The Project Gutenberg EBook of Rural Health and Welfare by George Thompson Fairchild

This eBook is for the use of anyone anywhere at no cost and with almost no restrictions whatsoever. You may copy it, give it away or re-use it under the terms of the Project Gutenberg License included with this eBook or online at http://www.gutenberg.org/license

Title: Rural Health and Welfare Author: George Thompson Fairchild Release Date: April 28, 2010 [Ebook #32158] Language: English Character set encoding: UTF-8 ***START OF THE PROJECT GUTENBERG EBOOK RURAL HEALTH AND WELFARE***

The Rural Science Series

Edited by L. H. Bailey

Rural Wealth and Welfare

Economic Principles Illustrated and Applied in Farm Life

By

Geo. T. Fairchild, LL.D.

New York

The MacMillan Company

London: MacMillan & Co., Ltd.

1900

Contents

- Dedication

- Preface.

- Introduction. General Welfare.

- Part I. Productive Industries: Analysis of Aims, Forces, Means and Methods.

- Chapter I. Aims Of Industry.

- Chapter II. Forces In Production Of Wealth.

- Chapter III. Labor Defined And Classified.

- Chapter IV. Capital Defined And Classified.

- Chapter V. Personal Attainments.

- Chapter VI. Combination Of Forces For Individual Efficiency.

- Chapter VII. Methods Of Association.

- Chapter VIII. Exchange: Advantages, Limitations And Tendencies.

- Chapter IX. Value The Basis Of Exchange.

- Chapter X. Exchange—Its Machinery.

- Chapter XI. Banks And Banking.

- Chapter XII. Deferred Settlement And Credit Expansion.

- Chapter XIII. Technical Division Of Labor.

- Chapter XIV. Aggregation Of Industry.

- Chapter XV. Special Incentives To Production.

- Chapter XVI. Business Security.

- Part II. Distribution of Wealth for Welfare.

- Chapter XVII. General Principles Of Fair Distribution.

- Chapter XVIII. Wages And Profits.

- Chapter XIX. Conflict Between Wage-Earners And Profit-Makers.

- Chapter XX. Proceeds Of Capital: Interest And Rent.

- Chapter XXI. Principles Of Interest.

- Chapter XXII. Principles Of Land Rent.

- Part III. Consumption of Wealth.

- Chapter XXIII. Wealth Used By Individuals.

- Chapter XXIV. Prudent Consumption.

- Chapter XXV. Imprudent Consumption.

- Chapter XXVI. Social Organization For Consumption.

- Chapter XXVII. Economic Functions Of Government.

- Chapter XXVIII. Economic Machinery Of Government.

- Conclusion.

- Index.

- Advertisements.

Dedication

This little volume is thankfully dedicated

Geo. T. Fairchild

Preface.

In giving these pages to the public I offer no apology for a restatement of fundamental principles always requiring adjustment to new life and circumstances; but economic literature has usually dealt too exclusively with the phenomena of manufactures and commerce to gain the sympathy of rural people. An experience of more than thirty years in handling such subjects at the Michigan and Kansas Agricultural Colleges, together with the expressed confidence of former pupils whose judgment I trust, has led me into the effort to bring the subject home to farmers and farmers' families in this elementary way.

I have carefully refrained from quotations, or even references to works consulted, for the obvious reason that such formalities would distract the attention of most readers from the direct, common-sense thinking desired, and render the style of the book more complex. I hereby acknowledge my debt to the leading writers of past and present upon most of the topics treated, not excluding any school or party.

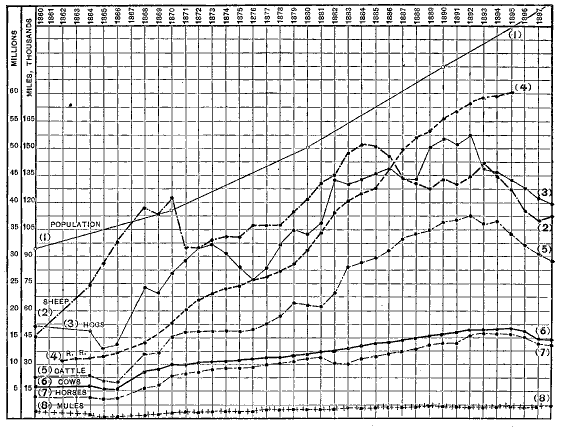

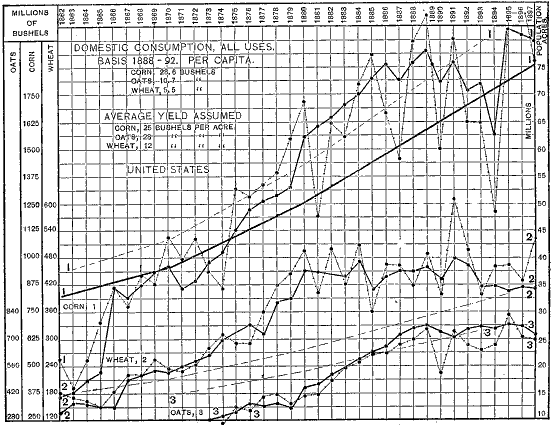

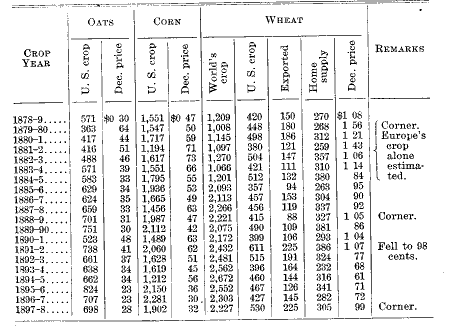

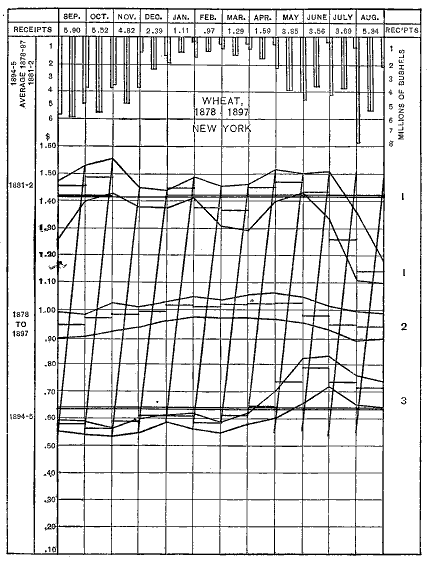

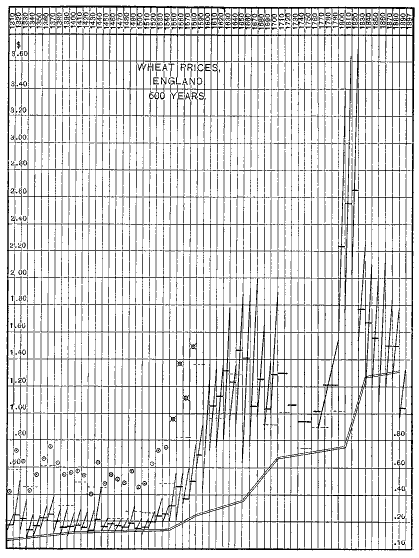

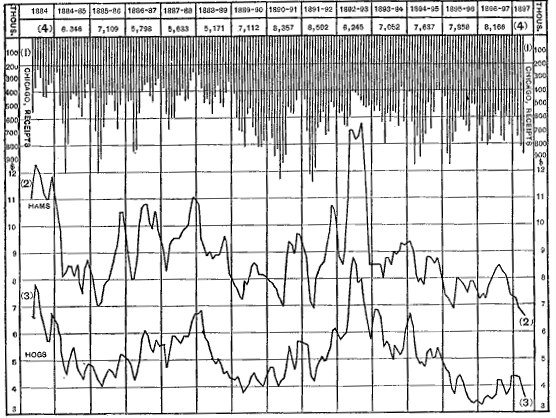

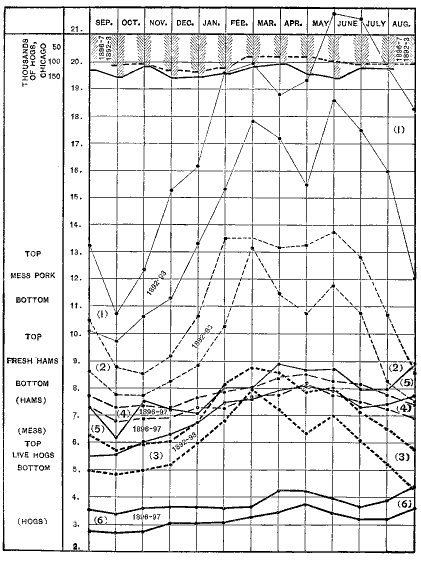

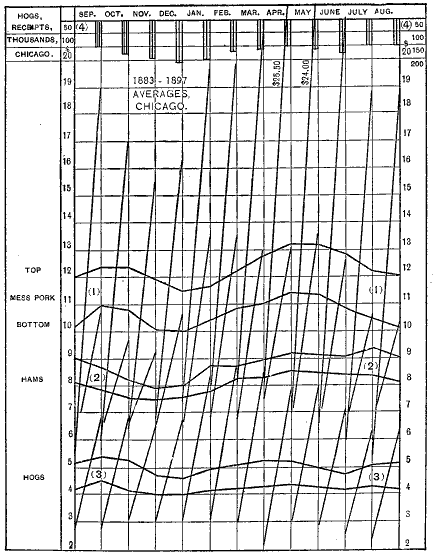

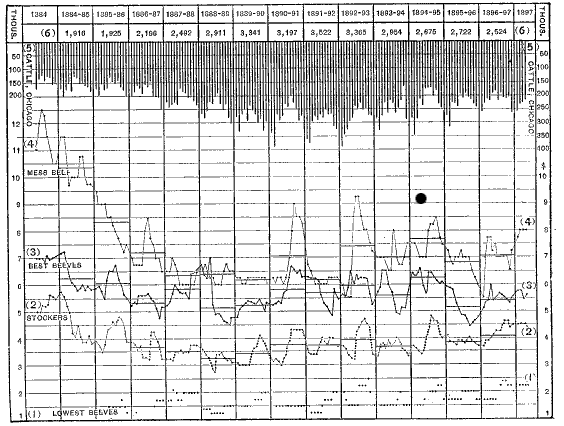

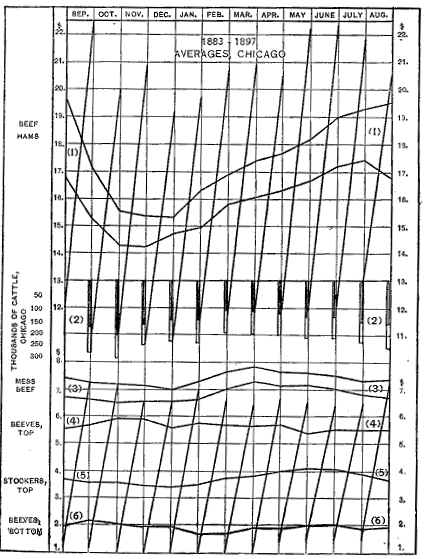

[pg viii]The statements of facts I have taken from best authorities, with care to verify, if possible, by comparisons. Many data have been diligently compiled and rearranged for more exact presentation of facts, and the phenomena of prices of farm crops have been analyzed with especial care. The necessities of the printed volume have to some extent obscured the charts by reduction, but I trust they may be intelligible and interesting to all students of agricultural interests.

No attempt has been made to argue or to expound difficulties beyond a simple statement of principles involved, and the spirit of controversy has been absent from my thoughts throughout. Whatever bias of opinion may appear is without a tinge of bitterness toward those who may differ. I trust that men of all views may recognize in these pages the wish of their author to have only truth prevail.

In offering this volume to farmers I do not assume that all questions of wealth and welfare can be settled by rule. I hope to point out the actual trend of facts, the universal principles sustained by the facts, and means of most ready adjustment to circumstances in the evolutions of trade and manufacture. The business sense of farmers is appealed to for the sake of their own welfare. Several important questions of rural welfare have been touched only suggestively because [pg ix] the limits of the volume could not admit of fuller treatment.

My gratitude is offered especially to Professor Liberty H. Bailey, of Cornell University, to whose suggestion and patient attention the existence of this volume is due.

George T. Fairchild.

Berea College, Kentucky,

March 1, 1900.

Introduction. General Welfare.

Elements of welfare.—The welfare of communities, like that of individuals, is made up of health, wealth, wisdom and virtue. If we can say of any human being that lie is healthy, wealthy, wise and good, we are sure of his satisfaction so far as it depends upon self. When a community is made up of individuals kept in health and strength from birth to old age, sustained with accumulated treasures, wise enough to use both strength and wealth to advantage, and upright, just and kind in all human relations, our ideals of welfare are met.

These are four different kinds of welfare, each of which is essential, and only confusion of thought follows any attempt to treat them all as wealth, however they may be intermingled and exchanged. Health is essential in gaining a full measure of wealth and wisdom, and perhaps in maintaining genuine character; but a healthy life gives no assurance of complete welfare. The facts concerning health in a community make a distinct subject [pg 002] of study for promotion of welfare, and we call it public hygiene. The science of education deals with ways and means of securing public wisdom. The science of government includes all facts relative to public virtue. So the facts by which we know the nature and uses of accumulated wealth in any community make a distinct study under the name economic science; it deals with certain definite groups of facts. To call everything good “wealth” and everything evil “ilth” adds nothing but confusion to our thoughts.

Mutual welfare.—Every human being in society is directly interested in the study of wealth as related to his own and his neighbors' welfare. No one can understand his relations to those about him in the family, the neighborhood, his country and the world without some understanding of the sources and uses of wealth all about him. His very industry gains its reward by certain means in society depending upon economic principles. His motives for accumulating wealth have a distinct place. His uses of accumulated wealth are a part of the general facts which make wealth desirable. So the study of wealth in society must be everybody's study, if each wishes to do best for himself or for his neighbors. In such study of welfare every one finds his interests completely blended with the interests of others. His existence is part of a larger existence called society, from which he receives himself in large measure and most of his satisfaction; to which he contributes in like measure a portion of its essential character and future existence.

[pg 003]The old idea that one gives up freedom of self for the advantages given by society has no foundation in fact, because we are born into our place in society without power to escape its advantages, disadvantages or responsibilities. The maxim “Each for all and all for each” is thoroughly grounded in the constitution of man; his needs and abilities enforce society and insist upon community of interests. Even personal wealth confers little welfare outside of its relations to other human beings. The whole progress of the human race tends toward acceptance of the clear vision of Tennyson, where

Each stage in the progress of the conquest of nature to meet human wants, from the gathering of wild fruits, through hunting and fishing, domestication of animals, herding, and tillage of permanent fields, to the manufacture of universal comforts and tools, and to general commerce, has made more important the welfare of neighbors. Even the wars of our century are waged in the name of and for the sake of humanity. The study of individual welfare involves the public welfare. Welfare of a class is dependent upon the welfare of all classes. Wealth of individuals is genuine wealth in connection only with the wealth of the world. Welfare without wealth would imply the annihilation of space, of time, and of all forces acting in opposition to wishes.

Wealth in farming.—The subject of the following [pg 004] pages is wealth, how it is accumulated, how distributed to individual control and how finally consumed for the welfare of all concerned. But special reference is made to the sources of wealth as a means of welfare in rural life, and to the bearing of definite economic principles upon farming, especially in these United States of America. Farming is, and must always remain, a chief factor in both wealth and welfare, and its relations to the industry of the world grow more important to every farmer as the world comes nearer to him. We cannot now live in such isolation as our fathers loved. The markets of the world and the methods of other farmers all over the world affect the daily life of every tiller of the soil today. Commerce in the products of farm and household reaches every interest, when the ordinary mail sack goes round the world in less time than it took our immediate ancestors to go as pioneers from Massachusetts to Ohio. It seems possible to show from the experiences of farm life the essential principles of wealth-making and wealth-handling, including the tendencies under a world-wide commerce. These every farmer and laborer needs for his business, for his home, and for his country.

[pg 005]Nature Of Wealth

Wealth defined.—If we look at the objects which men number in speaking of their wealth, we shall soon find the list differing in important particulars from the list of things which they enjoy. All enjoyable things contribute to welfare, but not all are wealth. Some, like the air and the sunshine, if never lacking, cannot be counted, because no storing against future need is practicable; but the fan that cools the air and the coal that gives heat are counted when they are stored as means of meeting future wants. If we could not foresee wants of ourselves or of those dependent upon us, we could not gather means of supply for those wants. If we had all wants supplied at a wish or a prayer, we should have no incentive to store. The pampered child whose every wish is met has no clear conception of wealth or its uses. Let him be without a meal, and he seeks provision for the future by an effort to save what is left over from his last meal and by exertion to add to his store in anticipation of want. Thus wants, to be met only by exertion, are the foundation of the universal ideas of wealth, and whatever we have stored as a provision against wants becomes our wealth. If hunger were our only desire, our wealth would include only stores of food, conveniences for storing, means of increasing the store, and means of utilizing the articles to be eaten. Each desire adds to the range of articles which may enter our list of objects of wealth until enumeration is impossible. None of these, however, will be stored as wealth beyond the limits of anticipated use: [pg 006] if so stored, they add nothing to the supposed wealth. An isolated family, able to consume only thirty bushels of potatoes in a season, is not more wealthy from having three hundred bushels stored: the wealth is measured by actual relations to wants not otherwise supplied. Even in a populous city, the three hundred bushels of potatoes become a store of wealth only when other people need them and are able in turn to meet other wants of the owners.

Indeed, we soon come to estimate any object of wealth according to its power, directly or indirectly, to meet the first want that comes. A cherished memento of friendship may be ever so gratifying, and yet find no place in our account of wealth, because it can serve no purpose in meeting other wants.

Any object of wealth may cease to be counted, not because it has changed, but because wants have changed. The last year's bonnet goes for a song, because the fashion changes; the reaper rots behind the barn or at the roadside, because the harvester is wanted in its place. So the wealth in any object is limited by its relation to the present or prospective wants of its owner, and his control to meet these wants. The wealth of any community is its store of material objects suited to the current wants or fitted to exchange with other communities for more suitable articles of use. We estimate it only by thinking of uses in producing pleasure or preventing pain, its limitations in quantity to a certain range of wants, and its control for use or transfer by an owner.

Wealth distinguished from power.—Wealth is not to [pg 007] be confused with power of other kinds. Power may be for future exertion; wealth is the result of exertion. Power may take any form of welfare,—health, wisdom, character, as well as wealth. So no personal abilities can be counted as wealth, however useful they may be as means of gaining it. Jenny Lind's abilities as a singer may have been better than wealth; but exertion of those abilities in the United States enabled her to carry back to Europe wealth of which she had none before coming. The ingenuity of Elias Howe exerted upon the sewing machine has been an immense source of wealth and welfare to the world, but it alone could not secure him daily food. Your words and my music combined in a song fit to tickle the fancy of the multitude may transfer wealth to our pockets, but it was in neither the words nor the music, nor yet in the song, and still less in the power to contrive them. If wealth in material things had not been in possession of the multitude, the same sweet sounds might have given satisfaction to the crowds without an idea of wealth in the transaction. Much of the welfare of the world is from exertion of powers entirely independent of wealth. The chief joys of home are not measured by the wealth in our tenement. The chief welfare of society is only incidentally connected with wealth.

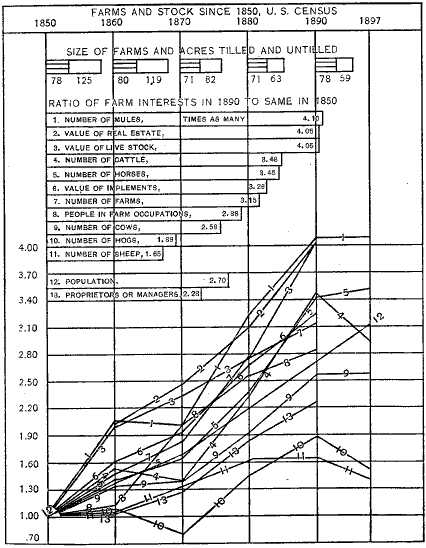

[pg 008]Chart No. I

Fluctuation of Farms and Farm Interests since 1850

At the top is shown the relative size of farms at the close of each census period, with the number of acres tilled and untilled. The lower part of the chart shows the changes in different farm interests, especially in the amount and character of capital employed and the number of people engaged in agriculture. Assuming the conditions of 1850 to be par, the increase or decrease is shown for each kind of live stock, the number of farms, the total farm population, and the number of farm managers, as well as the valuation of real estate and of live stock. To illustrate, take No. 4, the number of cattle, excluding the cows. In 1860 there were 1.5 times as many as in 1850. In 1870, on account of the consumption and disturbance of the war, the number was reduced to 1.4 times as many. In 1880 there were more than 2.3 times as many, and in 1890 there were 3.48 times as many. In a few instances the estimate for 1897, though not an accurate enumeration, is added for comparison. A careful study of these various changes will show that while the total population in 1890 was only 2.7 times the population of 1850, the total number of people employed in farm occupations of every kind was 2.88 times as great; although the number of independent farmers was only 2.28 times as great. The total value of real estate in farms was over four times as great, and the total value of live stock exactly corresponded. The number of cows, sheep and hogs had not kept up with the population; while the number of beef cattle and horses and mules had increased much more rapidly. The fact that the value of live stock had increased in much greater proportion than the numbers shows that there has been great improvement in the individual character of the animals. That the average wealth of farm proprietors is more than three-fourths as large again is shown by comparison of the number of farmers with the value of the farms. That the number of mules, cattle and hogs actually decreased between 1860 and 1870 indicates the enormous consumption of the armies in the Civil War.

[pg 009]

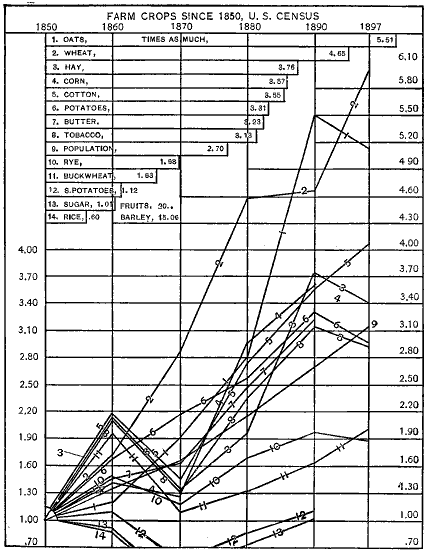

Chart No. II

Progress of the United States in Farm Crops since 1850

This chart indicates to the eyes facts shown by the census reports as to the relative increase or decrease of certain staple crops in comparison with the population. Assuming the conditions of 1850 to be par, the several lines indicated by numbers show the ratio of the several crops to the crop of 1850. Thus the wheat crop in 1860 was nearly .75 greater than in 1850; in 1870 it was 2.87 times as great; in 1880 it was nearly 4.6 times as great; only a little greater in 1890, but in 1897 was nearly 6 times as great. It should be remarked that the census returns are founded upon the crop of the previous year, and therefore, will not exactly correspond with current estimates. At a glance it will appear that rye, buckwheat, sweet potatoes, sugar and rice have nowhere nearly kept up with the increase of population, while all the other crops have been considerably in excess. The barley crop could not be shown upon the chart for want of room, but is more than fifteen times as great. The cultivation of fruits is estimated to be twenty times as great, although the census returns give insufficient figures for accuracy. It is evident that the people of the United States demand a better living, as well as raise more profitable crops, than in 1850. Some striking illustrations of the effects of the Civil War are seen in the falling off of many crops during that period. Only oats, wheat and potatoes increased beyond the increase in population. Most of the others actually diminished; and the staple products of the southern states prior to the war have scarcely as yet regained their previous standing. This is accounted for in part by the immense destruction of capital, but in larger part by the entire change in conditions of plantation cultivation.

[pg 011]

Wealth in material objects.—Our attention is called to wealth in comparing two material objects of desire. One has more uses, more important uses, more rare uses, than another; or one is less easily obtained than another. In either case we prize that one in store, as the more important. We compare two farms, as material aids to different owners, and call both wealth in different degrees. We note the condition of two countries as to all the machinery of industry, and know that one has greater wealth than the other. We compare the accumulations of this generation with those of our fathers, and rejoice in our advance in wealth as one important form of power to gain a genuine welfare. Thus, in comparing our country's inventory by the census of 1890 with that of 1850, we find that while its people are only 2.7 times as many, there are 3.15 times as many farms of exactly the same number of acres, though more of each is cultivated, and that the value of property used in farming is more than four times as great; so we know that the farmers have increased in wealth and welfare as compared with our fathers. See Charts I and II.

Rural wealth analyzed.—A brief analysis of rural wealth in any established community will help to understand the meaning of the word and its relation to welfare. First may be named the farm fields and plantations brought by exertions continued through long years from raw forest or prairie to present tilth and productiveness. An English farmer, when asked how long it took to establish a certain permanent pasture, replied, “Three hundred years.” Second, all fences, [pg 013] drives and farm buildings, for convenience of handling and storing produce and stock. Third, all the tools and implements of the trade. Fourth, all domestic animals of every kind, and all attendants of their sustenance and growth, including feed and manure. Fifth, all contrivances for marketing and preparing for market. Sixth, all highways between neighbors and toward market. Seventh, all local elevators, stock-yards and depot facilities. Eighth, the homes, with all material comforts and utensils. Ninth, any store of provisions in cellar, pantry, smokehouse or bin. Tenth, all personal belongings for clothing, adornment and enjoyment. Eleventh, the family libraries and associated treasures. Twelfth, any actual store of gold, silver or other current wealth available for future wants. This does not include notes, mortgages, bonds, or any other promises to pay, nor certificates of stock in any business enterprise, because these are mere titles to wealth supposed to exist elsewhere,—as distinct from the wealth as the deed is from the farm. Thirteenth, any peculiar advantages of location, scenery, pure air, pure water and agreeable temperature, that are controlled by owners for personal advantage or enjoyment, and can be objects of desire to others. Fourteenth, any “good will” attached to, and part of, particular farms, due to long established methods and facilities in preparing or marketing produce. If such “good will” is attached to a person rather than to the place, it is not wealth, but power.

The last two are seldom distinctly enumerated by the assessor, yet they are clearly estimated in any [pg 014] exchange of places or transfer of titles. They are owned, used and transferred like other forms of wealth, and save future exertions to obtain them. All these are wealth because they contribute to welfare through being accumulated materials to meet future wants, and are to be measured in any estimate by their relation to the wants they will satisfy and the exertions they will save.

Future wants certain.—Wants and exertions are readily seen to be at the foundation of all ideas of wealth as indicated above. If we are uncertain as to the continuance of any wants or uncertain as to the conditions for meeting those wants, we stop accumulation of materials for satisfying them. Exertion stops unless the satisfaction to be gained by our effort is foreseen with a reasonable certainty. The farmer is never absolutely sure of returns for his labor upon the cornfield; but he is reasonably certain, and is absolutely certain that the crop will not come without labor. This assumed continuance of individual wants and their relations gives the grand motive for wealth gathering.

The means of protection and support for physical life will be needed by ourselves and our children. Tools of better form and machinery of better manufacture will be needed to reduce exertion in future. Reduced exertion for a given satisfaction will mean a fuller supply of things we are going to need still. If these wants are fully met, we are going to have leisure to satisfy larger and higher wants. It is the certainty that each advance of wealth will bring advancing wants [pg 015] to consume more wealth, that gives a genuine motive to activity in gaining wealth, i.e., in accumulating the things to be used. The degree of uncertainty in all future plans leads to over-estimating the importance of gold, diamonds or any forms of wealth that can most easily be transferred between places or individuals, or be turned to account in each change of necessities.

Ownership.—The importance of wants and exertion emphasizes the importance of the individual self in all ideas of wealth. The ownership of one's own abilities and their products is absolutely essential to his care for accumulation, and that care is in proportion to his security in such ownership. Directly or indirectly, every exertion and every sacrifice must depend upon confidence that it will bring its object; but wealth-getting has no object without control, in some measure, of results. This fact makes individual ownership an essential to the highest exertion, a natural sequence to the right of liberty.

Property rights are grounded in the general and individual welfare, as shown in human nature and in the progress of the world along the line of protection to property. Those communities are most happy which best protect individual property. As J. E. Thorold Rogers remarks, “Sacredness is accorded to private property, because society prospers by it.” Even theorizers who denounce individual property-holding found their argument upon the equity of individual rights in property. War is less harmful than anarchy, because it ensures a measure of control. Slavery has sometimes been less injurious than war in giving security to [pg 016] enjoy a portion of self. But a conquest of freedom by bloodshed is worth its cost in self-control. Civilization advances as individual responsibility for property, as well as everything else, is recognized.

Christianity is ideally practical in upholding every man's right to self-control in the interest of all. It distinguishes equity from equality in distribution of all good, wealth included. Public property is rightly public when the wants and energies of all the community are best provided for by such common ownership. Proof in each particular case is essential against the presumption that individual needs are the best impulses to provision for welfare. Even common property is limited necessarily to the numbers who can use it. No property or wealth can exist for anybody without the control of some human individuals for whom it is accumulated.

Wants individual.—We are likely to lose sight of the essential individuality of wants and exertions which make wealth possible, because in any community exchange of services modifies the direct relation of each man's wants to his accumulations. Assuming that others, wanting food, will exchange clothing for it, one man stores food alone, but in quantities far beyond his own need, measuring its relation to all his material wants through the wants and exertions of others. He feels even more sure of the continued activity of wants and powers among a multitude than if he had but one neighbor; but individuals, after all, must need his products and exert themselves to meet the need, or all his calculations fail.

[pg 017]Progress in welfare.—Economic progress must show a larger welfare to individuals of the community. The familiar figure by which a commonwealth is compared to an animal organism fails to include the important fact that the individuals of the commonwealth furnish the only reason for the existence of the commonwealth itself, as well as its only means of existence. The cells of the animal, or even the most important organs, have no reason for existence in themselves. Each individual man furnishes the reasons for his activity, and the needs of individual men furnish the only reason for having a commonwealth.

We can speak of progress, then, only when these individuals secure a better use of wealth in some way. It may be by accumulation through saving from the full years for the empty, as older communities can endure a drought with little suffering, while pioneers are ruined. It may be by an increased product for a given exertion, as illustrated by every labor-saving implement upon the farm or in the factory. It may be by lessening exertion for a given product, as in the devices of kitchen and dairy to make tasks lighter. It may be in better distribution of the total product through readier and fairer exchanges of services or products, as happens with every improvement in transportation and every means for fairer understanding in a bargain. Lastly, it may be in more economical expenditure for common wants, as in maintaining government machinery. Usually, progress has been marked along several of these lines at once, if not all of them. There is reason in the statement of Charles Francis Adams that the last [pg 018] century far exceeds the gain of a thousand years before.

Production, distribution, consumption.—Full consideration of rural wealth as related to welfare must first give the principles upon which wealth is produced, including exchange with all its machinery; for the marketing of produce is today one of the chief steps in securing wealth by farming. The thrifty farmer of today is the man of most business tact and energy, who uses most approved means of raising, handling and marketing his goods.

It also requires a careful study of principles upon which any product of exertions, where more than one person has contributed toward the whole, can be fairly shared between the producers, however they have helped. A farmer is as thoroughly interested in problems of rent, interest and profits, if not in wages, as any other worker for wealth or welfare.

It further involves the study of economic uses for wealth, private and public, since no wealth has found the true reason for its existence till the uses to which it is put are known. This includes all questions upon the economic functions of government, the ends to be served, and the raising and handling of revenues. If any patriots need to know for what, how and in what measure their country is dependent upon their own resources, it is the farmers, whose homes make the bulk of the land we love, whose children furnish the bone and sinew of industry, and whose interests are most sensitive to misdirected energy in public administration.

Security in stable government.—Agriculture, of all [pg 019] industries, can flourish in that country alone where personal and property rights are fully understood and respected, where claims are equitably adjusted by a stable government, and where taxes are properly apportioned and revenues economically expended.

Part I. Productive Industries: Analysis of Aims, Forces, Means and Methods.

Chapter I. Aims Of Industry.

Production defined.—A very little thought shows that men produce nothing in the sense of creating. All production is simply overcoming obstacles to satisfaction of wants as we find these obstacles in space, time and form or substance of natural objects. In doing this we are confined to mere ability to move things. The very highest effort of man's energy today but proves the saying of Lord Bacon, “All that man can do is to move natural objects to and from each other: nature working within accomplishes the rest.” This is fully illustrated in farm operations. The bringing together of soil, seed, sunshine and shower, according to their natures, secures the product of nature—a crop. Moving food and water to the steers, or the steers to food and water, under proper conditions of warmth, air and exercise, produces beef. To know how and when and where to move things so that nature may meet our wishes by what always happens under the [pg 022] same circumstances, would be to have all the arts of life; in short, production is the art of moving things. But we distinguish different kinds of production according to the direct results expected from our motion, as reducing space and time, modifying the form, or changing the substantial qualities of things handled.

Transportation in production.—The change of place necessary to bring together wants and those things which satisfy them is a method of producing wealth most apparent everywhere. The bringing of wild fruits from the forest or the swamp to the home gives them worth. The mere transportation, change of place, gives them an importance they did not have on the trees or bushes. In this transportation we put the energy necessary to take grain from the fields all the way to the bake-ovens, and finally to our mouths, or to carry the milk from the stable or yard in pail, can, wagon, train, delivery cart and bottle, to the lips of the child whose life it maintains. Every kind of material or force expended in this process of overcoming space is used in the idea that the object is worth the expenditure in the place finally reached. If the motion stops anywhere along the way, the wealth is not obtained, or at least is held only in expectation until the motion can be completed. While each of fifty individuals may give a hand, and pass his claim to the next for a consideration, the wealth is all the way increasing in anticipation, as the object comes nearer its use.

In this progress time as well as space is an important obstacle to be overcome, and we employ all means of increasing speed, or preserving against what we call [pg 023] “the ravages of time,” i. e., the operation of injurious forces acting in time upon most material substances. The methods employed for storing, curing and forcing to maturity the various forms of food needed in a community are aimed at meeting this obstacle, and add to its final worth; indeed these may be the means of giving value to all the other efforts in transportation, as in moving beef from Kansas City to New York, or fresh fruit from San Francisco to Boston.

In the same process of putting things where they are needed, all merchants are engaged. Without the store, the order upon the shelves, the ready attendant and his despatch in meeting your demand, the pounds of sugar or salt essential to your comfort could not be had for love or money. These efforts are an essential part in the motion between wants and objects to satisfy them. Much of this kind of motion we include under the name commerce, though that word more directly implies the exchanges involved. The machinery of commerce is chiefly the means of bringing things wanted to the people who want them.

Much, however, of the exertion required in all industries, especially in farming, is simply “to fetch and carry.” It will emphasize this fact to study, while you eat a piece of cherry pie, the processes involved in bringing it from the treetop, grainfield, dairy and cane-field, through mill and store and pantry and oven, to your plate. Transportation cuts a tremendous figure in production of wealth. In the first stages of social life it is almost the whole. The hunter talks of “bringing in” his game. Australians, Hottentots and Digger [pg 024] Indians lived by carrying themselves from one supply of food to another.

Transformation in production.—Much of the material gathered by us needs some change of form to suit our wants. An ax-helve has in it the original wood of the young hickory brought from the forest, but its form is fashioned by effort with ax, drawshave, scraper and sandpaper, until it satisfies the judgment of an expert chopper. This transformation is employed in any industries where wood, ivory, the metals and other minerals are shaped by tools, or by molding, or pressing or bending, to our wishes. Most fabrics are materials put into form. The word manufacture covers most of such work where materials are manipulated by shaping; but it also includes many operations with a different aim, to change the substance itself.

Transmutation in production.—Men have found that two metals, tin and copper, melted together produce brass, different in qualities from either. Farmers have for many centuries contrived, by keeping nature's forces under control in the wheat field, to combine certain elements of the soil, including its moisture, into grain. The single seed has multiplied a hundredfold through being placed in favorable conditions, with the raw materials at hand in the fertile soil.

The process of maintaining animals with suitable food for the production of milk or flesh is similar. The combination of flour, water, salt and yeast, by heat, first mild and then intense, into a loaf of bread is a good illustration of a change of qualities by rearrangement of the elements of a substance. It is sometimes [pg 025] called transmutation, and comes the nearest possible to creation of material things. The chemist's laboratory exists for making such new combinations, and many of the arts produce materials, like steel, which would not exist without such combination. But many have seen in the art of agriculture a most prominent illustration of transmuting coarser elements into products adapted to human wants for food, shelter and adornment. All such work, however, is done by bringing objects and forces into such contact that chemical or vital changes will take place while we wait.

Production extended.—In all these three directions, or in any combination of them, transporting, transforming and transmuting materials, men seek the production of a supply for meeting anticipated wants, and so contribute directly or indirectly to welfare. No one way of producing what men need, where they need it, and when they need it, has any superior claim to the name production. All are making the material yield up welfare to the one who needs it, and produce wealth just so far as their services are necessary in bringing the welfare. If ever any step in the process becomes useless, it ceases to be productive of wealth and becomes waste. The inventive powers of mankind are always at work to shorten the processes and hasten the advantages of production. Men study the minutest workings of nature to find the conditions under which she does her part of the work. The application of such minute knowledge is a chief part of every art. This is also the object of science; for, as Guizot says, “It only began to have a well defined existence when it confined itself to [pg 026] seeking the ‘how’ rather than the ‘why’ of nature's workings.” This purpose sustains in the United States more than fifty agricultural experiment stations, united in a great organization, to find how the natural forces used by farmers do their work.

This prophecy of a noted economist is warranted: “Probably the greatest economic revolution which the youth of today may in his old age behold, will be found in this all-important branch of our industries.” When we know how nature works, we can adjust our little motions in time and place to promote that work; we shall have the art of moving things to suit our needs. Nothing can be truer than Tennyson's line, “We rule by obeying nature's powers.”

Chapter II. Forces In Production Of Wealth.

Nature.—When men learn to meet their wants by exertion in accord with nature's ways, they are said to use the forces of nature in production of wealth. Every accumulation of materials for satisfying future needs implies some control over natural objects. If advantage is taken of natural motions or other activities to bring about larger accumulation, the man whose plans secure this has gained control over, and so property-rights in, the natural force which he has harnessed. The wind caught by a sail and the water controlled by a dam contribute to the power, and indirectly to the wealth, of the man who contrives to make them move things for him. The directive actions of men necessarily appropriate the natural objects which they use, together with all the qualities of those objects.

Energy.—Human exertion produces wealth, as we have seen, whenever it anticipates and provides for future wants by securing at hand the things to be used. So far as this anticipation includes control of forces or qualities in nature, these natural agencies contribute to wealth of individuals or communities. So voluntary human exertion is combined with involuntary forces of outside nature to give wealth. No amount of [pg 028] gold in Alaska is wealth until some human ability has appropriated it to human uses; but the mere fact of locating a claim for mining purposes gives the prospector advantage over any other man because of his foresight. So every activity of nature may become a factor in wealth by human ingenuity in making it useful.

Natural forces.—Such natural agencies for producing wealth are seen in the simple properties of material bodies, such as the metals or woods or grains or fruits or flowers possess. We secure these properties for our uses. Gravity, sound, heat, light, electricity, chemical affinity, crystallization, even life itself, are names for certain forms of energy in nature which men are using more or less to meet their wants. Whenever exertion is needed to provide for using these, the thought of wealth is connected with the forces themselves. The fish in the sea and rivers become wealth to one who has caught them, and even more distinctly the property of the community which has protected them in breeding. Sunlight may reach all alike in welfare, but the man who has contrived to make it print pictures for him has made sunlight into wealth in the picture. Equally so the farmer's energy and contrivance use the properties of soil and climate and the vital energies of seeds to make wealth in a crop.

Control for welfare.—As each individual worker gains control over any of these properties or forces he advances in wealth and welfare. It becomes his own means of meeting wants. If all individuals in a community share in such control, they think of the good [pg 029] things as part of the general welfare, and do not enumerate them in anybody's wealth except when comparing their own condition with that of another community. Advantages of this kind constantly tend to become more universal, and so to count very little in individual wealth. Many advantages of civilization today belong to all the world alike, so that nature seems to meet our wants gratuitously; but the story of progress shows that these are gifts inherited from the wealth of past ages. The human exertion which they once cost is overlooked in the ease of the present. Mere fire was once a treasure to be cherished and kept at much expenditure of strength and foresight. Now we kindle a fire so easily that nobody thinks of it as a part of the world's wealth.

Land as a force.—Land represents a combination of natural energies and properties so important as to be named sometimes as a distinct force in production. It implies, first, needed space for various kinds of exertion in both country and town. Second, it includes all mineral, vegetable and animal bodies that are found above, on or under the surface. Third, it is soil, an essential part of a farmer's equipment in using nature's processes of growth.

As most of these properties of land can be put to use only by repeated and continued exertion in the same place, a large portion of the earth is necessarily apportioned to individual control, i. e., to the ownership of those who can direct its uses, and so it becomes wealth. The sea in most of its uses to men requires no such local control, and so is not owned by a nation even; [pg 030] but the harbors, ships and wharves, the oyster-beds and fishing banks, soon become the property of some body of men that will make and keep them useful. Even a pathway over the high seas may yet be controlled for the safety of the huge steamers that dash across.

Land, except when used for absolutely universal welfare, must be under individual control, and even then other individuals may have the right of way because of its necessity in the common use. Peculiarities of property in land arising from limitations in quantity or quality will be spoken of under Scarcity Prices and Rent. They differ from similar questions as to any other form of property only because this form of property seems more permanent. Any force of nature brought under control by individual effort contributes to wealth of individuals till all gain equal control. Peculiarities of climate affect the quality of wool, cotton, grains and fruit, and even the beef and mutton raised under it. But these effects we connect with the land. Such peculiarities also affect manufactures of various kinds, and so location has value.

Effort for gain.—Voluntary human effort is always made with the expectation of gain from its exertion; otherwise it would not be made. As Guizot says, “Our ideal is to procure the maximum of utility with the minimum of effort.” The exertion is always counted in the cost of any product, whatever the natural forces employed. If the crop fails, or the product is unsalable, the effort has lost its expected reward, and prospective losses are estimated with more or less care [pg 031] in judging whether a product is worth the exertion. The half crop of a droughty year costs as much as the full crop of a plenteous year, and compensation for the loss is expected from the surplus of the full crop.

In estimating the exertion given, all human energies are counted, whether they belong to the present, like muscular power, good eyesight, quick intelligence; or to the past, like dexterity from training, superior knowledge, accumulated tools, established character. If the immediate exertion is most prominent, the word labor includes the whole exertion. If tools and machinery are used, capital is a contributor to the product and takes its share. If skill or knowledge or character become important, personal attainments are a chief cause of the product, and so a chief claimant in the reward.

Chapter III. Labor Defined And Classified.

Labor defined.—Exertion of any kind for meeting individual wants we call labor, whether it simply gathers food from the forest, or contrives the most intricate machinery for satisfying wants that may take years to grow. Exertion that has no end beyond itself, no matter how severe it may be, we call play, and consider it important in public welfare only as it aids in health and morals. Labor is separated, too, from all exertions to destroy or injure the welfare of others, if we can see their object. Any person claiming to labor professes to have given his exertions for the satisfaction of somebody's wants without doing violence to the welfare of others in the community. Whenever we do not assume this we concede a state of war, violence and destruction taking the place of production and accumulation. These may require exertions usually classed with labor; but are punished instead of being rewarded, unless we can establish their final advantage in a larger welfare for humanity, or in defense of society.

Productive labor.—The various classifications of labor serve merely to call attention to peculiar relations implied in the results. If exertion results in giving additional wealth, or power to produce wealth, it is called [pg 033] productive labor; but if it contributes only to immediate comfort or pleasure or safety it is called unproductive. The distinction is useful so far as it enables us to be prudent in adjusting energies to meet real wants. All labor is maintained by the product of exertions. Any labor expended without a product must be provided for by an increased product from some other form of labor. A farmer may sustain life upon the food he raises; but the wife who makes his house a home cannot live on the product of her labors. She may add to the value of some products directly, as in turning milk into butter, and raw materials into palatable food; but her chief energy may be in getting satisfaction for the household out of materials gained by her husband. Both are essential to the welfare of either, and prudence requires a proper adjustment between them. A force of physicians may be needed to keep a community in working condition; but if a whole community tried to live as doctors some other community must furnish the material wealth to sustain them.

Any increase of labor upon material products, either directly or indirectly, may increase ability to meet future wants, while increase of labor upon present uses of wealth may diminish ability for the future. The wealth of a community is the product of all the labors that contribute to make material nature useful. This classification is important in studying the question of productive consumption of wealth, but does not decide which gives best results. It is a serious error to assume that the worker, whose labor is directly applied to materials, gives to our wealth all its value. If several men are [pg 034] building a house, one may contribute as much to the building by cooking for the rest as if he worked in turn in the construction. In the same way all the household, if well ordered, aid toward the result of their united labors. The physician who shortens the illness of a farmer contributes his share toward raising the farmer's crop. The lawyer who makes property safer, and the minister who gives stronger motives for exertion, are sharers in the force that brings the product.

Physical, mental, moral labor.—The classification of labor according to the powers employed serves to call attention to the wide range of exertions rightly classed as labor. If the exertion is chiefly muscular, labor of hands, shoulders, legs or any part of the body, it is properly called physical. If the main effort is that of the intellect in planning, inventing, contriving ways and means, or in remembering, counting or thinking of any kind, it is just as truly labor, but mental. If the chief exertion is in the good will that resists temptations, guards interests, controls violence and folly, secures order and devises liberal things for society, the labor is moral. Moral labor is often recognized in wages, faithfulness being more important in some services than in others, and paid for. Mechanical devices for promoting honesty or watchfulness may save, in part, moral labor.

This view of labor helps us to see the wide range of efforts that unite in production of wealth, since all the energies of a man may be employed in his work. The successful farmer is one who makes the most of all his abilities—his muscles, his mind and his heart—and [pg 035] his hard work is far from being confined to his hands. The three kinds of labor are combined in some proportion in every life, but the best and most productive life his most room for hard thinking and self-control.

Operative, executive, speculative labor.—In the advancing complexity of society a still more important classification of labor is apparent. If a man's effort of any kind is simply to follow directions in an established routine, it is called operative labor, and the laborer becomes an operative. He works usually by the day, hour or piece, under a foreman or overseer. Beyond the task set for him, he has no thought nor will. Over him is a director—the foreman, overseer, contractor or boss—whose chief effort is to carry forward to completion some plan committed to him as a trust. The foreman's labor is largely mental and moral in adjusting tasks and keeping the operatives, “the hands,” well employed. This is well named executive labor, and requires peculiar abilities and character.

Still farther away from the mere task is the effort that devises the plan; adjusts part to part, decides upon materials suitable for each part, establishes the ideal of excellence for every part and for the whole, and foresees its actual uses. Invention of every kind illustrates the exertion of foresight in planning, but such exertion is not confined to technical invention. The farmer who lies awake nights to plan his year's work so that he may have the largest returns for his undertakings in marketable products, gives the same kind of effort as the inventor. A good name for this is speculative labor,—an exertion to foresee and provide for future needs of society.

[pg 036]In much of farm life all these are mingled: the same man devises the plan, executes his own ideas, and performs the tasks himself. But every one realizes the difference of success growing out of the planning. Many a good man needs to follow another's plans, and not a few “work better for others than they can for themselves.” In some great undertakings the projector and planner, the contractor and overseer and the worker of details are necessarily separated. This may be well illustrated in the construction of a great building, for which an architect gives all attention to a plan, and may require a considerable force of assistants and draftsmen to embody his ideas on paper; then contractors, one or several, secure material, employ men and direct them in placing materials in form and combination to suit the plans; but a host of workmen move as directed at the will of a foreman to pile brick, mortar, stone, iron or timber according to the plan. The labor of the architect makes possible the entire structure—makes the work for all that enter into his labors.

This classification into speculative, executive and operative labor helps to a fair estimate in sharing the proceeds of combined labors, and gives a proper importance to the inventive and foreseeing energy which causes the growth of civilization. That form of exertion which has done most to meet the world's wants is speculative labor.

Invention in farming.—A capital illustration of speculative labor, productive in the highest degree, is the invention of reaping machinery. The inventor has gained riches by his contrivance, but the world has [pg 037] gained far more by his foresight and ingenuity. Similar energy has been put into all labor-saving machinery, and still plays an important part in devising the best uses for it.

Every farmer has a similar need of planning for every field he plows. There is a certain draft for each horse, a certain speed for the plow, a certain adjustment of harness to the team, which gives a full return for the force employed. A failure to find this causes waste. All the effort of scientific research into causes and conditions of growth or disease of plants and animals is speculative labor, out of which the next advance of agriculture must come. The mere operative power of a laborer can be supplanted by brute force or by machinery, but nothing can ever supplant the intelligent foresight that invents, plans and devises the end to be reached, and the ways and the means for reaching it.

The very foundation of any success in farming is clear foresight and distinct planning for a succession of crops, each to be tended, harvested, stored and marketed in the very nick of time. The best energy of every farmer is properly given to finding what crop to raise, how and when to have it ready for the world that is going to need it. He best meets his own daily wants when “Mr. Contrivance” stands by him in all his efforts. This contrivance is the chief exertion of a successful farmer's life.

Chapter IV. Capital Defined And Classified.

Capital distinguished from wealth.—Whenever material wealth is used not directly in meeting present wants, but to produce more wealth suited to future wants, it is called capital. Any store of good things devoted only to meeting wants as they come is thought of as wealth, as well as possible capital, since at any time it may be made the means of creating other wealth to more than take its place. The distinction grows wholly out of the uses of wealth, not its forms. A horse used, or to be used, as a force in production by drawing loads is counted as capital; but if used for mere pleasure-riding is only wealth, which leaves no material return when consumed. Thus the same horse may, in the hands of a breeder, a trainer, or a liveryman be capital, but in the hands of a fancier or a pleasure seeker be only wealth, to be used as wanted.

Wealth in dwellings or public buildings constructed for enjoyment rather than protection of a working community is not capital, and may be destroyed by fire or storm without serious disturbance of industry. The loss is bravely met, the hardship endured and extra energy put into restoration. A farmer may lose a fine house and by living in less comfort for a time restore it, while [pg 039] the loss of his teams or his barns may cripple his industry. In the great Chicago fire of 1871 the wealth destroyed is estimated at $50,000,000, while the loss of actual capital may have been only $5,000,000. An energetic use of the capital remaining wrought apparent wonders in the restoration of wealth. Indeed, the total capital of our country is supposed to be only three times the annual product of industry, though a century of labor could not restore it if destroyed entirely, because effective tools would be wanting.

The capital of an individual is such a portion of his wealth as he is using to maintain and increase his wealth. The capital of a country includes all the farms, so far as they are made such by improvements directly or indirectly, including all ways and means of communication and transportation, for roads contribute to all goods drawn over them; all buildings devoted to systems of production, including necessary protection of laborers themselves; all tools, machines and contrivances for power; all animals employed in connection with industry; all materials of construction or growth; all materials consumed in securing and maintaining power, as fuel, lubricating oil, etc., or in performing operations of manufacture, as dye stuffs; subsistence for the workers, the brutes they use, and the families which keep up the life and comfort of the people; the necessary stock in trade, that all wants may be readily supplied; all the machinery of trade for ready transfers, including any actual wealth in form of money; all the governmental machinery for protection and maintenance of order, as a first essential to wealth-producing.

[pg 040]All these are more simply grouped in their different relations to labor under three classes: first, as sustaining labor by food, clothing, protection and material on which to work; second, as aiding efficiency by tools, machines and stored up forces; third, as stimulating exertion by reducing present anxieties and arousing more far-reaching plans for future undertakings, illustrated by possession of satisfactory stocks of goods or comfortable homes for families.

Capital a time-saver.—All these forms of wealth serve in production by extending the possible waiting between an effort of any kind and the greater satisfaction secured by it. No community could begin farming as a business until it had secured housing and seeds and tools and provisions in some form for most of a year's sustenance. All the capital that constructs a great thoroughfare is used in getting ready to satisfy wants in many future years. Capital furnishes subsistence for laborers of every kind during those years of waiting for a product. This is true capital, because the object of its use is a greater product of wealth; but the product may be long delayed. So all accumulated wealth in every form represents sustained labor during the past. Professor Taussig estimates the accumulation of subsistence in all existing goods at five years of labor for the community. The total value of farms in our country is just about five times the average annual product of the farms, though a large portion of the land is unused.

Capital circulating or fixed.—A further distinction is desirable between capital in food, fuel or stock in trade, which may be turned at a single use into new wealth, [pg 041] and capital in buildings, bridges, roads and farms, which may be used many times in adding new wealth before they entirely disappear or give place to new forms of capital. The first is called circulating capital, and the last fixed capital.

The degree of permanence in fixed capital is indefinite of course—even drains vary in permanence—and the line between the two is not always easily drawn, yet the distinction is real. Most men distinguish “the plant” in any enterprise from “the current supplies,” and realize that some fit proportion exists between them. A farm well equipped can not be handled to advantage without a proportional investment in current supplies. Many a renter cannot pay his rent for want of means to work his farm profitably. If the farm were given him, he would still be hampered by the same lack of consumable goods to turn at once into larger products. Many a “land poor” farmer would gain at once by exchange of acres for more “current supplies” for his farming, such as food for help, feed for teams and stock, seed or fertilizers for his crops, or young stock to consume the raw product of his fields. In the fourteenth century the stock of European farms was worth three times the value of the farms. Similar conditions are found now in some newer portions of the United States. It is impossible to estimate exactly the existing ratio between fixed and circulating capital from statistics at hand. Farmers in older, more developed regions can use, without suffering, a larger per cent of fixed capital than pioneers can, because the circulation is more rapid. For the same reason the raising of staple annual crops gives place to [pg 042] double cropping, dairying and full feeding as land grows more valuable, frequent returns serving instead of large circulating capital.

In general, the wealth of a community is better judged by its fixed capital, while its thrift is known from its circulating capital. Fixed capital is always secured by consumption of circulating capital. The extension of railroads always implies great reduction of ready supplies. Money between individuals and communities ranks as circulating capital, but within any community the stock of money needed for domestic trade may be thought of as a permanent machine. Even machinery may be circulating capital in the hands of one who manufactures or sells it, though fixed when located in its work, and for the whole community is “fixed” as soon as its destined use is determined by its form. Thus the distinction, though real, is flexible. Its importance in discussing the industries of a country, or in understanding the relations of various industries to each other and to the world, will appear later in the book.

Capital unproductive.—Capital is sometimes said to be unproductive in contrast with productive, although the very nature of capital requires productiveness. The occasion for this distinction is in the fact that means devoted to future production of wealth in a particular way may be years in returning the product; the destination is evident and the return confidently expected, yet the owner is without income or near prospect of income. Such ventures are seen in the reclaiming of waste lands by drainage, the equipment of extensive mines, and the construction of dykes and levees. Land held for sale [pg 043] or use in the indefinite future is a most common illustration of unproductive capital.

If wealth in some readily exchangeable form is intended for productive use, but is held for a satisfactory opportunity, it is sometimes called free or floating capital. It may be available for any temporary use, and so afloat among a variety of investments. Some great enterprises, like the building of the Suez canal, are begun in view of attracting floating capital. Borrowers generally look to such accumulations for their supply of funds.

Capital in farming.—A clear view of the uses of capital may be gained from estimating the needs of a young farmer just starting out for himself. For all his equipments he must depend upon the time and effort of somebody embodied in form of tools, material and sustenance, for capital in any form is simply this. A farm of 160 acres improved, or already out of the crude pioneer stage, represents about ten years of one man's time, say $3,000. A house suitably furnished for himself and his young wife means three years of time, $1,000. His barns and corrals and intersecting fences cost two years of time, $600. His team and stock and the necessary tools make nearly three years of time again, $900. Seed, feed, provisions, clothing, insurance and wages for help, all to be used before his first year's crop is sold, require at least $500 worth of time, or nearly two years more. The needed capital for such a farm thus represents full eighteen years of the time of an able-bodied man, or $6,000. If we add to this the cost of bringing to mature age and intelligence the three [pg 044] able and efficient workers needed to manage and work that farm, we shall credit the past, without counting the time and energy of the young people themselves in growing and learning and gaining their skill, with thirty years of labor; $10,000, put into the farm and its occupants as they stand ready for a year's work. This accumulation is likely to show all the forms of capital described.

Capital conservative.—Capital, especially in fixed forms, being in its nature the conserving of energy, is necessarily an incentive to conservatism in society, since any great and sudden changes in the habits of a community involve rapid consumption or destruction of capital. Capital is said to be “timid.” This statement means simply that all owners and users of capital who realize the time required for accumulating it hesitate to risk its destruction in doubtful enterprises, uncertain confidence or venturesome experiments in government or financiering. War, riots, or even revenue laws, may destroy fixed capital that has been the growth of a century. A small change in tariff laws has rendered useless immense factories. For the same reason farmers, having so large a fixed capital in farms and farm machinery, do not take kindly to political changes involving doubtful consequences. States where the capital is still circulating may readily venture upon experiments financial or political, since little time is lost even in destructive results. People in new countries take risks readily because they have less to risk.

Chapter V. Personal Attainments.

Accumulated energies.—The force accumulated through personal effort in training, education and discipline is similar to capital in the fact that it represents a period of time between the effort and its full accomplishment, and that it is devoted to production of wealth. It differs from capital in being immaterial human energy, exceedingly useful in combination with capital, but a part of the laborer, not his tools. It is gained by devoting time, attention, thought and practice to acquiring methods of greatest efficiency in any act of labor. It requires surplus energy in labor at any task to gain, not only the material result, but power to do the same task better and more easily next time. All the time expended in acquiring such powers is put into the value of what is finally produced. Any peculiar tact or ability developed becomes an essential part of individual powers, and its product, like that of any form of exertion, becomes the property of the individual.

In this way, not only is the cost of gaining skill or education, or of establishing habits, returned in the product, but often a considerable increment, or gain, from the larger demand for such abilities. A [pg 046] skilled artisan's labor meets more urgent demands for its use.

Skill.—If this extra exertion takes the form of training muscles, nerves and brain to act with speed and accuracy as judgment directs, we call the attainment skill. Even if the action required is simple, dexterity comes only by practice, and in special cases may multiply the product many times. Two men may shear sheep with equal accuracy, but one has three times the speed of the other. His skill secures employment at three times the wages of the other, with profit to the employer, because the extra speed saves room, attendance and risk over employing three men at one-third the rate. The shearer profits by the rarity of his skill in getting the wages of three men, with the support of but one, and in more constant employment. When the operation is more complex, and success involves larger interests, skill counts indefinitely more, and as society grows complex the room for exercise of skill becomes larger and more varied. The wide difference between pioneer farming and market-gardening illustrates this. The history of agriculture shows the slow development of skill in the furrow, the ditch and hedge, and in the handling and breeding of stock. Farmers once barely scratched an acre a day with their rude plow and were long in learning the use of a harrow. No attempt, according to Professor Rogers, to improve the breeds of cattle and sheep appeared before the eighteenth century in England. Most early improvements in farming skill came from the industrious monks, whose intelligence fostered skill.

[pg 047]The advantage given by skill perpetuates skill from generation to generation through aptitude and superior training, and so the people of a neighborhood or a country may inherit such power in contrast with other regions. “Yankee ingenuity” has become proverbial through such natural extension.

Discipline.—Education serves the same purpose by acquisition of knowledge in such ways as to give wisdom in its application. It involves an exercise of intelligence to the establishing of sound judgment. Broader than skill in its range, it increases the possibilities of skill as storage of power. The skill of the surgeon would never have existed but for the brightening of his intelligence by education. The electrician's training depends upon a broad foundation of education in knowledge of the matters he handles so dextrously. In farming, this source of stored up power has until very recently been ignored. While men in many professions were multiplying their individual power by spending youth in school, the farm boy would be simply trained at the plow, without the enlargement of practice in thinking required elsewhere. Such education has become at length, like skill, a requisite of each generation in order that our civilization may be maintained. For this the states build and the nation sustains agricultural colleges.

Character.—Just as important, though often overlooked in enumerating economic forces, is the acquired personal habit of self-control. Without it both skill and education avail but little, and it may do its work independently of both. “Tried and trusted” expresses [pg 048] our estimate of the importance of long practice of virtue in meeting obstacles. The formation of habits—personal, business and moral,—is a matter of time and discipline. It costs exertion through a series of years; but the power accumulated may be needed only once, in some great emergency.

The character of the workman, the tradesman and the farmer enters more or less into the product of his toil and gives it value. Though I may not care from whence come the shoes I wear, or the butter I eat, I do care for the genuineness of both, for which I must depend upon the genuine character of the makers and sellers of both. This, too, is maintained from generation to generation by its successful use in acquiring both power and wealth. It cannot be had without the expenditure of time, energy and means of the fathers and mothers of one age upon their successors.

Importance of attainments.—All these personal attainments, whether confined to individuals or extended over whole communities, must be reckoned among producing powers and reckoned with in estimate of earnings. A community deficient in either is low in ability to supply its own wants or the world's wants, and no amount of material capital can take their place. They are superior to capital in being less destructible by fire or flood, and more easily turned to account in new enterprises as needed. No capital is perpetual, even in most fixed forms, nor is any personal attainment sure to remain of direct use; but the latter has a larger expectation of usefulness and greater permanence in the economy of nations.

Chapter VI. Combination Of Forces For Individual Efficiency.

Ideal manliness.—Every community has highest efficiency and best civilization when each individual member has the largest range of abilities to meet wants, and the largest range of wants to be met. An ideal civilization involves the distinct aim of gaining for each mature person in any association the fullest development of all abilities and all materials and tools for their use. This is amply illustrated in a family of well grown, well trained, well educated, trustworthy men and women with sufficient capital under control to maintain the highest activity of every personal power and attainment. Childhood and old age must always be provided for by exertions of those whose abilities are in their prime, and accidental weakness of every kind is met from the same strength.

Any mature person is best equipped for productive industry when, sound in both body and mind, he has the accumulated energy of the past for his use in the shape of capital and hereditary traits, together with skill, education and established character. Such a man is recognized at once to have his place among “the heirs of all the ages in the foremost files of time.” Any [pg 050] people claiming leadership among nations must depend upon its representatives of such a fully equipped body of men for that leadership.

From savage to enlightened.—The increasing importance of such full manliness, as society becomes more complex in both wants and efforts, is easily seen. In ruder life muscular energy and endurance, with some slight ingenuity, are sufficient to meet the ruder needs, with some chance of saving for future wants of a growing family, which will continue the same round of muscular contest with savage conditions.

The American Indians have given the fairest exhibition of the kind of welfare which such exertion and accumulation afford. The weak disappear quickly, because the strong have too little surplus of energy to care for them. Among those left, both burdens and means of satisfaction are quite equally distributed, because of essentially equal powers of exertion. But in older and more civilized communities large portions of the people are dependent upon the rest for knowledge, ingenuity and skill to keep the very much larger supply of material needed for maintaining the civilization. At this stage of progress a man with only muscular development finds himself entirely dependent upon some one else for the plans by which all must live. A savage cannot share equally with the wise man either in the burden of caring for the community or in the welfare which the community enjoys.

It is easy to see that the relative importance of accumulated wealth in the shape of capital or of skill or of the character which results from generations of training, [pg 051] becomes more and more distinct as the community becomes more developed. Any man, then, who is lacking capital, skill and morals, or all three, is in some respects like the savage, and will find his equals among the savages. For this reason a pioneer country affords opportunity for a youth without skill or personal attainments of any kind “to grow up with the country;” and the famous advice, “Go west, young man, go west,” applies strictly to such a youth, and with less and less directness in proportion as the young man has control of himself and of accumulated wealth.

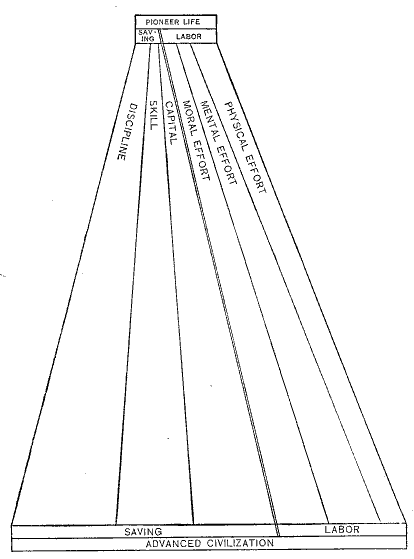

A simple diagram (Chart III) may illustrate the progress of civilization from the general poverty and inefficiency of rude pioneer life to the power of a thoroughly organized and developed community. The poor man, in the sense of one whose abilities are undeveloped and who has no visible means of support, is relatively less able to care for himself in the enlightened community than in the ruder pioneer life. In this sense, and this alone, the poor man grows poorer with advancing civilization. This may easily be seen by comparing a thrifty farming community of today and all the accumulated stock, machinery and tools of the farms, with the same community sixty years earlier, when all was practically wilderness. A strong man with an ax and a hoe could enter the wilderness anywhere and live nearly as well as any of his neighbors. Such a man in the higher country life of our times must work for some one else at wages, or must be supported at public expense. In either case he feels his poverty. At the same time, the extreme of suffering is less likely [pg 053] to be reached in the richer community. The poorest man has comforts of which the pioneers never dreamed. Even a tramp can live on the fat of the land, but not by his own exertions. The failure of a crop in the pioneer country means starvation for a large portion of the few inhabitants. A failure in the older community means suffering for a few in diminished food and clothing, but all live on the accumulations of the past.

Developing civilization.—This essential advantage of accumulating power in individuals, as civilization advances, is necessarily connected with the very nature of civilization and growth. As no conceivable device can make a babe as efficient as a man, so no contrivance, political or social, can make an undeveloped man equal to a fully developed one.

The intense community of interests in high civilization makes even more important the individual abilities of each sharer in those interests. For this reason every device for universal education, development of skill and strengthening of character, and every check upon deterioration of personal strength or wisdom or virtue is to be considered. Any neglect of the individual in his development of personal attainments retards the development of the community. Any device for the equal distribution of wealth which does not increase individual thrift in the use of wealth at least retards the growth of the community, and may very quickly reduce the power of the community as a whole until it reaches the inefficiency of savage life.

All true charity, even equity, requires that the object of distribution of wealth shall be the greater efficiency [pg 054] of each individual. If there shall ever be a community of individuals gaining equal enjoyment, it will be made up of those possessing essential equality in personal powers and attainments, and in accumulated capital as well.

Chapter VII. Methods Of Association.

Simple association.—While the absolute equality of individuals referred to in the preceding chapter is practically impossible, the community of interests as civilization advances becomes much closer through various plans of association of individuals in common work. Indeed, the community is a community because a multitude of individuals work together. The simplest form of association is seen where men work in gangs, all acting alike, as in lifting a log or a rock, hoeing the field, or in building an embankment by shoveling. Among farmers the habit of exchanging work, so common in pioneer settlements, illustrates the advantage of combination. This may be called simple association, by which many hands make light work.