not always very apparent on the surface, and from the historic point of view it is important to recognize the individuality of the Eastern plain which extends from the Vale of York across the Humber and the Wash into Essex. The Eastern plain thus includes a portion of the Triassic plain in the north, a portion of the Jurassic and Chalk belts in the middle, and a portion of the Tertiary plain of the London Basin in the south.

The Fenland.—The continuity of the belts of Chalk and of the Middle and Upper Oolites in the Eastern Plain is broken by the shallow depression of the Wash and the Fenland. The Fenland comprises a strip of Norfolk, a considerable part of Cambridgeshire, and the Holland district of Lincoln. Formerly a great inlet with vague borders of lagoons and marshes, the Fenland has been reclaimed partly by natural processes, partly by engineering works patiently continued for centuries. The whole district is flat and low, for the most part within 15 ft. of sea-level; the seaward edge in many places is below the level of high tide, and is protected by dykes as in Holland, while straight canals and ditches carry the sluggish drainage from the land. The soil is composed for the most part of silt and peat. A few small elevations of gravel, or of underlying formations, rise above the level of 25 ft.; these were in former times islands, and now they form the sites of the infrequent villages. Boston and King’s Lynn are memorials of the maritime importance of the Wash in the days of small ships. The numerous ancient churches and the cathedrals of Ely and Peterborough bear witness to the share taken by religious communities in the reclamation and cultivation of the land.

The Weald.—The dissection of the great east and west anticline in the south-east of England has resulted in a remarkable piece of country, occupying the east of Hampshire and practically the whole of Sussex, Surrey and Kent, in which each geological stratum produces its own type of scenery, and exercises its own specific influence on every natural distribution. The sheet of Chalk shows its cut edges in the escarpments facing the centre of the Weald, and surrounding it in an oval ring, the eastern end of which is broken by the Strait of Dover, so that its completion must be sought in France. From the crest of the escarpment, all round on south, west and north, the dip-slope of the Chalk forms a gentle descent outwards, the escarpment a very steep slope inwards. The cut edges of the escarpment forming the Hog’s Back and North Downs on the north, and the South Downs on the south, meet the sea in the fine promontories of the South Foreland and Beachy Head. The Downs are almost without population, waterless and grass-covered, with patches of beech wood. Their only important towns are on the coast, e.g. Brighton, Eastbourne, Dover, Chatham, or in the gaps where rivers from the centre pierce the Chalk ring, as at Guildford, Rochester, Canterbury, Lewes and Arundel. Within the Chalk ring, and at the base of the steep escarpment, there is a low terrace of the Upper Greensand, seldom so much as a mile in width, but in most places crowded with villages scarcely more than a mile apart, and ranged like beads on a necklace. Within the Upper Greensand an equally narrow ring of Gault is exposed, its stiff clay forming level plains of grazing pasture, without villages, and with few farmhouses even; and from beneath it the successive beds of the Lower Greensand rise towards the centre, forming a wider belt, and reaching a considerable height before breaking off in a fine escarpment, the crest of which is in several points higher than the outer ring of Chalk. Leith Hill and Hindhead are parts of this edge in the west, where the exposure is widest. Several towns have originated in the gaps of the Lower Greensand escarpment which are continuous with those through the Chalk: such are Dorking, Reigate, Maidstone and Ashford. Folkestone and Pevensey stand where the two ends of the broken ring meet the sea. It is largely a region of oak and pine trees, in contrast to the beech of the Chalk Downs. The Lower Greensand escarpment looks inwards in its turn over the wide plain of Weald Clay, along which the Medway flows in the north, and which forms a fertile soil, well cultivated, and particularly rich in hops and wheat. The primitive forests have been largely cleared, the primitive marshes have all been drained, and now the Weald Clay district is fairly well peopled and sprinkled with villages. From the middle of this plain the core of Lower Cretaceous sandstones known as the Hastings Beds emerges steeply, and reaches in the centre an elevation of 796 ft. at Crowborough Beacon. It is on the whole a region with few streams, and a considerable portion of the ancient woodland still remains in Ashdown Forest. The greater part of the Forest Ridges is almost without inhabitants. Towns are found only round the edge bordering the Weald Clay, such as Tonbridge, Tunbridge Wells and Horsham; and along the line where it is cut off by the sea, e.g. Hastings and St Leonards. The broad low tongue of Romney Marsh running out to Dungeness is a product of shore-building by the Channel tides, attached to the Wealden area, but not essentially part of it.

The London Basin.—The London Basin occupies a triangular depression in the Chalk which is filled up with clays and gravels of Tertiary and later age. It extends from the eastern extremity of Wiltshire in a widening triangle to the sea, which it meets along an irregular line from Deal to Cromer. It thus occupies parts of Wiltshire, Hampshire, Surrey, Kent, Berkshire, Hertfordshire, the whole of Middlesex, the county of London and Essex, and the eastern edge of Suffolk and Norfolk. The scenery is quiet in its character, but the gravel hills are often prominent features, as at Harrow and in the northern suburbs of London; the country is now mainly under grass or occupied with market and nursery gardens, and many parts, of which Epping Forest is a fine example, are still densely wooded, the oak being the prevailing tree. The coast is everywhere low and deeply indented by ragged and shallow estuaries, that of the Thames being the largest. Shallow lagoons formed along the lower courses of the rivers of Norfolk have given to that part of the country the name of the Broads, a district of low and nearly level land. Apart from the huge area of urban and suburban London, the London Basin has few large towns. Norwich and Ipswich, Yarmouth, Lowestoft, Harwich and Colchester may be mentioned in the north-eastern part, all depending for their prosperity on agriculture or on the sea; and a fringe of summer resorts on the low coast has arisen on account of the bracing climate. Reading and Windsor lie in the western portion, beyond the suburban sphere of London. The Bagshot Beds in the west form infertile tracts of sandy soil, covered with heath and pine, where space is available for the great camps and military training-grounds round Aldershot, and for the extensive cemeteries at Woking. The London Clay in the east is more fertile and crowded with villages, while the East Anglian portion of the basin consists of the more recent Pliocene sands and gravels, which mix with the boulder clay to form the best wheat-growing soil in the country.

The Hampshire Basin.—The Hampshire Basin forms a triangle 415 with Dorchester, Salisbury and Worthing near the angles, and the rim of Chalk to the south appears in broken fragments in the Isle of Purbeck, the Isle of Wight, and to the east of Bognor. On the infertile Bagshot Beds the large area of the New Forest remains untilled under its ancient oaks. The London Clay of the east is more fertile, but the greatness of this district lies in its coast-line, which is deeply indented, like that of the London Basin. Southampton and Portsmouth have gained importance through their fine natural harbours, improved by engineering works and fortifications; Bournemouth and Bognor, from their favourable position in the sunniest belt of the country, as health resorts.

Communications.—The configuration of England, while sufficiently pronounced to allow of the division of the country into natural regions, is not strongly enough marked to exercise any very great influence upon lines of communication. The navigable rivers are all connected by barge-canals, even across the Pennine Chain. Although the waterways are much neglected, compared with those of France or of Germany, they might still be very useful if they were enlarged and improved and if free competition with railways could be secured. The main roads laid out as arteries of intercommunication by the Romans, suffered to fall into neglect, and revived in the coaching days of the beginning of the 19th century, fell into a second period of comparative neglect when the railway system was completed; but they have recovered a very large share of their old importance in consequence of the development of motor-traffic. Following the Roman roads, the high roads of the Eastern Division very frequently run along the crests of ridges or escarpments; but in the Western Division they are, as a rule, forced by the more commanding relief of the country to keep to the river valleys and cross the rougher districts through the dales and passes. The railways themselves, radiating from the great centres of population, and especially from London, are only in a few instances much affected by configuration. The Pennine Chain has always separated the traffic from south to north into an east coast route through the Vale of York, and a west coast route by the Lancashire plain. The Midland railway, running through the high and rugged country between the two, was the last to be constructed. The most notable bridges over navigable water affording continuous routes are those across Menai Strait, the Tyne at Newcastle, the Severn at Severn Bridge and the Manchester Ship Canal. It is more usual to tunnel under such channels, and the numerous Thames tunnels, the Mersey tunnel between Liverpool and Birkenhead, and the Severn tunnel, the longest in the British Islands (4½ m.), on the routes from London to South Wales, and from Bristol to the north of England, are all important. The Humber estuary is neither bridged nor tunnelled below Goole.

Density of Population.—The present distribution of population over England and Wales shows a dense concentration at all large seaports, in the neighbourhood of London, and on the coal-fields where manufactures are carried on. Agricultural areas are very thinly peopled; purely pastoral districts can hardly be said to have any settled population at all. There are very few dwellings situated at a higher level than 1000 ft., and on the lower ground the Chalk and the Oolitic limestones, where they crop out on the surface, are extremely thinly peopled, and so as a rule are areas of alluvial deposits and the Tertiary sands. But, on the other hand, the broad clay plains of all formations, the Cretaceous sandstones, and the Triassic plain, are peopled more densely than any other district without mineral wealth or sea trade.

Political Divisions.—In the partition of England and Wales into counties, physical features play but a small part. The forty ancient counties, remnants of various historical groupings and partings, are occasionally bounded by rivers. Thus the Thames divides counties along nearly its whole length, forming the southern boundary of four and the northern boundary of three. Essex and Suffolk, Suffolk and Norfolk, Cornwall and Devon, Durham and Yorkshire, Lancashire and Cheshire, are all separated by rivers, while rivers form some part of the boundaries of almost every county. Still, it is noteworthy that the Severn and Trent nowhere form continuous county boundaries. Watersheds are rarely used as boundaries for any distance; but, although slightly overlapping the watershed on all sides, Yorkshire is very nearly coincident with the basin of the Ouse. The boundaries of the parishes, the fundamental units of English political geography, are very often either rivers or watersheds, and they frequently show a close relation to the strike of the geological strata. The hundreds, or groups of parishes, necessarily share their boundaries, and groups of hundreds are often aggregated to form larger subdivisions of counties. A wider grouping according to natural characteristics may now be recognized only in the cases of Wales, East Anglia, Wessex and such less definite groups as the Home Counties around London or the Midlands around Birmingham. Configuration is only one out of many conditions modifying distributions, and its effects on England as a whole appear to be suggestive rather than determinative.

III. Geology

For an area so small, England is peculiarly rich in geological interest. This is due in some degree to the energy of the early British geologists, whose work profoundly influenced all subsequent thought in the science, as may be seen by the general acceptation of so many of the English stratigraphical terms; but the natural conditions were such as to call forth and to stimulate this energy in an unusual way. Almost every one of the principal geological formations may be studied in England with comparative ease.

If we lay aside for the moment all the minor irregularities, we find, upon examination of a geological map of England, two structural features of outstanding importance. (1) The first is the great anticline of the Pennine Hills which dominates the northern half of England from the Scottish border to Derby. Its central core of Lower Carboniferous rock is broadly displayed towards the north, while southward it contracts; on either side lie the younger rocks, the coal-fields, the Permian strata and the Triassic formations, the last-named, while sweeping round the southern extremity of the Carboniferous axis of the uplift from its eastern and western flanks, spread out in a large sheet over the midland counties. (2) The second striking feature is the regular succession of Jurassic and Cretaceous rocks which crop out in almost unbroken lines from the coast of Dorsetshire, whither they appear to converge, to the Cleveland Hills and the Yorkshire coast. Lying upon the Cretaceous rocks in the S.E. of England are the two Tertiary basins of London and Hampshire, separated by the dissected anticline of the Weald.